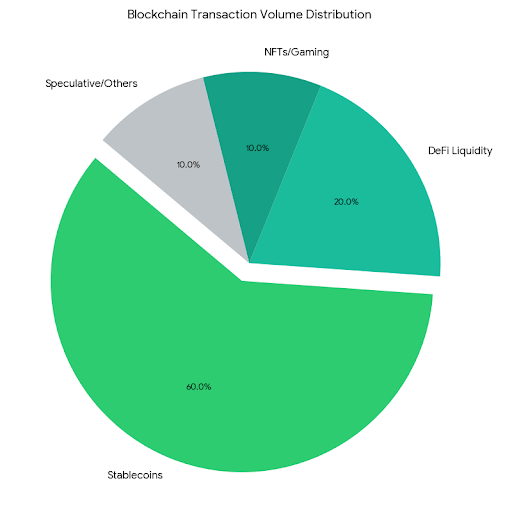

Crypto is maturing, with infrastructure quality taking center stage over hype. Non-fungible tokens, blockchain games, Layer-2 solutions, and restaking keep growing, but stablecoins have already proven their worth. They drive most on-chain activity, dominate decentralized finance, enable payments across borders, and are used more and more by institutions. Plasma is built to address this reality. It's a Layer 1 blockchain designed specifically for stablecoin transactions, not speculative trading.

Most blockchains were first created to secure a volatile asset. Stablecoins were later included as tokens that work on top of this structure. This creates problems when blockchains are used for actual finance: users have to hold tokens for transaction fees that they don't want, fees change without warning, and settling transactions can be slow or unsure. Plasma addresses this differently by making stablecoins the main unit of value and designing the network to support their real-world use.

Plasma offers full Ethereum Virtual Machine compatibility through Reth, Ethereum’s fast execution client. This is important because it lets developers use their existing Ethereum smart contracts with minimal changes and continue using their familiar tools, wallets, and libraries. Instead of competing with Ethereum, Plasma expands it into a chain made for financial settlement. This eases things for developers and speeds up the creation of payment, decentralized finance, and settlement apps.

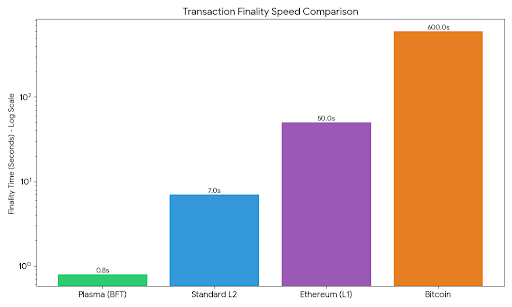

Speed and reliability are key for any system that handles money. Plasma introduces PlasmaBFT, a Byzantine Fault Tolerant consensus mechanism created to deliver very fast, guaranteed transaction finality. Unlike systems that need multiple confirmations and waiting periods, Plasma finalizes transactions quickly and irreversibly. This is particularly important for payments, treasury operations, and institutional transfers where settlement delays create risks and inefficiencies.

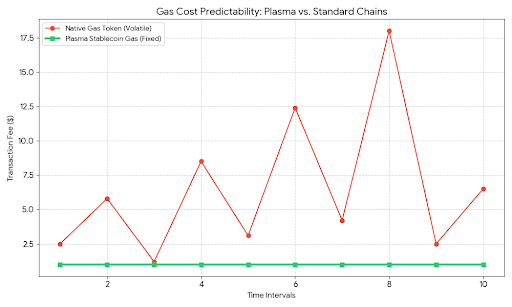

One of Plasma’s most important ideas is its stablecoin-focused economic model. On most blockchains, even users who just want to send stablecoins have to buy and manage a volatile token for fees. Plasma removes this problem by supporting fee-less USDT transfers and allowing fees to be paid directly in stablecoins. This greatly improves the user experience and makes cost structures predictable for businesses. For companies, fintech platforms, and payment providers, stablecoin-based fees simplify accounting and reduce worries about token volatility.

Security and neutrality are essential for settlement infrastructure. Plasma strengthens these features through Bitcoin-anchored security. By connecting key security aspects to Bitcoin’s proof-of-work chain, Plasma gains from Bitcoin’s unmatched decentralization, resistance to censorship, and reputation. This connection helps position Plasma as neutral financial infrastructure suitable for global and institutional use.

Plasma’s purpose becomes clearer when seen next to current crypto trends. In decentralized finance, stablecoins are still the main unit of account and liquidity. Plasma gives a settlement layer that matches this reality, improving speed and reliability. In the Layer-2 world, rollups focus on execution but still rely on solid base-layer settlement. Plasma supports these systems by offering a Layer 1 specifically for stablecoin settlement. As real-world asset tokenization and regulated on-chain finance grow, the need for infrastructure based on stablecoins will keep increasing.

Besides finance, Plasma enables uses in on-chain commerce, gaming economies, payroll, and digital marketplaces. Transaction finality in under a second and stable pricing make micro-transactions and frequent payments doable. Developers can focus on building products instead of managing infrastructure problems, while users engage with blockchain technology in a way that feels like traditional digital finance.

Plasma shows a larger move in blockchain design toward specialization. Instead of trying to do everything, it focuses on one proven and essential use. As stablecoins increasingly connect traditional finance and crypto, Plasma wants to provide the settlement rails under that connection—fast, reliable, secure, and made for real economic activity.