Most blockchains try to be everything at once.

Fast, cheap, secure, scalable, decentralized… the full checklist.

And in chasing all of that, they often forget one simple truth: real-world usage usually starts with payments.

That’s where Plasma feels different.

Not louder.

Not trendier.

Just… focused.

Built Around One Clear Idea

#Plasma isn’t trying to compete with every Layer-1 in existence.

It’s designed around a very specific mission:

Make stablecoin payments instant, cheap, and usable at global scale.

That sounds simple.

It isn’t.

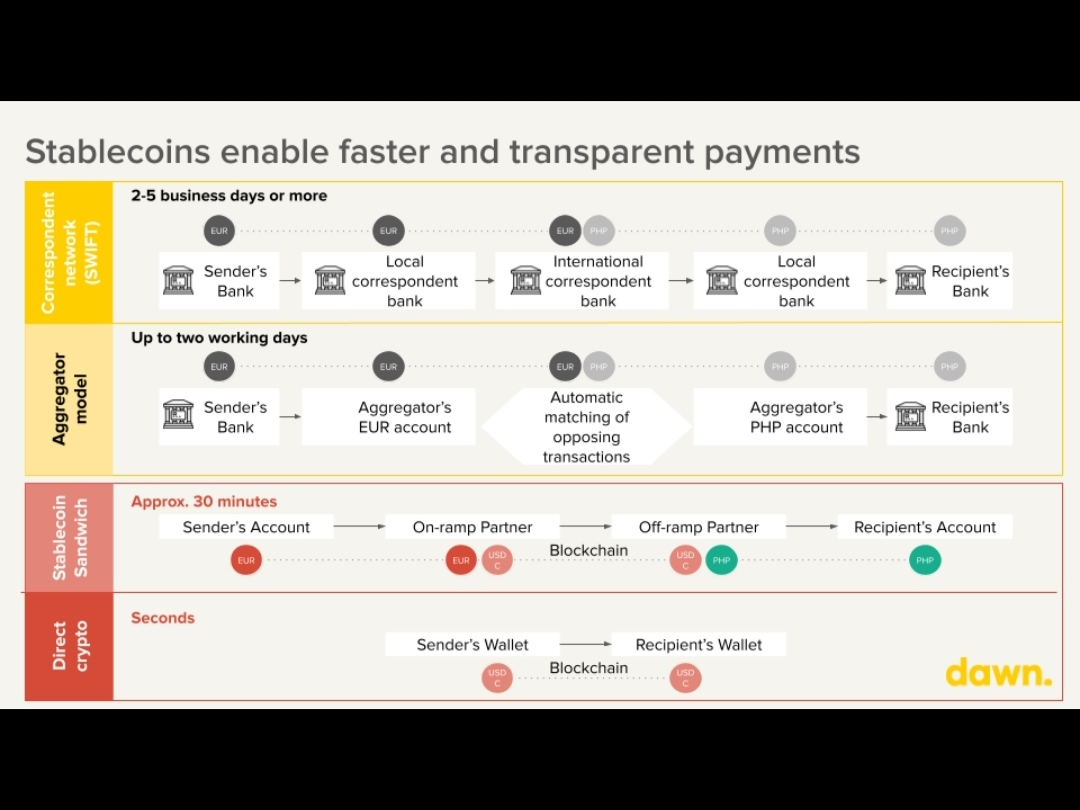

Because stablecoins already move billions of dollars daily, yet the experience is still messy:

Gas fees fluctuate

Transfers slow down during congestion

Settlement finality isn’t always predictable

User experience still feels “crypto-native,” not mainstream

@Plasma approaches the problem from the ground up instead of patching it later.

Sub-Second Finality Changes the Feeling of Payments

Speed in crypto is usually measured in seconds.

Sometimes minutes.

But real payments?

They feel instant.

Tap → done. No waiting. No anxiety.

Plasma’s sub-second finality aims to recreate that psychological comfort.

Not just technical speed, but confidence.

Because adoption doesn’t happen when something is fast.

It happens when something feels reliable.

Stablecoin-First, Not Stablecoin-Compatible

Most chains support stablecoins.

Plasma is designed around them.

That difference matters more than it sounds.

Features like:

Gasless USDT transfers

Stablecoin-denominated fees

Optimized settlement flow for payments

These aren’t add-ons.

They’re the foundation.

And when infrastructure is built for a single purpose, efficiency naturally follows.

Security Anchored to Bitcoin

Here’s an interesting philosophical choice.

Instead of inventing a completely new trust model, Plasma connects security to Bitcoin’s proven foundation.

That signal is subtle but important:

Innovation on the surface.

Conservatism at the base layer.

For institutions and payment networks, that balance is attractive.

Because radical tech is exciting…

but boring security is what actually gets adopted.

Why Plasma Matters in the Bigger Crypto Cycle

Every bull market highlights a different narrative:

DeFi

NFTs

AI

Memecoins

But beneath the noise, one sector keeps growing quietly:

Stablecoin settlement.

Real money.

Real usage.

Real demand.

If crypto truly becomes global financial infrastructure,

then the chains optimized for moving stable value efficiently

will matter more than the chains optimized for hype.

Plasma seems positioned exactly in that lane.

Not flashy.

Not noisy.

But extremely practical.

And in the long run,

practical systems usually win.