The $BTC market in early 2026 has become a high-stakes tug-of-war. We are currently seeing a clash between a technical "buy" signal and a cold, hard dose of reality from the Federal Reserve.

Here is the ultimate master view of where we stand today.

🚀 The Bull Case: Technicals & Institutions

While the headlines look scary, the underlying math and "big money" moves suggest the fire isn't out yet.

The RSI "Spring": Bitcoin’s Relative Strength Index (RSI) recently plunged below 30. Historically, this means the asset is oversold. Think of it like a spring being pushed down; the harder it's pressed, the more violent the eventual bounce back toward $90,000 could be.

The Support Fortress: BTC is currently fighting for its life in the $73,000–$75,000 zone. This is a critical psychological floor where institutional giants like MicroStrategy have their "break-even" points.

The Long Game: Analysts still view 2026 as the "Institutional Era." Even with the current dip, the shift from gold to digital assets is accelerating, with predictions that Bitcoin will "massively" outperform precious metals over the next decade.

⚠️ The Bear Case: The "Fed Chill" & Liquidation Risks

The bears have a powerful ally this month: Jerome Powell.

The Fed Pause: On January 28, 2026, the Fed halted its rate-cutting streak, keeping rates at 3.5%–3.75%. This "pause" signals that the era of "easy money" is on hold, causing a massive $1.7 billion weekly outflow from crypto products.

The Death Spiral: Famous investor Michael Burry has warned that if Bitcoin breaks its current support, it could trigger an institutional "death spiral," forcing fund managers to sell off gold and silver to cover crypto losses.

Regulatory Clouds: With political figures like Senator Elizabeth Warren warning of volatility risks in retirement accounts, the "fear factor" is keeping new retail money on the sidelines.

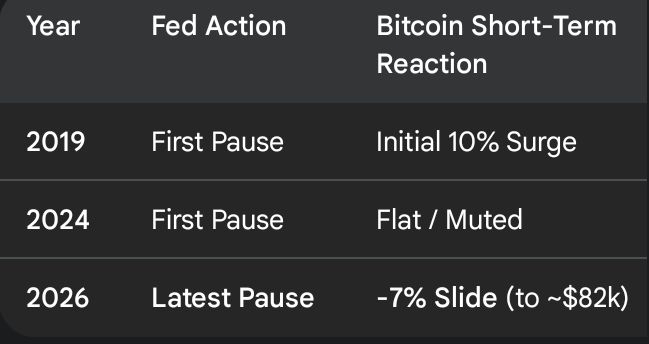

📊 Historical Pattern: The "Pause" Effect

How does Bitcoin usually handle a Fed pause? It’s a bit of a roller coaster:

🔍 The Verdict

We are currently in a "Sell the News" phase. The market expected the Fed to keep cutting, and the "pause" felt like a cold shower. However, as long as Bitcoin stays above the $70,000 mark, the "oversold" technical bounce remains on the table. If that floor breaks, things could get messy fast.