🟢 Solana Market & Price Movement

Market Overview

SOL price saw intense volatility recently, trading below $100 amid broader crypto weakness.

Technical rebounds from key support near $100 have analysts eyeing potential recovery toward $150–$250 levels

Macro sell-offs keep pressure on SOL near major support, with sharper downside risks visible. (IG)

Price is in a crucial demand zone: a hold could signal trend continuation; a break might deepen bearish pressure.

📈 Analyst & Institutional Signals

Some analysts still see long-term upside, forecasting significant growth off current depressed setups despite cutting near-term targets. (CoinDesk)

Institutional interest remains notable with ongoing ETF flows driving attention to SOL as a liquid major asset.

🔗 Ecosystem & Adoption Highlights

Growing TVL & Usage

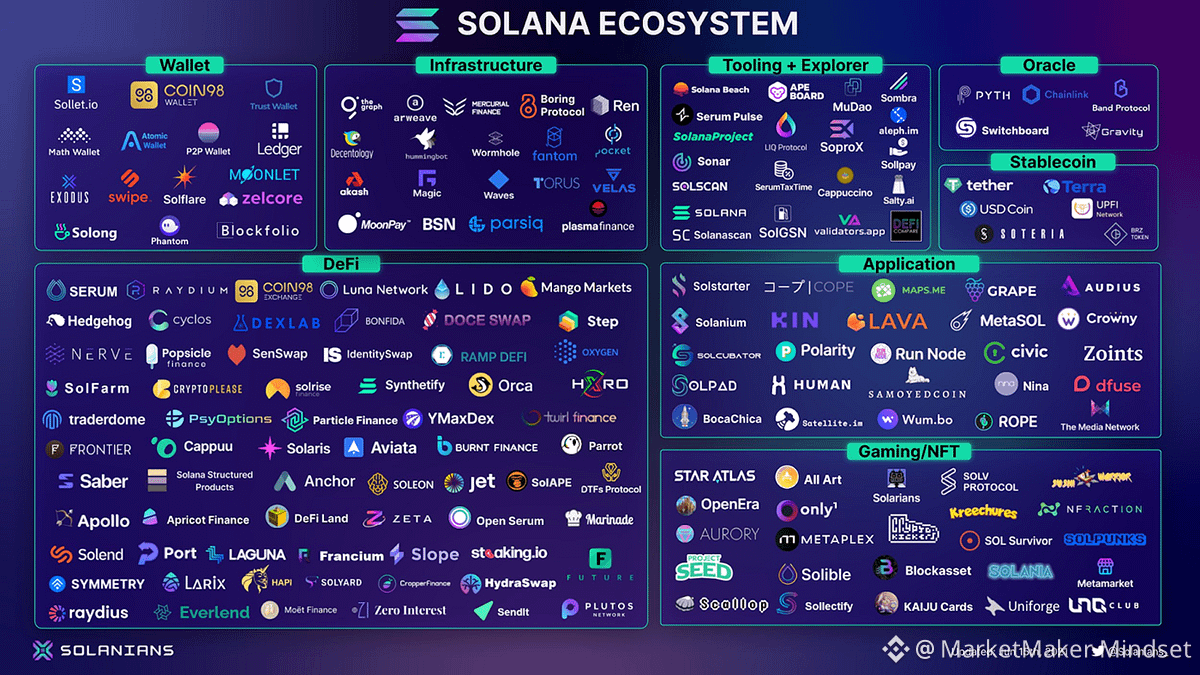

Solana’s ecosystem continues expanding with rising total value locked (TVL) and active DeFi participation.

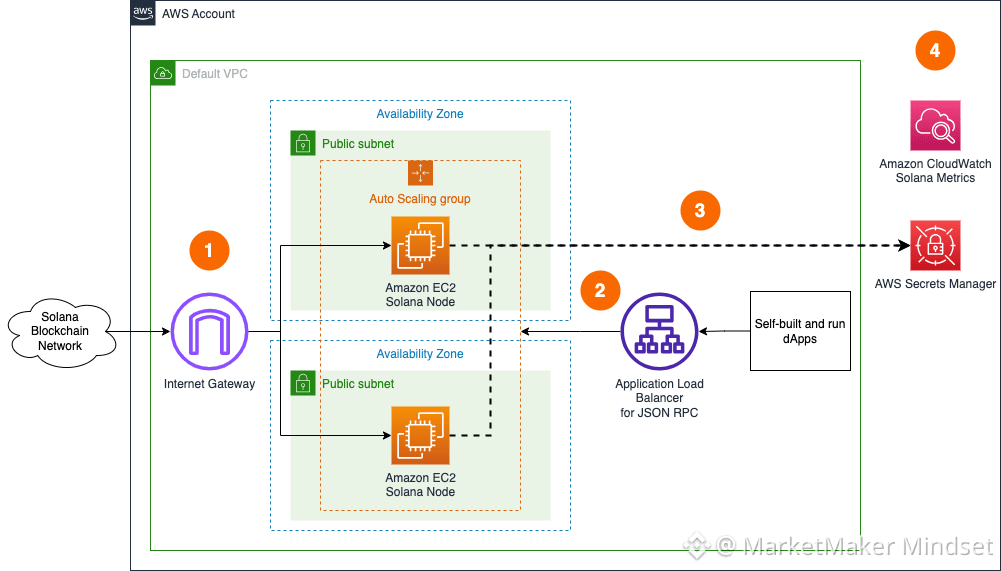

Infrastructure & Partnerships

Major partnerships and integrations (e.g., wallets, validators) support credibility and higher on-chain utility.

Remittances and global finance integrations are enhancing Solana’s real-world use cases. (Blockchain News)

Network Upgrades

Upgrades like Firedancer and validator ecosystem expansion aim to improve performance and institutional appeal.

🚀 What’s Next for Solana?

Bullish Catalysts

Continued DeFi growth, institutional ETFs, and global partnerships could steady long-term adoption.

Bearish Risks

Near-term price pressure and macro influences may keep volatility elevated.

$SOL

Technically 71 and 67 are possible so try to buy there in parts