---

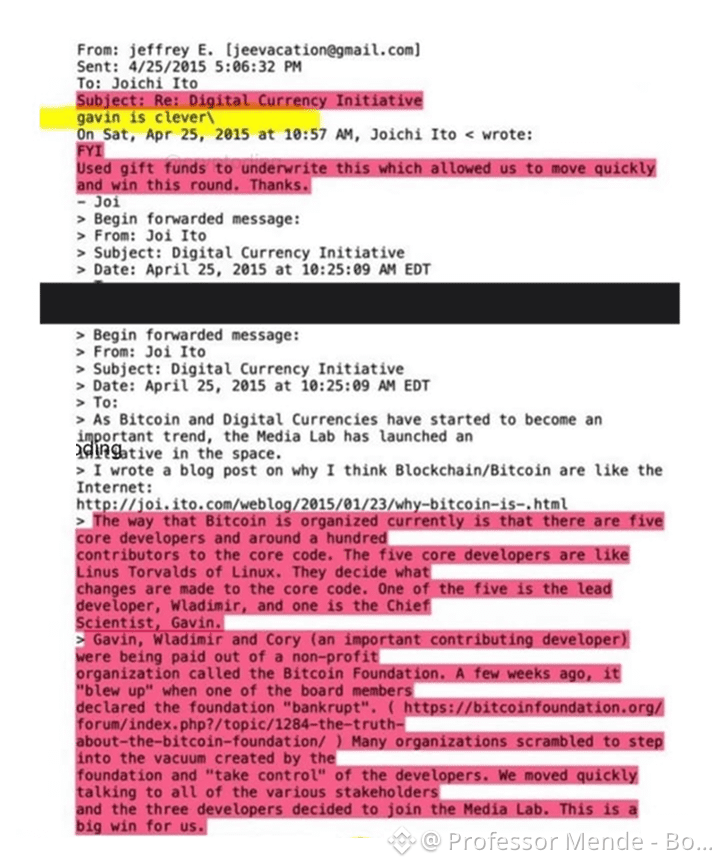

📩 PART 1: THE EMAIL THAT CHANGES EVERYTHING – April 2015

Institutional Control of Bitcoin From the Start

An email dated April 25, 2015, sent by Jeffrey Epstein to Joichi Ito (then director of MIT Media Lab), reveals a deliberate attempt to take control of Bitcoin's core developers.

What the email says:

"Gavin, Wladimir and Cory were being paid out of a non-profit organization called the Bitcoin Foundation. A few weeks ago, it 'blew up'... Many organizations scrambled to step into the vacuum... We moved quickly... and the three developers decided to join the Media Lab. This is a big win for us."

Clear translation:

· Bitcoin's core developers were in financial trouble

· Multiple organizations "scrambled to fill the vacuum"

· MIT Media Lab, funded by "gift funds" (Epstein's money), "won"

· 3 of the 5 core developers joined MIT

Epstein's comment: "gavin is clever!" – A simple phrase confirming his direct involvement.

Current Implications:

✅ Bitcoin was never fully decentralized

✅ Elites controlled its development from 2015

✅ The agenda behind Bitcoin may not be "for the people"

This explains why:

· Bitcoin often follows traditional market movements

· Regulations advance without major resistance

· Institutions suddenly adopt what was "rebel money"

---

---

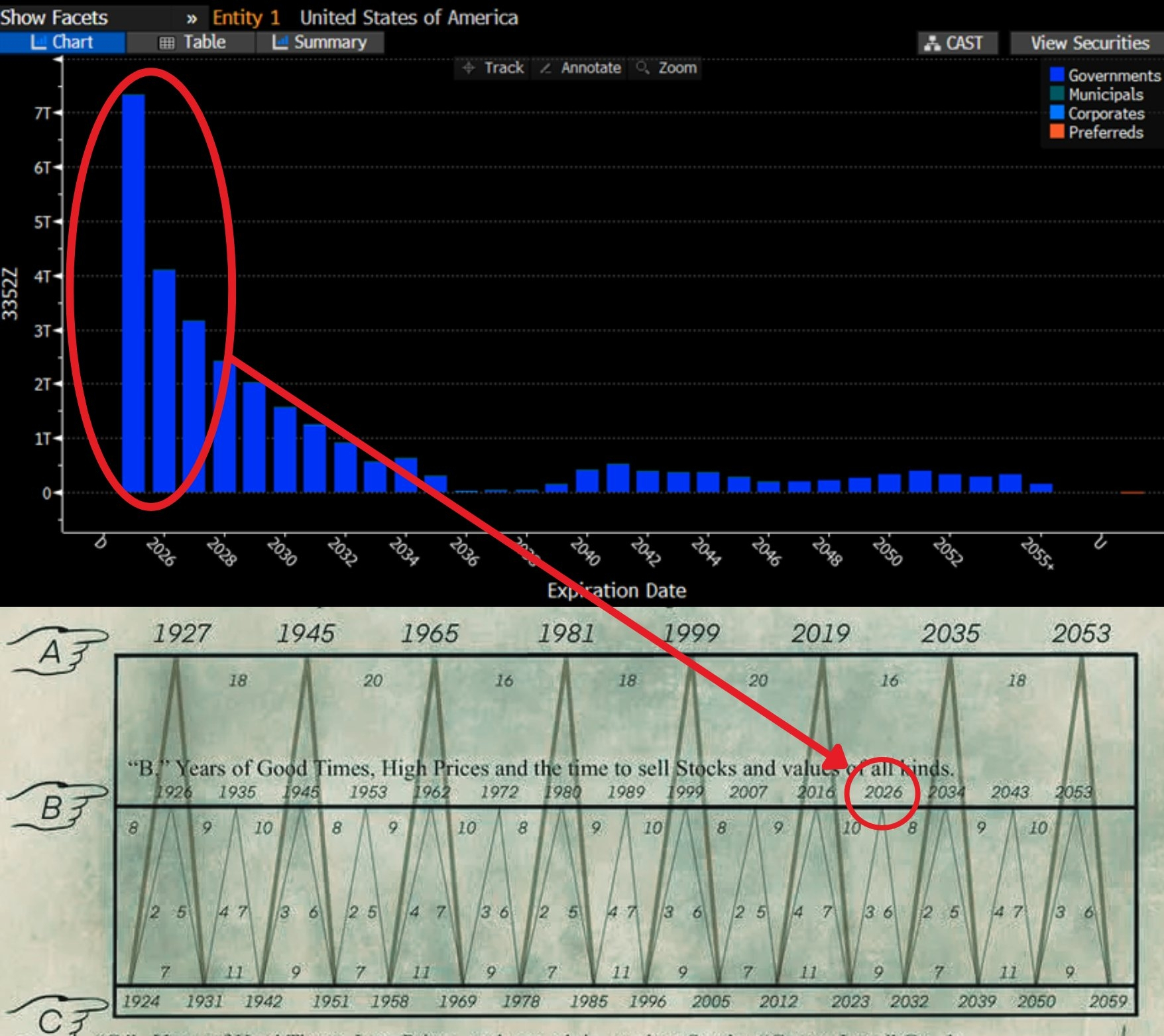

📊 PART 2: THE INEVITABLE ECONOMIC CYCLE – 1926 to 2059

The Chart That Predicts Everything

An economic cycle chart spanning 1926 to 2059 shows a clear, repeating pattern:

90-year cycle (Kondratiev):

· Ascending phase: 40-45 years of growth

· Descending phase: 40-45 years of correction

· We are in 2026: Beginning of the descending phase

Key Phases:

· 1929-1945: Great Depression + War (descending)

· 1945-1971: Economic boom (ascending)

· 1971-2000: Stagflation + crises (descending)

· 2000-2025: Digital boom (ascending)

· 2026-2050: Next descending phase

Bitcoin Correlation:

· 2010-2021: Initial adoption (cycle ascending phase)

· 2021-2025: Speculative peak (end of ascending phase)

· 2026-2035: Major correction (beginning of descending phase)

The implicit prediction:

· Bottom around 2032-2034

· Then recovery for next cycle (2035+)

· Bitcoin could be replaced by then

- --

--

📉 PART 3: THE FALL OF GIANTS – Michael Saylor at -52.48%

The Reality of Institutional "Diamond Hands"

Michael Saylor, the public face of corporate Bitcoin adoption, shows catastrophic losses:

SaylorTracker.com data:

· Portfolio value: $42.15 billion

· Total loss: -52.48%

· Dollar amount lost: ~$22 billion

What This Means:

1. The biggest bull is wounded:

· MicroStrategy holds ~1% of all Bitcoin

· Their "buy and never sell" strategy is in peril

· 50%+ losses force reevaluations

2. Dangerous leverage:

· Bought +855 BTC on Feb 2, 2026 at ~$88K

· Now at $71K → -19% in days

· If continues → forced liquidations

3. Psychological impact:

· Saylor was the "king" of corporate Bitcoiners

· His fall demoralizes institutional adoption

· Other companies will hesitate to follow

---

🔗 PART 4: CONNECTIONS AND IMPLICATIONS

The Link Between All 3 Elements:

2015 (Epstein email): Elites take control

2024 (Saylor): They push mass adoption

2026 (Cycle): They let the market collapse

Suspicious pattern:

1. Control the technology

2. Promote adoption

3. Let the public bear the losses

4. Buy back cheap

Who Really Wins?

· Early investors (2010-2015): already exited

· Institutions (2020-2024): late entrants, now trapped

· Retail investors (2021-2025): bearing biggest losses

The classic pyramid, but digital era version.

---

🎯 PART 5: SURVIVAL STRATEGIES 2026-2035

Accept the New Reality:

1. Bitcoin is not a utopia:

· It's an asset controlled by powerful interests

· Trade it as such, not as a religion

2. Cycles are real:

· We're in early descending phase

· Prepare for 8-10 difficult years

· 2021/2025 peaks won't return before 2035+

3. Don't follow "gurus":

· Saylor, Musk, etc. have their own agendas

· Their losses are real, don't idolize them

Concrete Action Plan:

Short term (2026-2027):

· Reduce crypto exposure to 5-10% max

· Cash = king (prepare to buy dips)

· BTC targets: $60K → $45K → $30K

Medium term (2028-2032):

· Slow accumulation under $30K

· Focus on altcoins with real utility

· Develop skills, not just speculate

Long term (2035+):

· New cycle possible

· But don't bet everything on Bitcoin

· Diversify into new technologies

Essential Protections:

1. Financial education – understand cycles

2. Diversification – gold, silver, land, skills

3. Independence – don't depend on any "guru"

4. Patience – real cycles take decades

---

⚠️ PART 6: SIGNS TO WATCH

Signs the Theory is Correct:

1. More Epstein/Bitcoin revelations

2. MicroStrategy force-liquidated

3. BTC tests $30,000-40,000

4. New "savior" regulations

5. Global monetary reset 2028-2030

Signs We're Wrong:

1. BTC reclaims $100,000 in 2026

2. Saylor announces more massive buys

3. MIT denies the emails

4. Immediate new bull market

---

💎 CONCLUSION: TIME FOR AWARENESS

Evidence is mounting:

· Bitcoin was co-opted by elites

· We're entering a descending economic cycle

· Industry figureheads are in trouble

This isn't conspiracy theory – it's data:

· Verifiable 2015 email

· Economic cycle charts

· Public SaylorTracker data

Your decision now:

· Continue believing official narratives?

· Or adapt your strategy to the new reality?

The market doesn't lie, but storytellers sometimes do.

Trade the data, not the stories.

---

This article is based on public documents and data. Do your own research before any investment decisions. Caution is more important than ever.

#BitcoinRevelations #EconomicCycles #MarketTruth #FinancialAwakening #CryptoReality #TradingTruth #bitcoin #BTC☀ #MichaelSaylorEffect #EpsteinFiles$BTC $ETH $BNB