CryptoQuant data shows this Bitcoin drawdown is more severe than early 2022. Since BTC slipped below its 365-day moving average in November, price is down 23%, compared to just 6% in the same window in 2022.

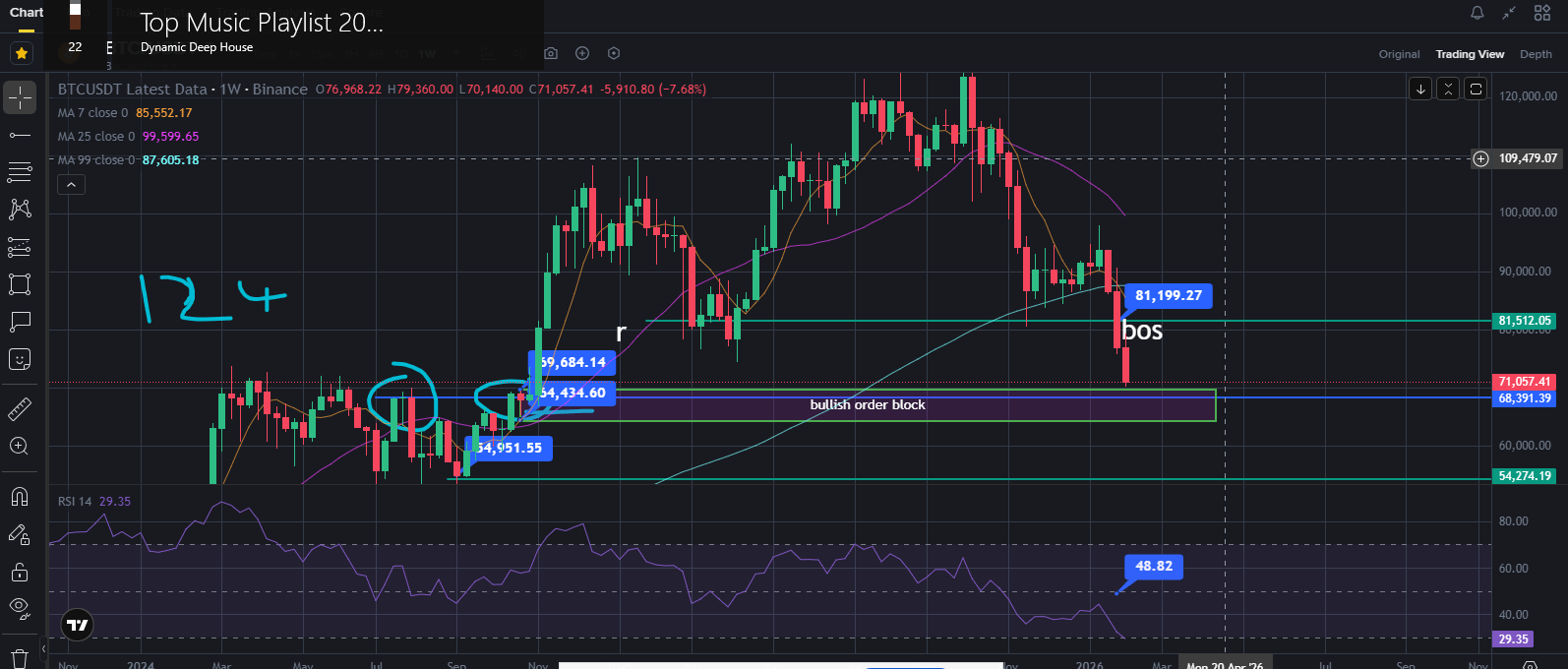

Momentum is deteriorating, and analysts warn of a potential retest of the $60K–$70K support zone — with risk skewed lower

What the market is saying right now:

Technical stance right now:

Signals: Strong Sell (19) | Neutral (4) | Buy (1)

Price: ~$70,850 and sliding

Intraday models leaning heavily bearish

Key levels to watch this week:

🧱 Resistance: $69K–$71K

🎯 Downside targets: $62K → $60K → $56K

Danger zone: A daily close below $60K opens the door to low-$50Ks

Big picture takeaway:

Short-term structure: Strong Sell

7-day forecast: ~ $56,800

ETF flows: showing institutional selling pressure

Sentiment: drifting toward Extreme Fear

“Bitcoin pullback is deeper, slower, and more structural than the 2022 correction.

If $60K fails to hold, $56K–$58K becomes the next real test. Bulls need a reclaim above $72K to invalidate the bearish setup.