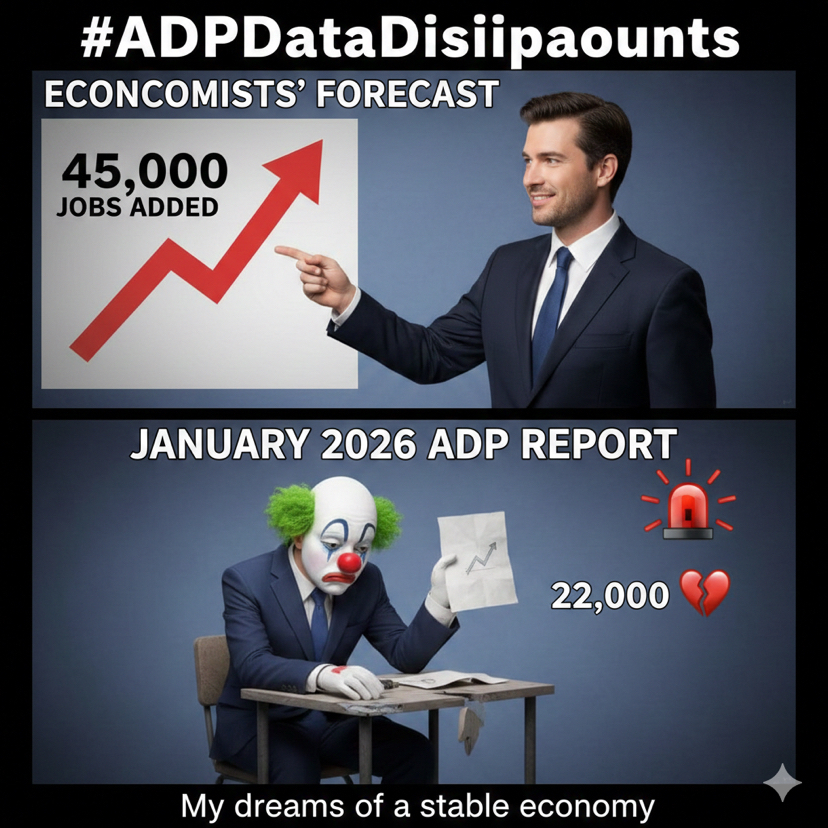

The hashtag #ADPDataDisappoints began trending on February 4, 2026, following the release of the January ADP National Employment Report. The data painted a sobering picture of the U.S. labor market, showing a significant slowdown in hiring that caught many economists and investors off guard.

Here is an article summarizing the situation.

The Big Chill: Why #ADPDataDisappoints is Trending Across Markets

The new year has started with a shiver—and it isn’t just the weather. On Wednesday, the private sector's primary pulse check, the ADP National Employment Report, revealed that U.S. companies added a meager 22,000 jobs in January.

This figure fell dramatically short of the 45,000 gain forecasted by economists, marking the weakest start to a year since the post-pandemic recovery began. As the data hit terminals, the hashtag #ADPDataDisappoints surged, reflecting a mix of economic anxiety and market volatility.

Inside the Numbers: A Tale of Two Economies

The headline number of 22,000 is jarring, but the internal data reveals an even deeper divide between industries:

* The Health Care Lifeline: If not for the Education and Health Services sector, which added 74,000 jobs, the national total would have been deeply negative.

* Manufacturing’s Long Winter: The manufacturing sector shed another 8,000 jobs, continuing a losing streak that has persisted every month since March 2024.

* White-Collar Retreat: The most alarming "disappointment" came from Professional and Business Services, which slashed 57,000 positions—the steepest monthly drop for the sector in nearly a year.

* The Big Business Pullback: Large employers (500+ employees) cut 18,000 jobs, suggesting that corporate America is tightening its belt in the face of rising interest costs and economic uncertainty.

Market Reaction: Tech and Crypto Feel the Heat

The "miss" triggered immediate tremors across financial markets. While the Russell 2000 (small caps) saw a slight "jolt" as investors bet on more aggressive interest rate cuts from the Federal Reserve, the tech-heavy Nasdaq took a hit.

The disappointment was felt most acutely in the SaaS (Software as a Service) and Cryptocurrency sectors. Bitcoin and Ethereum saw sell-offs as traders interpreted the weak labor data as a sign of a "cooling" economy that might be losing its grip on a "soft landing."

The Fed’s Dilemma

Just last week, Federal Reserve Chair Jerome Powell suggested that the labor market was "stabilizing." This ADP report complicates that narrative. With a partial federal government shutdown recently delaying official Bureau of Labor Statistics (BLS) data, the ADP report has taken center stage as the only reliable window into the economy.

> "Job creation took a step back in 2025, and we are seeing that momentum stall further in 2026," says Nela Richardson, ADP Chief Economist. "While wage growth remains stable at 4.5%, the 'low-hire, low-fire' environment is shifting toward a more cautious posture for employers."

>

What’s Next?

All eyes are now on the (delayed) official government jobs report. If the BLS data mirrors ADP’s disappointment, pressure will mount on the Fed to pivot toward rate cuts to prevent a "cooling" market from turning into a deep freeze.

#EthereumLayer2Rethink? #DPWatch