You are aware of how it is, one moment you are having chai and considering your next trade, then the next moment, boom, there will be an altcoin pumping due to a massive announcement. It was just the case with Plasma. I recall looking at my portfolio and having my tiny hold in the $XPL (yes, I had picked it up on spot a month ago at approximately $0.45) shoot up 15 per cent within the night. Why? Since they announced their new compliance tools, which target large businesses. Man, I should have loaded more earlier man, but, live and learn eh?

I am a trader that has been in this game since 2020 and that I have witnessed dozens of projects come and go. But Plasma? It's different. It is not another layer-2 scaling solution that takes one back to those early Ethereum days, no, in 2026, Plasma has become this strong blockchain platform all about making crypto accessible to the big boys, such as banks and corporations. Their compliance tools are the star in this case. Considering the attempt to make a Fortune 500 corporation to put their toes in DeFi or NFTs without panicking about regulation. That's where Plasma shines. I say why not, I lost count of how many times I heard friends in the community talk of how KYC has given them headaches or AML policy has killed the vibe. But Plasma's toolkit? It is a bridge, ensuring that nothing is above board, and the spirit of decentralization is not lost.

I want to paint a picture: imagine that you are an enterprise executive and in a boardroom, your team is pitching on integration of blockchain. The first question? Is it GDPR or SEC or whatever the new rules are? Plasma provides an answer to that with their native automated reporting and smart contract audit capabilities, and even AI-based risk measurements. I tested their demo wallet a month ago - incredibly easy, even to someone who is less technologically inclined (like a futures trader). It sounded an alarm of possible wash trade in my simulation and I escaped a hypothetical nightmare. Wild West crypto days, how far have we come?

Getting into the Compliance Magic at Diving Deep into Plasma.

So, what exactly is Plasma in 2026? Plasma, to the uninitiated, began as an Ethereum scalling concept as early as 2017 by Vitalik Buterin and Joseph Poon, but it has taken an enormous shape. It is currently a layer-1 blockchain on its own and is focused on enterprise-grade solutions. Their currency, named $PLASMA, drives the network - they stake to become privileged, they pay fees, the typical. However the juice lies in their compliance suite. We are speaking of tools that will go hand in hand with current financial systems. Their RegTech Module, as an example, follows transactions in real-time with blockchain and makes sure that they conform to anti-money laundering (AML) and counter-terrorist financing (CTF) legislation.

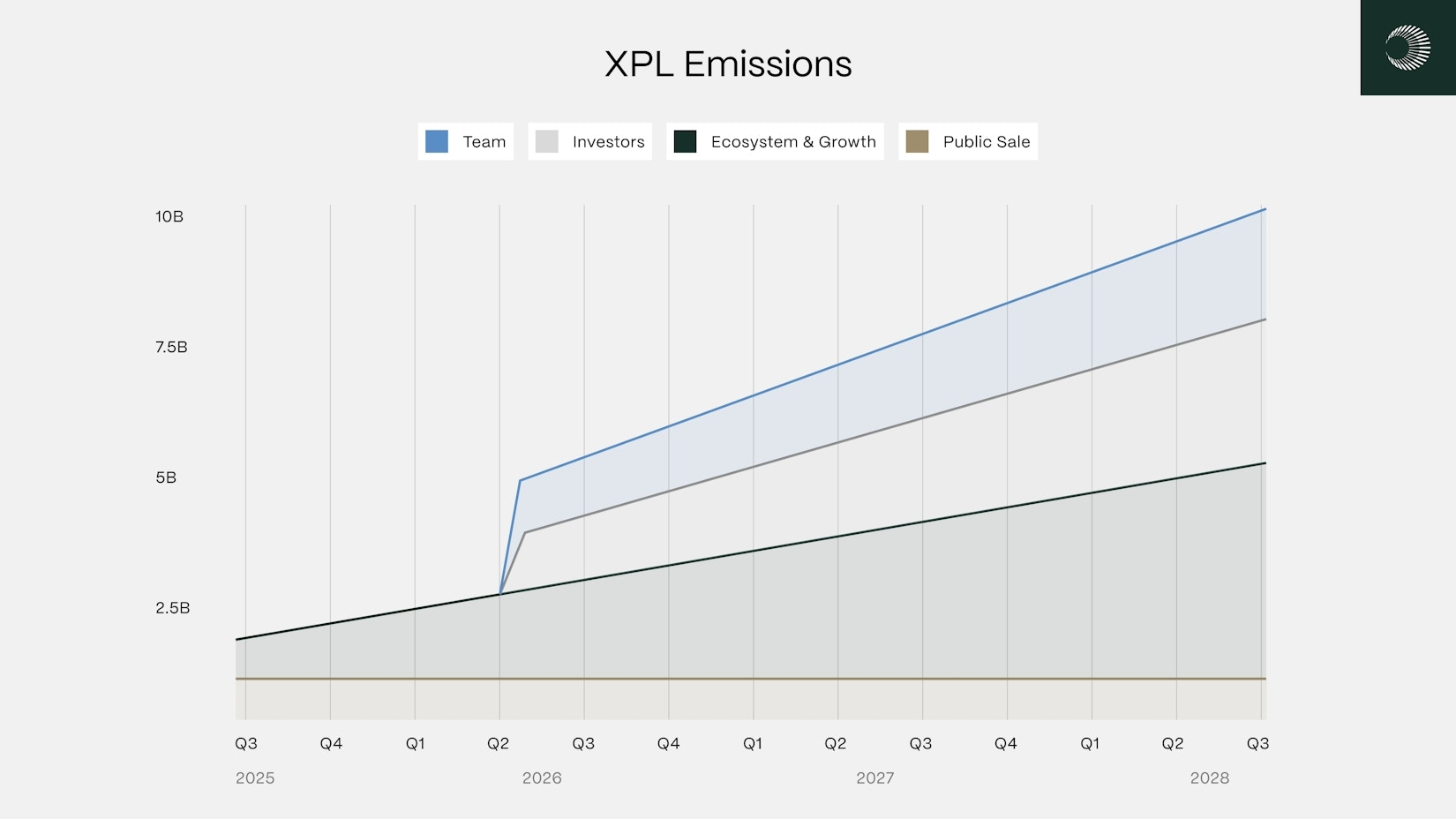

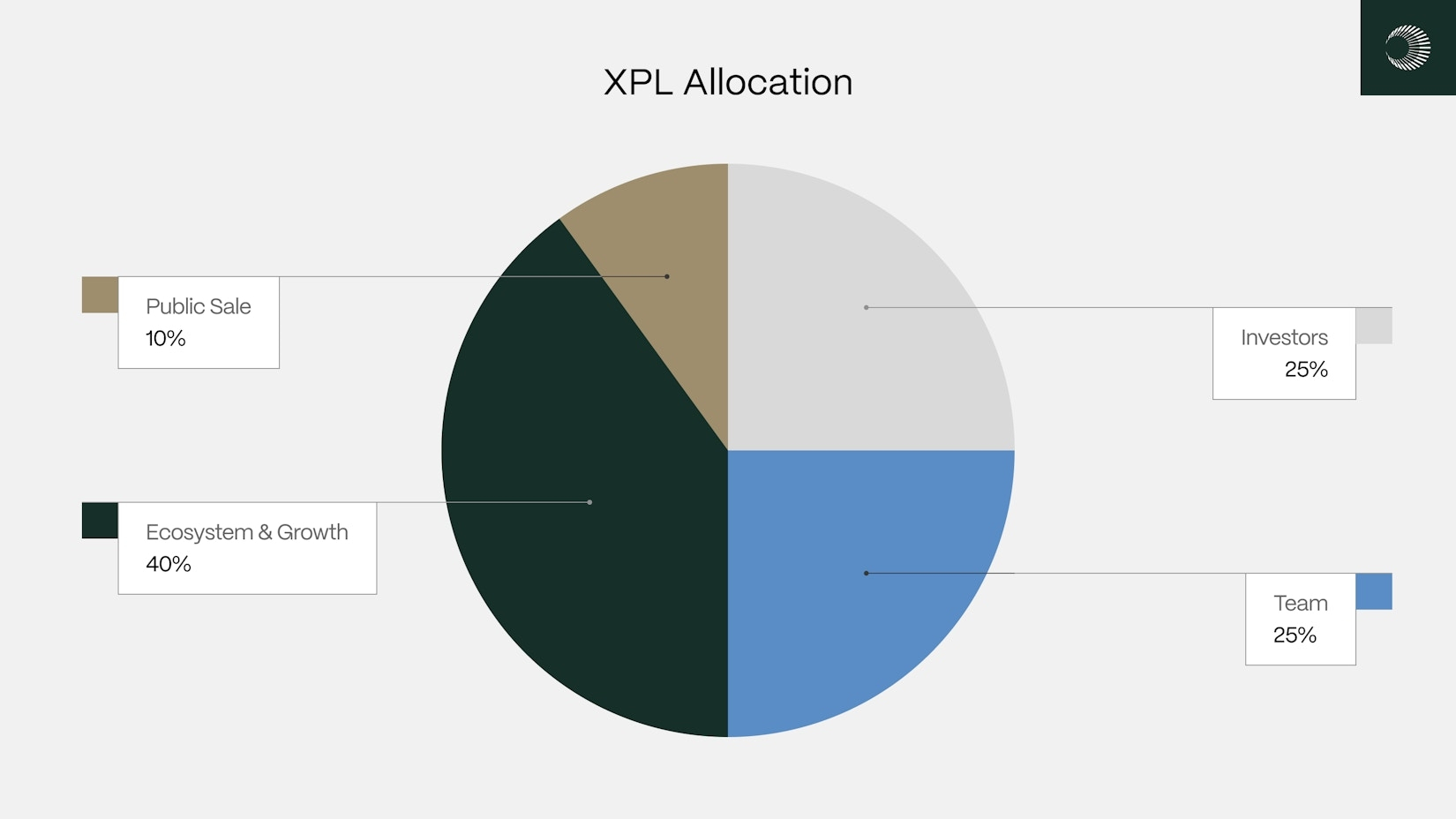

I keep track of their updates since, as a Pakistani trader, I do have my own group of regulations by the State Bank and the SECP. The features of plasma are customizable smart contracts that may impose jurisdiction-specific rules. Similar, on the EU, it uses GDPR data privacy automatically. In the US? Boom, SEC compliance checks. They even enlisted the services of Deloitte in the last quarter on third party audit- that is massive on credibility. In tokenomics terms, the total supply of $PLASMA is 1 billion, and 40% of it is destined to be used in the ecosystem development. On high volumes of transactions, burning mechanisms are activated, and it may be the cause of scarcity. My point is this though, what is interesting to me is that this is what lures businesses. Consider it - many companies such as IBM or JPMorgan have been testing blockchain over years, yet compliance was the obstacle. Plasma removes that.

One unique angle? Their Enterprise Gateway a portal that corps can use to deploy their own chain of private chains connected to the open Plasma network. It is hybrid therefore you have your privacy without losing the interoperability. I have read their whitepaper (I mean, I only skimmed in on an off trading day), which explains how they apply zero-knowledge proofs to confidential transactions. And that is technology which has kept data confidential and proved it is authentic. Bothers me too, since not all projects are based on this. The majority of them are all smoke and mirrors. Plasma has some actual achievements: they have boarded three enterprises in pilot mode in Q1 2026, one of which is a logistics company to which they provided their tools that tracked supply chains. TVL? Sitting at approximately, $500 million current, as compared to 200 mil last year. The ease of listing and liquidity on partnerships with Binance (the partnership is with Square, of course) will be welcomed.

However, in reality, it is not that sunshine. Slow process of adoption due to the speed of enterprises being turtles. In addition to that, Polkadot or Cosmos competition who also flaunts enterprise stuff. Nevertheless, the advantage of Plasma is the compliance focus - it is laser-sharp. I would add a chart here of their TVL growth in the last six months, perhaps out of CoinGecko or their dashboard. A different place to put an infographic with features of compliance as compared to other competitors such as Chainlink or Avalanche.

My Trading Take on Plasma in 2026

Okay, enough of all that, now we can discuss trading as that is where the money is, right? I'm bullish on $PLASMA mid-term. It is hovering around $0.62 at the beginning of the month of February 2026 - I checked Binance this morning. Key support at $0.50, resistance at $0.75. I am monitoring RSI; it stands at 55 and is not overbought. The MACD indicated a bullish cross-over last week hence my addition to the position. Personal narrative: I placed a long futures at $0.55 with 5x leverage, and I took part profits at 0.60, but I remain holding the rest as I believe I can make more to 1 by Q2 in case more news of enterprises is announced.

Macro factors? The post-halving performance of BTC continues to reverberate but since the Fed rates are stabilizing, alts such as Plasma might shine. It has a correlation of 0.7 with ETH, meaning that with Ethereum pumping, Plasma goes. Risks? Regulatory crackdowns - this may be ironical to a compliance project, but as governments crackdown more, it would be detrimental. Besides, dumps may be as a result of token unlocks in March.