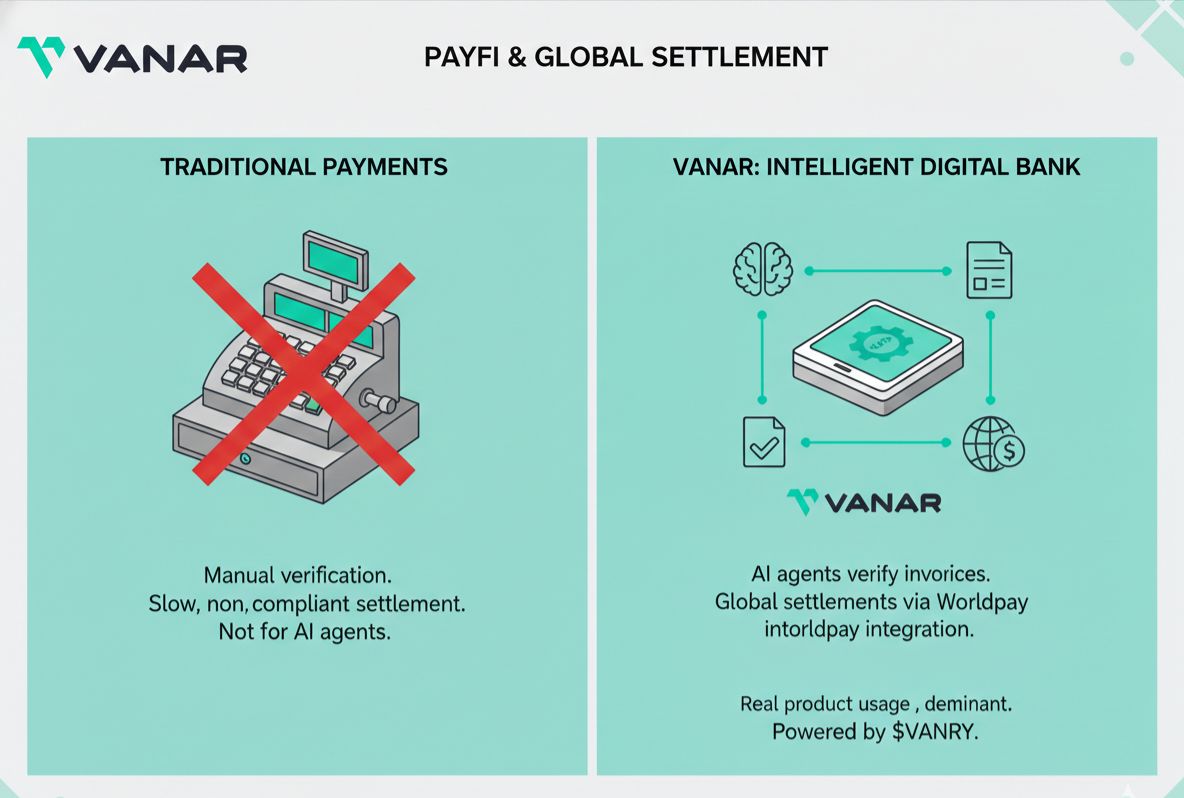

As we progress through 2026, the concept of a "bank" is being completely redefined. We are moving away from traditional institutions where humans sign off on transfers and toward a Machine Economy where AI agents handle billions of dollars in volume autonomously.

But for an AI agent to truly participate in global commerce, it needs more than just a wallet; it needs compliant settlement rails. This is the essence of PayFi (Payment Finance), and Vanar Chain ($VANRY) is at the forefront of this revolution through its groundbreaking integration with global payment giants like Worldpay.

1. What is PayFi? The Bridge to Real-World Commerce

While DeFi (Decentralized Finance) focused on trading and lending, PayFi focuses on the "Time Value of Money" within the payments industry. It’s about making money move faster, cheaper, and smarter across borders.

For AI agents, PayFi is the missing link. An agent can identify a product, negotiate a price, and verify an invoice, but it cannot "call a bank" to settle the debt. By integrating intelligence directly into the payment layer, Vanar allows these agents to transact in a language that traditional financial systems understand.

2. The Power of the Worldpay Integration

Vanar’s collaboration with Worldpay—one of the world’s largest payment processors—is a paradigm shift. Worldpay handles trillions of dollars in transactions annually, and by running validator nodes on the Vanar Chain, they are bringing institutional-grade "pipes" to the AI economy.

This integration allows for:

* Compliant Settlement: Agents can automatically handle KYC/AML (Know Your Customer/Anti-Money Laundering) checks during the transaction process.

* Invoice Verification: Using the Neutron and Kayon layers, an agent can "read" an unstructured invoice, verify the terms, and trigger a payment only when conditions are met.

* Global Reach: Agents on Vanar can settle in fiat or stablecoins across the massive Worldpay merchant network, bridging the gap between Web3 and traditional retail.

3. Intelligence Meets Execution: How it Works

On most chains, a payment is a "blind" transaction—a simple transfer from A to B. On Vanar, it is an Intelligent Settlement:

* Context (Neutron): The agent stores the semantic data of the trade (contracts, receipts) in a compressed "Seed."

* Reasoning (Kayon): The engine verifies that the delivery has been made and the price is correct.

* Action (Flows): The payment is triggered through the Worldpay-integrated rails, settling in seconds rather than days.

4. $VANRY: The Settlement Asset

In this new digital bank, Vanary serves as the essential utility. It powers the reasoning queries needed to verify payments and ensures the security of the settlement layer. As thousands of agents begin settling invoices for everything from cloud compute to supply chain logistics, the demand for $VANRY as the "gas" of the machine economy becomes exponential.

The Verdict: The Infrastructure of Future Finance

The integration of AI, PayFi, and global settlement rails isn't just an upgrade to crypto; it’s the birth of an entirely new financial system. Vanar is building a world where the "Digital Bank" doesn't have a building or a board of directors—it has an AI-native blockchain that thinks, verifies, and settles.

The future of payments isn't just digital; it's intelligent.

#VanarChain #vanar #VANRY #PayFi #Worldpay #GlobalSettlement #BinanceSquare