For more than a decade, Bitcoin has moved in a rhythm that many still call a theory.

But when you study the data, the timing, and the macro reactions — one truth becomes clear:

The Bitcoin halving cycle is not speculation.

It is a structural mechanism built into the system itself.

What Is a Bitcoin Halving? (Quick Recap)

Every 210,000 blocks (roughly every 4 years), Bitcoin’s block reward is cut in half.

2009: 50 BTC

2012: 25 BTC

2016: 12.5 BTC

2020: 6.25 BTC

2024: 3.125 BTC

This is not adjustable.

No central authority can change it.

It is hard-coded monetary policy.

Why Halving Creates Cycles (Supply Shock)

Bitcoin demand fluctuates.

Bitcoin supply does not.

When halving occurs:

New BTC entering the market drops by 50% overnight

Miner sell pressure is immediately reduced

Scarcity increases while adoption continues

This creates a delayed supply shock — not instant, but inevitable.

Markets don’t react instantly.

They react when the imbalance becomes impossible to ignore.

The 4-Phase Bitcoin Halving Structure

Bitcoin doesn’t move randomly.

It follows a repeating four-phase structure:

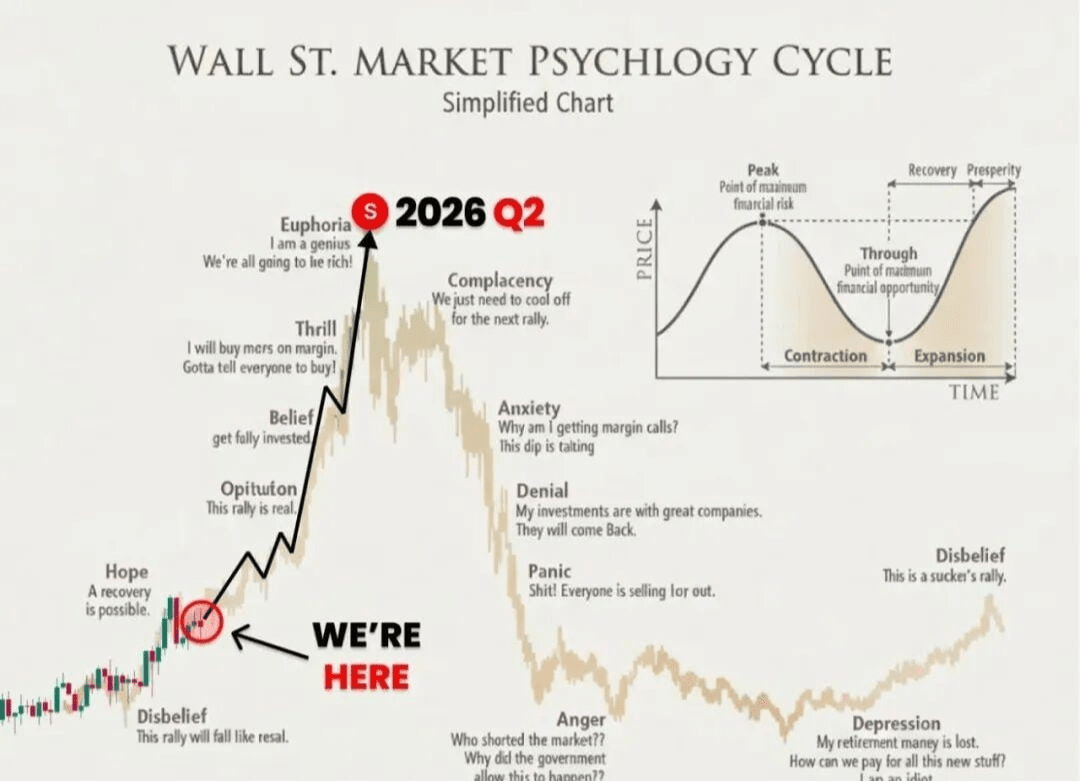

1️⃣ Accumulation Phase (Post-Crash / Post-Capitulation)

Price is boring

Sentiment is dead

Media declares Bitcoin “finished”

Smart money accumulates quietly

This phase builds the foundation.

2️⃣ Pre-Halving Expansion

Price begins to trend up slowly

Volatility increases

Retail interest starts returning

Narratives shift from fear to curiosity

This is where positioning matters most.

3️⃣ Post-Halving Supply Shock (Bull Phase)

New supply is cut in half

Demand continues or accelerates

Price breaks previous all-time highs

Momentum attracts global attention

This is where parabolic moves happen.

4️⃣ Distribution & Blow-Off Top

Euphoria peaks

Everyone becomes a “crypto expert”

Leverage explodes

Smart money exits into strength

Then the cycle resets.

History Does Not Repeat — It Rhymes Perfectly

Look at every halving cycle:

2012 → 2013 bull run

2016 → 2017 bull run

2020 → 2021 bull run

Different narratives.

Different macro conditions.

Same structural outcome.

That’s not coincidence.

That’s design.

Why This Cycle Is Even Stronger

This halving is structurally different:

Spot Bitcoin ETFs absorb supply daily

Institutional capital is now involved

Governments hold Bitcoin on balance sheets

Global debt is at record levels

Fiat currencies are structurally weakening

The supply is shrinking.

The buyers are growing.

This is not hype — it’s math.

Common Mistake Retail Makes

Retail waits for:

“Confirmation”

But confirmation comes after price expansion.

By the time headlines turn bullish:

Risk is highest

Reward is lower

Smart money is already positioned

The halving cycle rewards patience, not prediction.

Final Thought

Bitcoin does not move on hope.

It moves on structure.

The halving is not a theory.

It is a scheduled monetary shock that reshapes supply every four years.

Ignore the noise.

Study the structure.

Those who understand the cycle don’t chase price —

they wait for it.

#Bitcoin #Halving #CryptoCycle #BitcoinStructure #CryptoEducation