In the world of digital finance, trust is no longer built on promises but on "verifiable transparency." As of early 2026, Binance has transitioned from a single entity in a "gray zone" into a clearly structured financial ecosystem, operating under the rigorous oversight of the Abu Dhabi Global Market (ADGM).

The following analysis details the four core pillars that provide traders with the confidence to deposit and trade.

1. Proof of Reserves (PoR): Cryptographic Transparency

Binance ensures that user funds are held at a minimum 1:1 ratio. This means for every dollar or coin deposited, Binance holds an equivalent amount in its reserves.

Real-world Data (January 2026):

Total Reserved Assets: ~$155.6 billion.

Bitcoin (BTC): 101.4% reserve ratio.

Tether (USDT): 101.7% reserve ratio.

The Technology: By using Merkle Trees and zk-SNARKs, Binance allows you to cryptographically verify that your specific balance is included in the total reserves without compromising your privacy.

2. Regulatory Standards & Structural Oversight

To understand why deposits are secure, we must look at the "Gold-Standard" framework established via ADGM. Binance has moved away from a centralized black box to a Three-Entity Separation model as of January 5, 2026.

A. Separation of Entities (Eliminating Conflict of Interest)

Binance has split its operations into three independent arms, mimicking the safety of traditional investment banks:

Nest Exchange Limited (The Marketplace): Acts solely as the "meeting point" for buyers and sellers. It does not hold your funds and is prohibited from trading against customers.

Nest Clearing and Custody Limited (The Vault): A separately licensed entity dedicated to holding assets. These assets are legally segregated from the exchange's balance sheet. If the exchange faces issues, the assets in custody remain untouched and safe.

Nest Trading Limited (OTC/Brokerage): Handles large institutional trades and currency conversions.

B. FSRA "Gold-Standard" Compliance

Operating under the Financial Services Regulatory Authority (FSRA) requires:

Minimum Capital Requirement: Binance must maintain its own cash reserves (separate from user funds) to ensure operational continuity during crises.

Independent Audits: Periodic audits by "Big Four" firms to verify the accuracy of Proof of Reserves.

Independent Risk Management: A dedicated risk team that functions separately from the executive board to prevent risky investments.

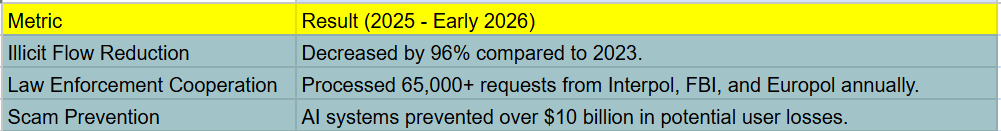

C. Anti-Financial Crime System

3. The SAFU Fund

The Secure Asset Fund for Users (SAFU) acts as an emergency insurance policy. It is a dynamic insurance mechanism designed to withstand extreme market volatility and "black swan" events.

A. Strategic Asset Composition

In earlier years, SAFU was heavily weighted in BNB (Binance's native token). However, to increase trust and stability, Binance rebalanced the fund into highly liquid and non-correlated assets:

Bitcoin (BTC): Provides long-term value appreciation. Since Bitcoin is the "gold standard" of crypto, it ensures the fund remains robust even if the specific Binance ecosystem faces FUD (Fear, Uncertainty, Doubt).

USDC (Stablecoin): In 2026, Binance shifted from BUSD/UST to USDC for the stable portion of the fund. This ensures instant liquidity. If a hack occurs, Binance can immediately reimburse users in a stable dollar value without waiting for market orders to execute.

B. The "Auto-Top-Up" Mechanism

A common question is: "What if the market crashes and the $1 billion becomes $800 million?"

Real-time Monitoring: Binance utilizes an automated tracking system that monitors the total USD value of the SAFU wallets 24/7.

Replenishment: If the market value of the BTC in the fund drops significantly, Binance commits to topping up the fund using its corporate profits (transaction fee revenue) to maintain the $1 billion floor. This ensures the "Safety Net" never has a hole in it.

Real-time Monitoring

C. Proof of Solvency (On-Chain Transparency)

The SAFU fund is not an "invisible" bank account. It is held in publicly disclosed wallet addresses.

Verifiability: Anyone can use a blockchain explorer (like Blockchain.com or Etherscan) to see the exact balance of the SAFU fund in real-time.

No Re-hypothecation: Binance legally and technically guarantees that SAFU assets are never "staked" or "loaned out." They sit idle, ready for one purpose only: Emergency Protection.

D. Incident Response: The "Kill Switch" vs. SAFU

In a 2026 security scenario, the SAFU fund works in tandem with the exchange’s security protocols:

Detection: AI detects an anomalous withdrawal.

Containment: The system may temporarily freeze withdrawals (the "Kill Switch").

Deployment: Once the loss is quantified, the SAFU Management Committee triggers the release of funds from the SAFU wallets directly to the affected users' accounts.

Result: Users see their balances restored, often before the full investigation is even concluded.

4. Advanced Customer Support Ecosystem

A critical factor in trader trust is knowing that help is available whenever a problem arises. By 2026, Binance has evolved its support system into a multi-layered defense and assistance network.

A. Next-Gen AI Chatbot (Instant 24/7 Support)

Binance utilizes a sophisticated Large Language Model (LLM) AI that goes beyond simple FAQ scripts.

Instant Resolution: Over 80% of common inquiries—such as password resets, account unlocks, and deposit status checks—are resolved by the AI in under 30 seconds.

Hyper-Localized: The AI supports 40+ languages, understanding regional dialects and complex technical slang to provide natural, helpful dialogue.

B. Specialist Human Intervention

For complex cases that require a human touch, Binance provides a tiered support structure:

Dedicated Case Managers: High-net-worth and VIP users have access to personal account managers for white-glove service.

SME Teams: Support is divided into Subject Matter Experts (SMEs). Whether you have a technical glitch in a Futures contract or a complex security verification issue, you are routed to a specialist who understands that specific field deeply.

C. Industry-Leading P2P Appeal System

For Peer-to-Peer (P2P) traders, Binance offers the most robust dispute resolution mechanism in the industry:

Escrow Protection: When a trade begins, the crypto is locked in a secure escrow. It cannot be released until the buyer confirms payment and the seller confirms receipt.

Rapid Appeals: If a dispute arises (e.g., a buyer sends funds but the seller doesn't release the coin), human moderators intervene. In 2026, the average resolution time for P2P appeals has been reduced to under 2 hours.

D. Self-Service Recovery Tools

Binance empowers users with tools to fix their own mistakes:

Deposit Recovery Tool: If you accidentally send tokens to the wrong network or forget a "Memo/Tag," Binance provides an automated recovery tool. This system can retrieve "lost" assets that would be permanently gone on other platforms, often with just a few clicks.

Check out the evidence of trust here! 👇

#BinanceSquare #STAYSAFU #ProofOfReserves #Write2Earn #BinanceSecurity #Crypto2026 #Bullish2026 #AssetSegregation #ADGM

$USDC