There’s a moment in every organization where the excitement of moving money gives way to something far less glamorous: the close.

End of day. End of week. End of month. Numbers are reconciled, discrepancies are hunted, and anything that doesn’t line up becomes someone’s problem. This is where many payment systems quietly lose favor — not because they fail outright, but because they introduce just enough ambiguity to slow everything down.

What keeps standing out to me about Plasma is how little it seems interested in the act of sending money, and how much it seems designed around the after — the moment when someone needs to be certain that what happened can be recorded, explained, and forgotten.

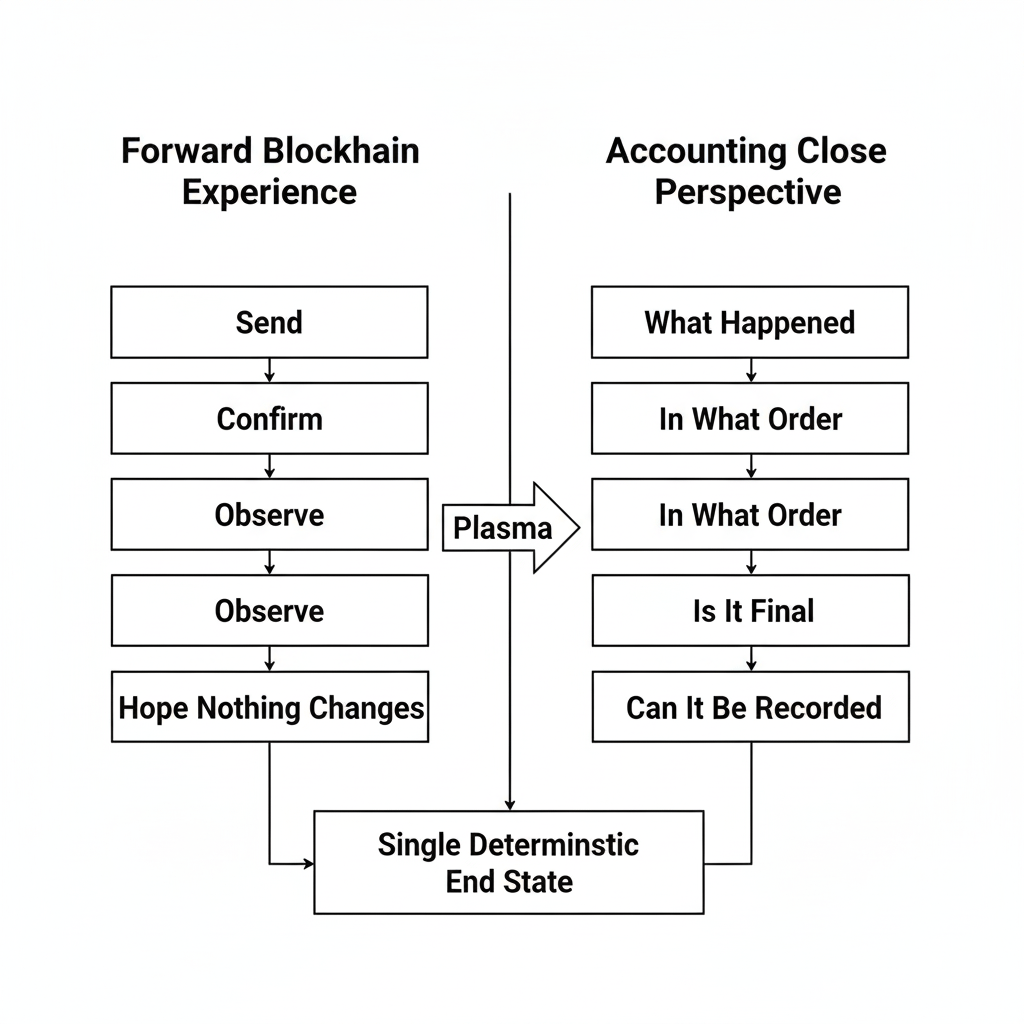

Most blockchains are experienced forward in time. You send, you wait, you watch. Accounting works backward. It asks what already happened, in what order, and whether that story is consistent everywhere it needs to be. Systems that feel smooth in the moment can become painful under retrospective scrutiny.

Plasma feels unusually sympathetic to that backward-looking reality.

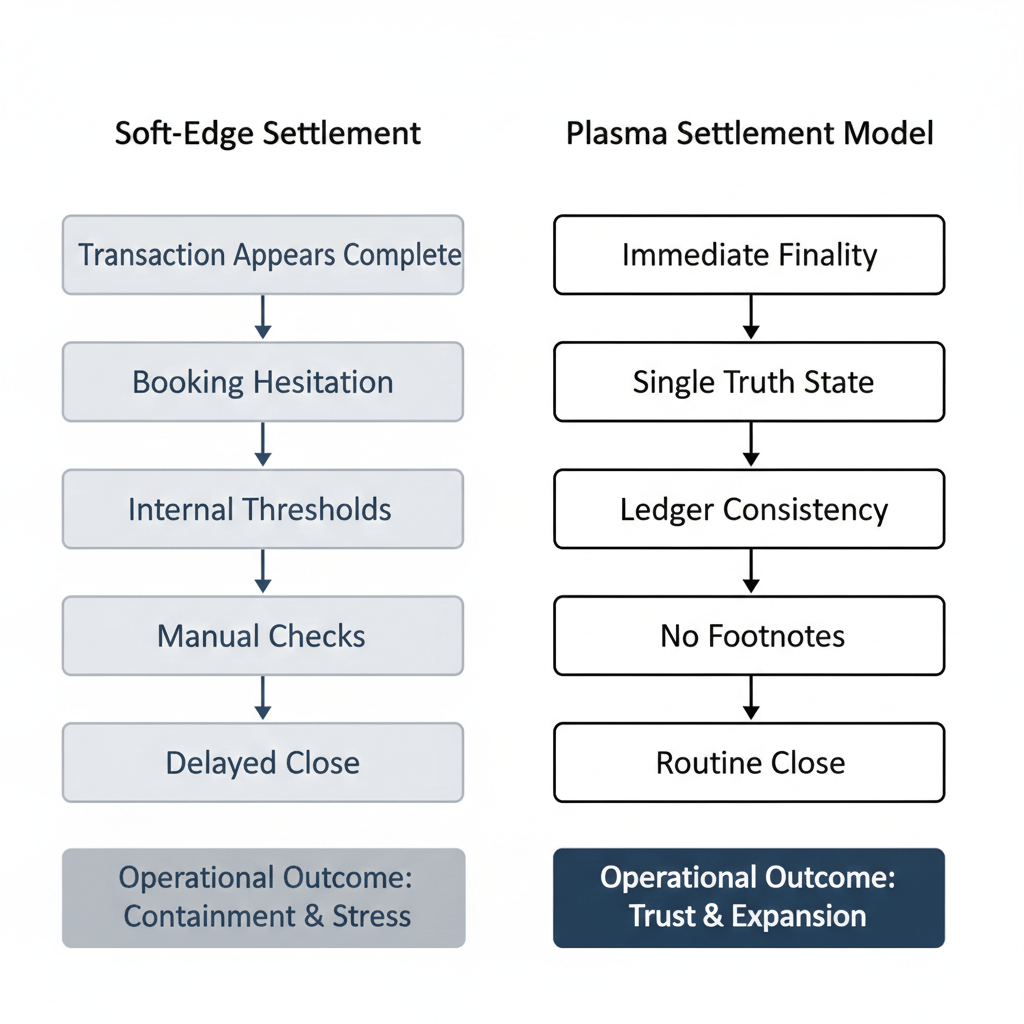

In many crypto systems, settlement has a soft edge. Transfers appear complete, but teams hesitate to book them. They wait for confirmations, internal thresholds, or just time to pass. That hesitation doesn’t come from fear of loss — it comes from fear of explaining something that later changes shape.

The cost of that fear is subtle but enormous. Books stay open longer. Reports are delayed. Manual checks proliferate. Over time, organizations stop using the system for anything that matters near a deadline.

Plasma seems to be built to remove that hesitation.

What I notice is an emphasis on decisiveness — not in a dramatic way, but in a clerical one. Payments are meant to land in a state that feels finished enough to record immediately, without footnotes or qualifiers. When something can be booked cleanly, people trust it more than when it’s merely visible.

That trust compounds.

Accounting teams don’t want to be brave. They want to be boring. They want systems that don’t require judgment calls at 11:47 p.m. on the last day of the month. A payment rail that behaves the same way every time allows routines to form, and routines are the real backbone of financial operations.

Plasma’s design choices suggest an understanding that most adoption doesn’t happen at the edge of innovation — it happens at the edge of tolerance. How much ambiguity can a team tolerate before they build workarounds or walk away?

There’s also something important about how this affects accountability. When systems leave room for interpretation, responsibility diffuses. People defer decisions. “Let’s wait and see” becomes policy. Over time, that erodes ownership. When outcomes are clear, responsibility sharpens. People know when a task is done and when it isn’t.

Plasma feels like it’s trying to create that sharpness.

This isn’t about making everything rigid. It’s about making normal outcomes obvious. When a payment closes cleanly, everyone downstream can move forward without coordination. When closure is fuzzy, coordination becomes mandatory — and coordination is expensive.

What I find interesting is how rarely this perspective shows up in crypto narratives. We talk about users and developers, but rarely about the people whose job it is to make sure the books make sense. Yet those people have veto power, even if they never say it out loud.

Systems that stress them out don’t get expanded. They get contained.

Plasma’s restraint — the way it avoids dramatic behavior — feels tailored to this audience. Not because it markets to them, but because it doesn’t force them to adapt. The system adapts to the reality that financial records are not optional artifacts. They are the final truth.

There’s also a psychological element here. When teams trust that yesterday’s activity won’t surprise them today, they stop checking obsessively. The system recedes from attention. That’s when usage stabilizes. Not because everyone loves it, but because no one has a reason to worry about it.

Crypto often celebrates transparency, but transparency without clarity is just noise. Plasma seems more interested in clarity — fewer states, fewer interpretations, fewer late-night questions.

If payments are going to become routine infrastructure, they have to survive the least glamorous test of all: the close. The quiet hour when nothing should move, and everything should already make sense.

Plasma feels like it was designed for that hour.

Not for applause.

Not for screenshots.

But for the moment when someone looks at a ledger, nods, and goes home on time.

In financial systems, that nod is one of the hardest things to earn.