In 2026, Bitcoin (BTC) is more mature than before.

The market is not only moving on hype. Now, data and analytics matter a lot.

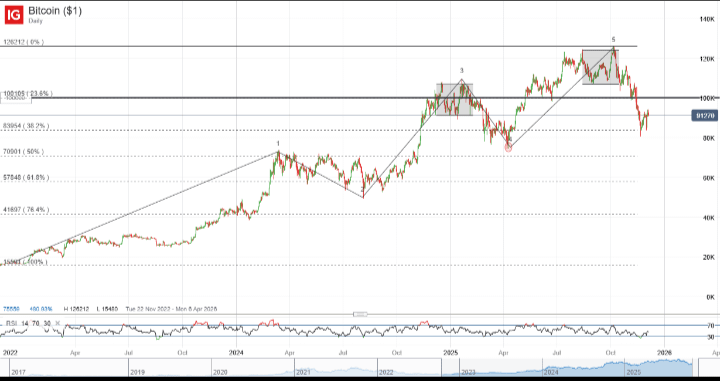

📊 Price Trend

BTC price shows clear trends in 2026.

Higher price levels = bullish trend

Lower price levels = bearish trend

Most traders check daily and weekly charts to understand direction.

📈 Trading Volume

Volume shows market strength.

High volume means strong move

Low volume means weak move

Price move without volume is risky.

🧱 Support and Resistance

Support is a price level where BTC usually stops falling.

Resistance is a level where price stops going up.

Smart traders always check these levels before buying or selling.

🔗 On-Chain Analytics

On-chain data helps us see what big holders are doing.

It shows:

Are whales holding or selling BTC

Is BTC going to exchanges or leaving them

If BTC is leaving exchanges, it is a long-term bullish sign.

🏦 Institutional Role

In 2026, big companies and institutions are active in BTC.

Because of this:

Market is more stable

Long-term trend is stronger

Institutions usually invest for the long term.

Market Sentiment

Fear and Greed Index shows market emotions.

Fear = possible buying chance

Greed = time to be careful

Do not trade only on emotions.

📝 Final Thoughts

BTC analytics in 2026 helps us make better decisions.

It does not give 100% prediction, but it reduces risk.

Always use data, control emotions, and manage risk.