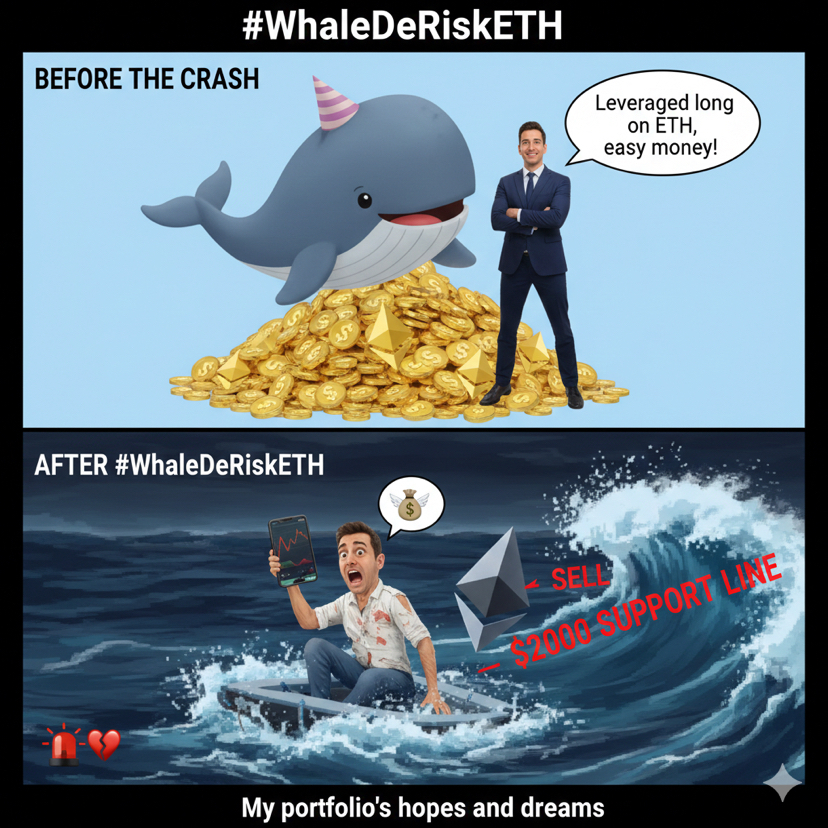

#WhaleDeRiskETH On February 5, 2026, the hashtag #WhaleDeRiskETH surged in popularity as Ethereum ($ETH ) suffered a sharp decline, briefly dipping toward the $2,100 level. The trend highlights a massive wave of "de-risking" by large-scale holders (whales) who are offloading assets to protect their portfolios from further liquidations.

Here is an article breaking down the current market crisis.

The Great Unwind: Why #WhaleDeRiskETH is Dominating the Crypto Narrative

The Ethereum market is currently facing its most significant stress test of 2026. As of this morning, ETH has plummeted nearly 34% over the past month, with a brutal acceleration in the last 48 hours. The catalyst for the trending hashtag #WhaleDeRiskETH is a series of massive "forced" sales and strategic exits by institutional-grade investors.

The Domino Effect: Liquidations and Loans

The primary driver behind the de-risking trend isn't just simple profit-taking—it’s survival. Over the last 24 hours, prominent on-chain entities, including Trend Research and Garrett Jin, have moved over 316,000 ETH (worth roughly $738 million) to exchanges like Binance.

* Debt Repayment: Whales who used their ETH as collateral for large loans are now selling to repay those debts before the price hits "liquidation levels."

* The $2k Psychological Barrier: With ETH currently hovering around $2,200, the market is terrified of a breach below $2,000, which could trigger a massive secondary wave of automated liquidations.

* Record Leverage: Experts note that ETH recently hit record-high leverage levels, making the current "unwind" particularly violent as long positions are forcibly closed.

Mixed Signals: Strategic Selling vs. Long-Term Betting

While many are fleeing, the data shows a fascinating "tug-of-war" among the elite:

* The Sellers: A "Bitcoin OG" recently offloaded 15,000 ETH to cover loans, adding to the downward pressure.

* The Buyers: Amid the chaos, the firm BitMine reportedly acquired over 41,000 ETH during the dip, bringing their total holdings to 4.28 million $ETH .

Market Sentiment: Why the Panic?

The de-risking isn't happening in a vacuum. Two major macro factors are fueling the #WhaleDeRiskETH fire:

* Fed Uncertainty: Investors are bracing for a high-stakes Federal Reserve decision that could further dampen "risk-on" assets like crypto.

* Quantum Anxiety: A niche but growing concern over "quantum computing threats" to legacy blockchain encryption has led some institutions to rotate out of older cryptographic standards, contributing to the selling pressure.

The Bottom Line

The U.S. labor market's recent "stumble" (see #ADPDataDisappoints) has only added to the "de-risking" mindset. For $ETH , the question is no longer about hitting new all-time highs, but whether the $2,000 support floor can withstand the weight of the whales heading for the exits.