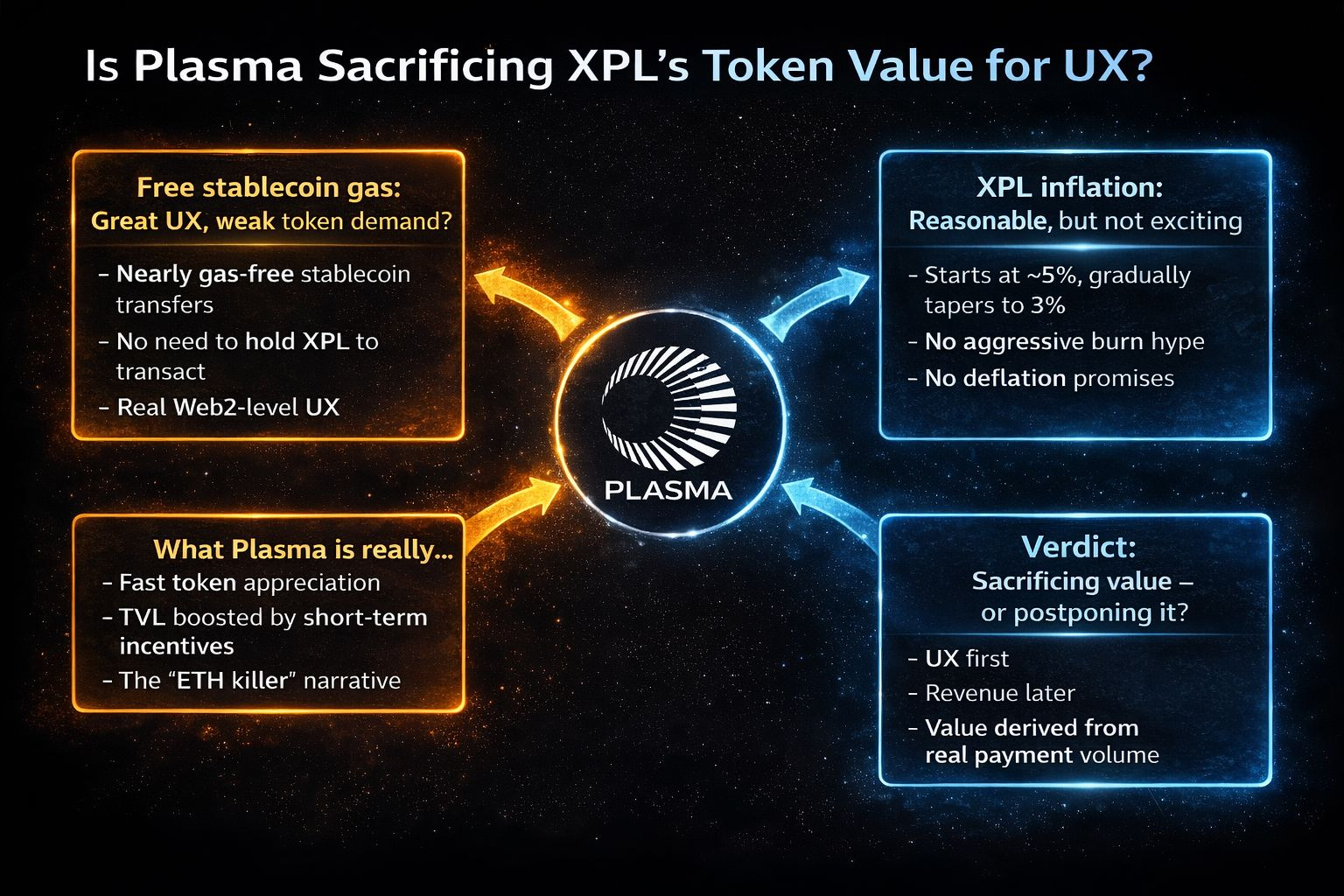

Plasma is doing something most L1s refuse to do:

it prioritizes payment UX over token price optics.

That raises an uncomfortable question:

Is XPL being diluted so users can have a smoother experience?

1. Free stablecoin gas: great UX, weak token demand?

On @Plasma , stablecoin transfers can be nearly gas-free.

For users, that’s real Web2-level UX:

No fee spikes😍

No need to hold the native token😀

No “pending” during congestion👍

But for $XPL holders, this is controversial.

If users don’t need XPL to transact, what actually drives demand for the token?

Plasma is clearly willing to delay short-term token demand to onboard real users first.

2. XPL inflation: reasonable, but not exciting

XPL starts at ~5% annual inflation, gradually tapering to 3%.

It’s controlled, transparent, and tied to validator participation — but it’s not designed to create scarcity narratives.

No aggressive deflation promises.

No token-burn hype.

This is clean tokenomics — and also hard to market in a speculation-driven cycle.

3. What #Plasma is really betting on

Plasma isn’t betting on:

Fast token appreciation

TVL boosted by short-term incentives

“ETH killer” narratives

It’s betting on something slower — and harder:

Consistent, real payment volume.

As usage grows:

EIP-1559 fee burns scale naturally

Staking rewards become meaningful

XPL gains value from network activity, not hype

4. Verdict: sacrificing value — or postponing it?

XPL is not designed to enrich early holders quickly.

But it’s also not a hollow governance token.

Plasma chose the hard path:

UX first

Revenue later

Token value derived from real usage

The real question isn’t:

“Will XPL pump?”

It’s:

“Does the market still have patience for tokens that only appreciate when infrastructure is actually used?”

If the answer is yes, XPL wins — quietly, and very differently from the rest of the market.