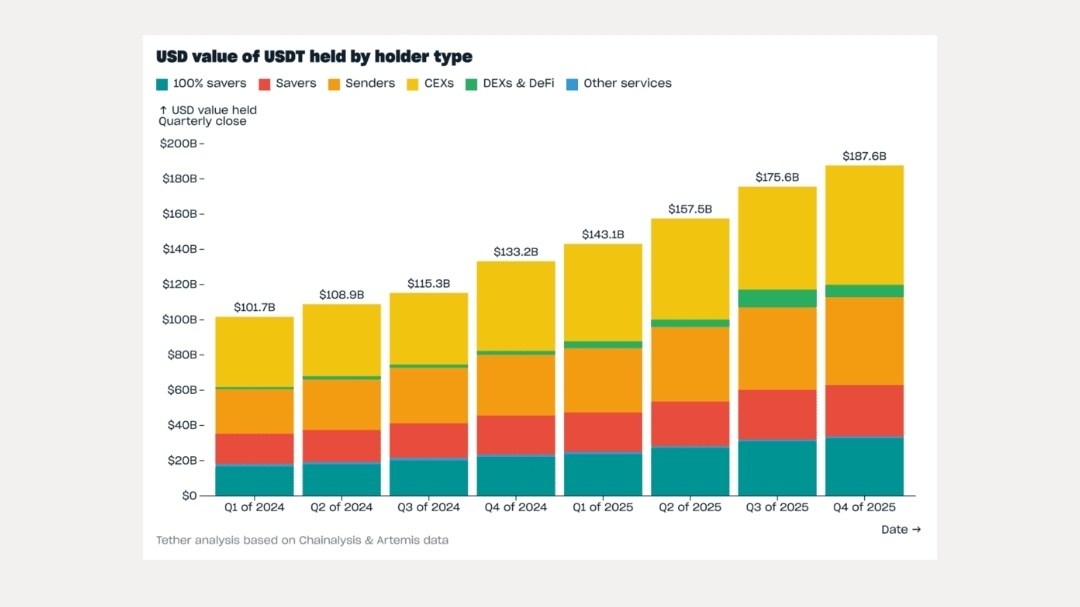

The greatest share of USD₮, 36%, was held in centralized exchanges (CEXs) at the close of Q4, an increase of 2.8 percentage points on the close of Q3. This was in part due to a decrease in USD₮ held in decentralized exchanges (DEXs) and decentralized finance (DeFi) following the 10 October crypto liquidation cascade, with USD₮ held in DEXs & DeFi decreasing by $3B (2 percentage points) in Q4 to $7.1B (3.8% share of USD₮).

The next largest share of USD₮, 33%, is held by savers, of which 17.4% is held by 100% savers and 15.6% by other savers. Savers added $2.9B of USD₮ to their holdings in Q4, bringing their total to $62.1B at the close of Q4. USD₮ attracts not just the most savers, as described earlier, but also the greatest amount of USD value saved, with 59.9% of all value saved in stablecoins, and 77.3% if wallets each holding $10M+ are excluded (which are often cold wallets of exchanges).

Senders held the third largest share of USD₮, at 26.5% at the close of Q4. This share was relatively constant between Q3 and Q4, with senders adding $2.2B of USD₮ to their holdings in Q4, reflecting growing liquidity for transactional use cases of USD₮