Stablecoins are everywhere in crypto, but most chains treat them like any other token. That creates tons of annoying friction:

weird fees, delays in confirmation, needing extra coins just to pay gas it all adds up and kills the “smooth payments” dream.

Plasma flips the script it’s a Layer 1 built from the ground up specifically for stablecoin settlement. Not just another general purpose chain where stablecoins are an afterthought.

First off, it’s fully EVM compatible via Reth, so devs can drop in existing contracts without rewriting a single line. But under the hood, the execution layer is tuned for predictable, consistent settlement perfect for real payments and finance where you need reliability over wild composability.

First off, it’s fully EVM compatible via Reth, so devs can drop in existing contracts without rewriting a single line. But under the hood, the execution layer is tuned for predictable, consistent settlement perfect for real payments and finance where you need reliability over wild composability.

The game-changer?

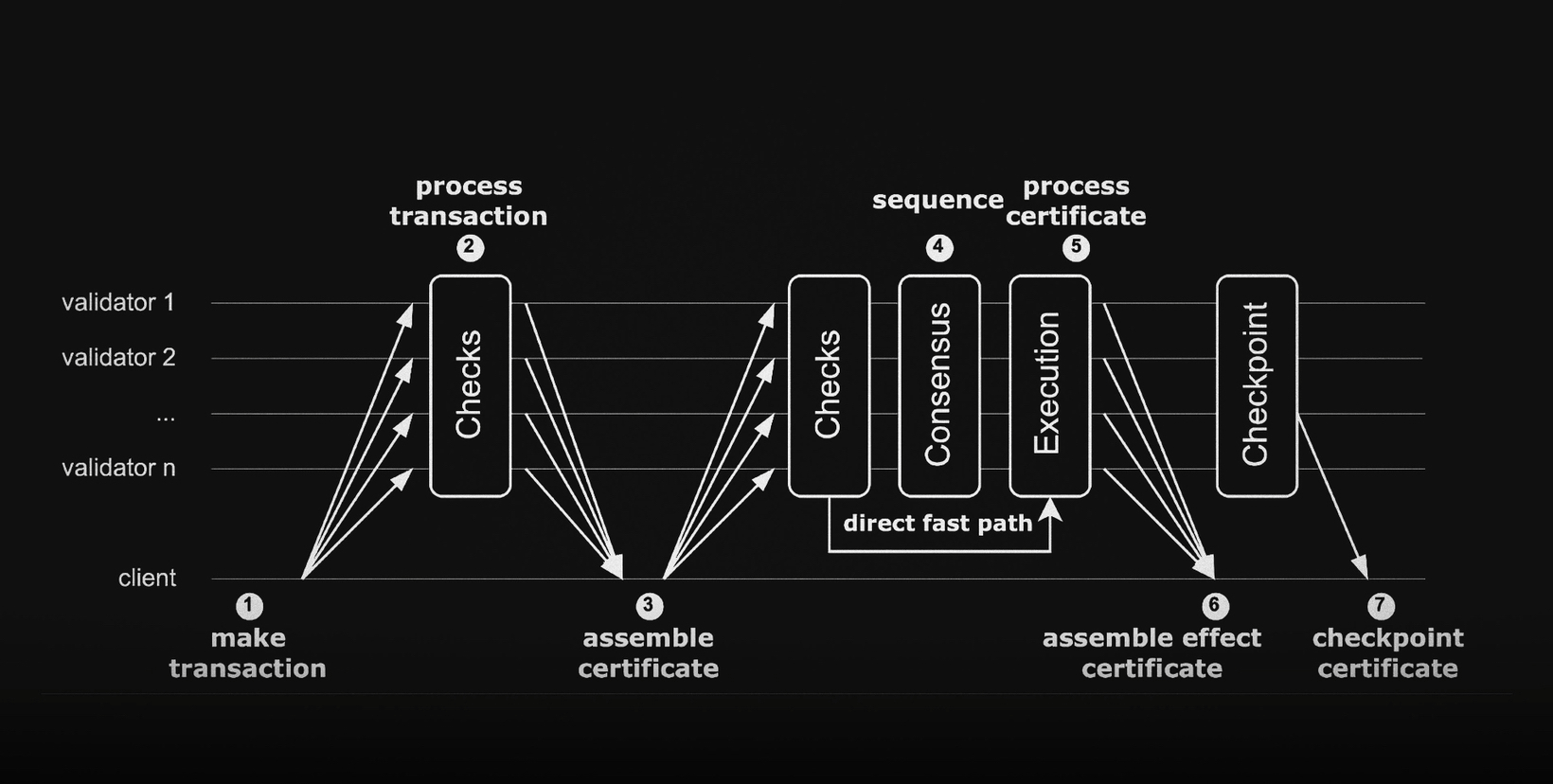

Sub-second finality powered by PlasmaBFT. Transactions confirm almost instantly, slashing the time between sending and actually using those funds. No more waiting around wondering if the payment landed.

Then there’s the killer feature:

Then there’s the killer feature:

native gas abstraction for stablecoins. You can do gasless $USDT transfers, or pay fees directly in stablecoins. No more forcing users to hold ETH or whatever just to move money. Huge win for retail users and high volume apps.

Security stays rock-solid with Bitcoin-anchored settlement. By tying into BTC, Plasma gets that extra layer of neutrality and censorship resistance no new trust hoops to jump through.

On the product side, @PlasmaOne builds wallets and payment tools right into the network as native features not bolted-on apps. It just feels like using money, not wrestling with crypto.

On the product side, @PlasmaOne builds wallets and payment tools right into the network as native features not bolted-on apps. It just feels like using money, not wrestling with crypto.

And the $XPL token?

It’s tied to the actual infrastructure and long-term settlement demand, not pump and dump hype.

Bottom line:

Plasma isn’t trying to be everything to everyone. It’s laser-focused on making stablecoin transfers feel as instant and frictionless as Venmo or a bank wire but on chain, secure, and decentralized.

If we’re serious about stablecoins powering real world finance, this kind of protocol level thinking is exactly what’s needed. 🚀