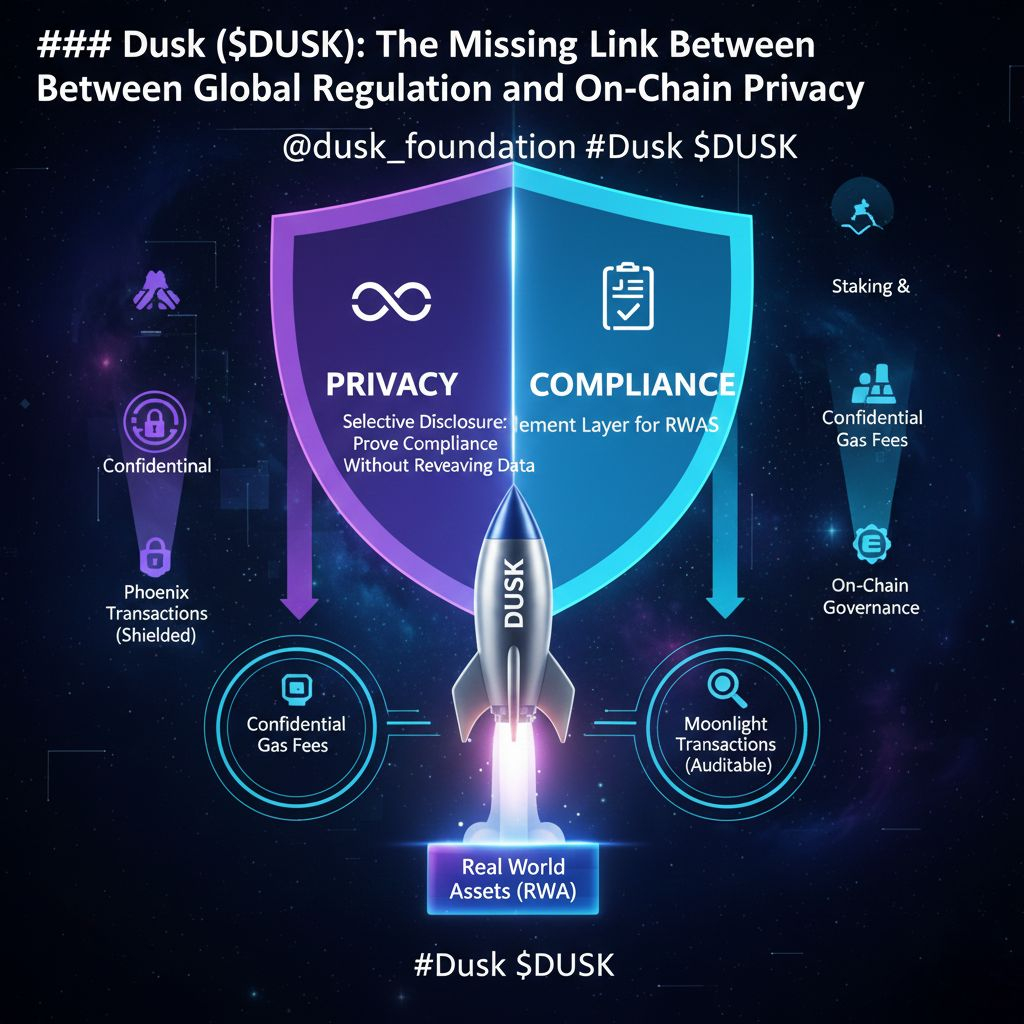

In the fast-moving world of 2026, the blockchain industry has reached a critical crossroads. On one side, we have the drive for mass adoption through Real-World Assets (RWA) and institutional entry. On the other, the non-negotiable need for data privacy and regulatory compliance. @Dusk has emerged as the definitive solution to this "Trilemma," building a Layer 1 that proves you don't have to sacrifice confidentiality to satisfy the law.

The Architecture of Institutional Trust

Dusk isn't just another general-purpose blockchain; it is a purpose-built Confidential Settlement Layer. What makes it unique is how it handles the conflict between public transparency and private finance.

Using advanced Zero-Knowledge Proofs (ZKPs)—specifically its custom PLONK-based implementation—Dusk allows for "Selective Disclosure." This means a financial institution can prove to a regulator that a transaction is compliant with EU MiCA or MiFID II standards without revealing the transaction amount, the identity of the participants, or the specific assets involved to the general public.

The Dual-Transaction Advantage

To maintain fluidity between different needs, Dusk utilizes a brilliant dual-model system:

* Phoenix Transactions: Fully shielded and private, perfect for sensitive institutional settlement.

* Moonlight Transactions: Transparent and auditable, designed for use cases where public verification is a priority.

This hybrid approach ensures that $DUSK can act as a bridge for trillions of dollars in traditional capital waiting for a secure, regulated entry point.

Fueling the Ecosystem: The $DUSK Token Utility

The $DUSK token is far more than a speculative asset; it is the economic engine of a regulated financial internet. Its utility is deeply integrated into the network:

* Staking & Security: Through the Segregated Byzantine Agreement (SBA) consensus, DUSK Holders can stake their tokens to secure the network and earn rewards.

* Confidential Gas Fees: Every transaction on the network, whether private or public, is powered by $DUSK, creating a constant demand loop.

* On-Chain Governance: Holders have a direct say in the protocol’s evolution, ensuring the network remains aligned with its community and institutional partners.

As we see more bonds, real estate, and private equity move on-chain, the "Default Privacy" model offered by @dusk_foundation is becoming the industry gold standard. Dusk isn't just building a chain; it's building the legal and technical rails for the future of finance.

Are you following the RWA revolution? How important do you think institutional privacy will be for the next bull run? Let’s talk in the comments! #dusk