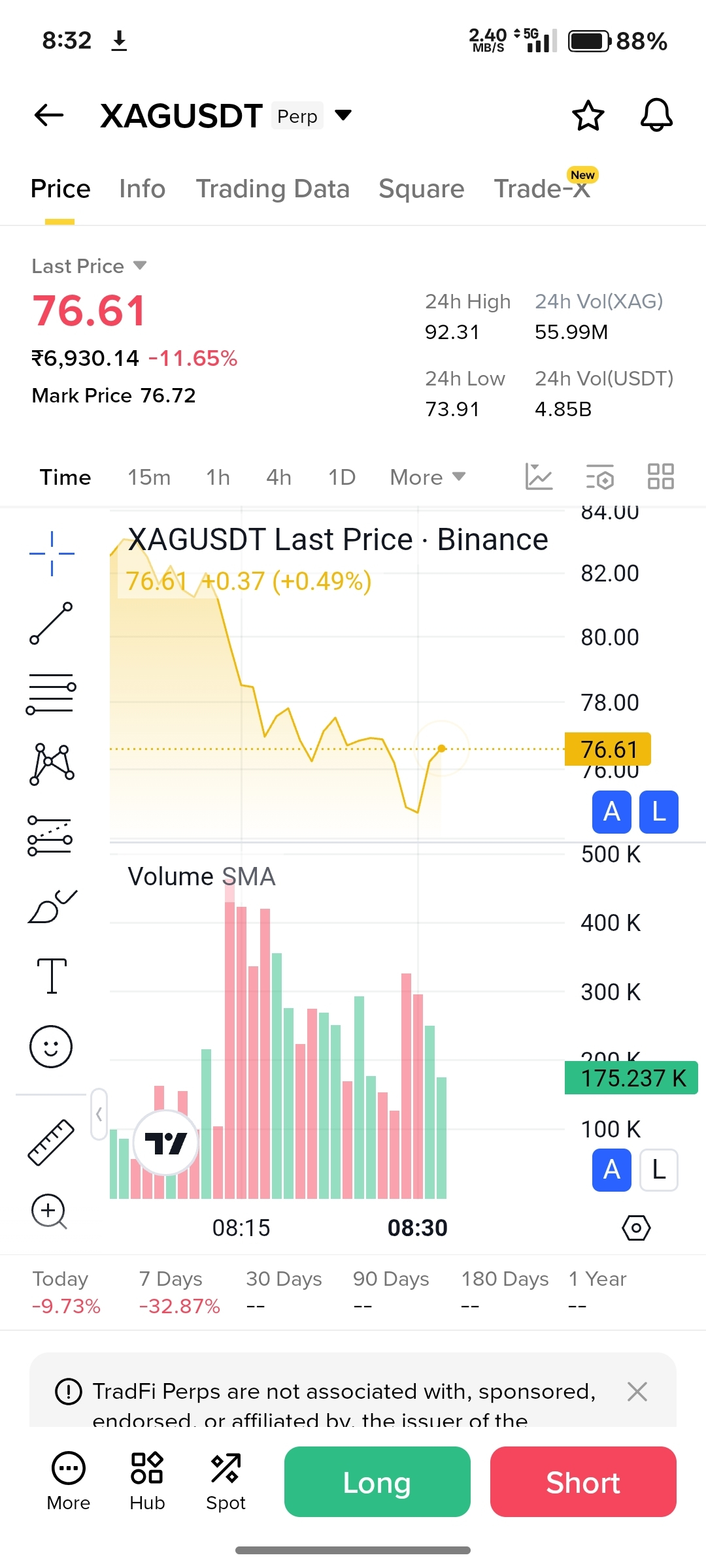

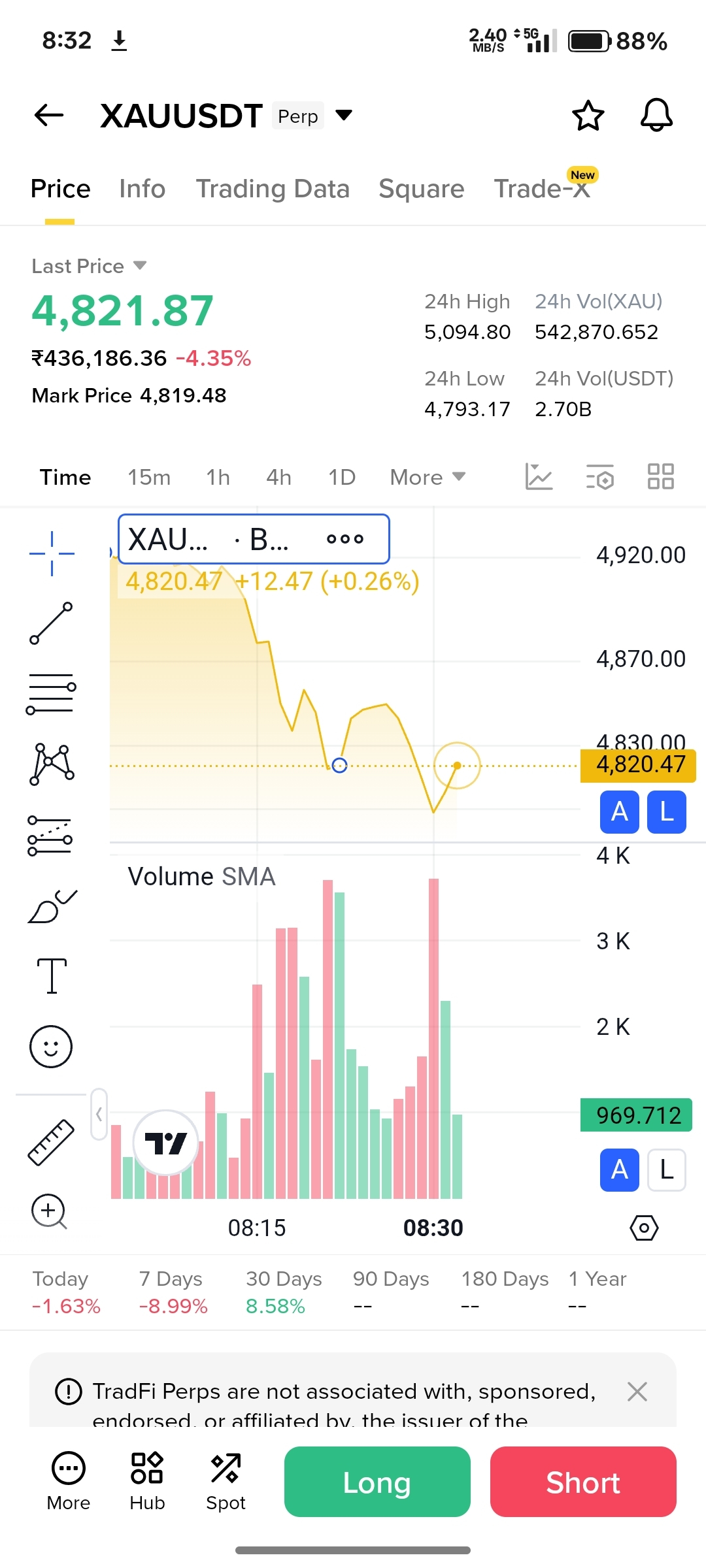

The sharp drop you're seeing in your Binance charts (with XAG down over 11% and XAU/PAXG down over 4% in 24h) is part of a massive "deleveraging event" following record highs.

The "Warsh" Effect: The nomination of Kevin Warsh as the new Federal Reserve Chair has rattled the market. He is viewed as a "hawk," leading investors to believe interest rates will stay higher for longer, which traditionally makes non-yielding assets like Gold less attractive.

CME Margin Hike: The CME Group recently raised margin requirements for gold and silver futures. This forced many leveraged traders to sell their positions immediately to cover costs, creating a "sell cascade."

Strong US Dollar: The US Dollar Index has jumped. Since precious metals are priced in USD, a stronger dollar makes them more expensive for global buyers, dampening demand.

Aggressive Profit Booking: Both metals hit all-time highs recently ($5,600+ for Gold). Many institutional traders are now "cashing out" to secure gains, leading to a technical correction.

Technical Liquidation: On platforms like Binance, once key support levels were broken, automated "stop-loss" orders were triggered, accelerating the downward movement you see in the 15m and 1h charts.

The Great Deleveraging: Why Bullion is Bleeding After Record Peaks

"While physical demand in India remains steady due to the wedding season, the digital and futures markets are experiencing a 'Black Friday' hangover. The combination of a hawkish Fed outlook and increased margin requirements has flushed out 'weak hands.' Analysts suggest that while the long-term bull case for Silver (industrial AI demand) and Gold (geopolitical hedge) remains, the current phase is a necessary cooling of an overheated market."

#GoldCrash #SilverSelloff #CryptoGold #MarketCorrection #BinanceSquare

XAUUSDTPerpetuu4,865.94-3.66%

XAUUSDTPerpetuu4,865.94-3.66% XAGUSDTPerpetuu78.34-13.21%

XAGUSDTPerpetuu78.34-13.21% PAXGUSDTPerpetuu4,878.2-3.77%

PAXGUSDTPerpetuu4,878.2-3.77%