I’ve been jumping from chain to chain, chasing the highest APY, convinced I was being clever a true liquidity hunter.

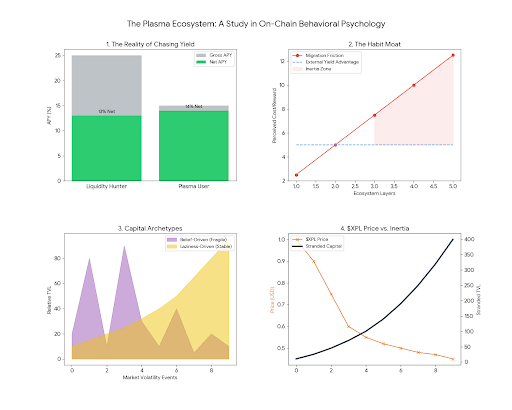

Then I finally did the math. Gas fees. Bridging costs. Slippage. Funds stuck because I wasn’t fast enough. After subtracting all of that, an uncomfortable truth appeared: I didn’t even outperform the @Plasma users who simply stayed put and collected what felt like DeFi “social welfare.”

The irony is hard to ignore.

We love to talk about decentralization and free capital flow, yet in practice, many of us have quietly been absorbed by a well-designed all-in-one ecosystem.

If you look closely, Plasma isn’t really competing on pure technological innovation. It’s competing on behavioral psychology.

Uniswap, Aave, Pendle, Ethena—none of these are exclusive. They exist everywhere. So why do we keep playing here?

Because rewards are wrapped like onion skins—layer after layer.

You want syrupUSDT yield? First, hold USDT.

You want the $XPL airdrop? Go provide liquidity on Curve.

You want to hedge risk? Pendle is conveniently right there.

Every step feels logical.

Every step feels efficient.

And before you realize it, your capital is navigating a maze that feels comfortable—but has no clear exit.

The feeling is eerily similar to being locked into the Apple ecosystem. I know Android phones charge faster. I know Windows laptops are cheaper. But my photos live in iCloud, my passwords sit in Keychain, and my habits are burned into muscle memory. The pain of migration outweighs the appeal of something new.

Plasma is building the on-chain version of iCloud.

It isn’t betting that its technology is superior—it’s betting on human laziness.

When all your DeFi actions can be completed inside a closed loop on one chain, even an external APY that’s 5% higher doesn’t feel worth it. You already know the answer: the stress, friction, and risk of crossing chains once outweigh that extra yield.

It’s a little sneaky—but undeniably effective.

The $XPL price is still dragging, and rationally, I should sell. Yet I hesitate. Not because of belief, but because I can see the amount of “stranded capital” growing. This money isn’t staying out of conviction—it’s staying out of inertia.

And in crypto, belief-driven capital is the most fragile.

Laziness-driven capital is the most stable.

That might be the hardest moat of 2026:

not a technological moat, but a habit moat.