Every crypto trader eventually runs into the same awkward truth: markets love transparency, but real money doesn’t. If you’ve ever watched a wallet get tracked, a position get front run, or a treasury move leak into Crypto Twitter before the transaction even settles, you already understand why “private financial data” on-chain is becoming a serious conversation instead of a niche one. Zedger is one of the more interesting answers I’ve seen lately, because it’s not trying to make finance fully invisible. It’s trying to make it selectively private—private to the public, but still verifiable when it needs to be.

In plain terms, Zedger is a protocol on Dusk designed to protect transaction and asset information while still allowing regulatory audit through selective disclosure. That phrase matters. Selective disclosure means you don’t broadcast everything to everyone by default, but you can prove specific facts or reveal specific records to an authorized party when required. Dusk’s own documentation describes Zedger as built for securities-style assets (think stocks or bonds represented as tokens), where privacy is expected, but compliance can’t be optional.

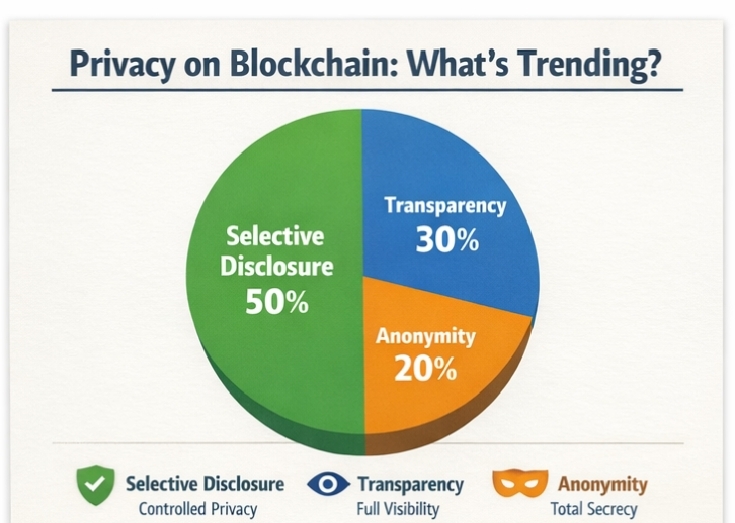

The reason this is trending into 2026 is bigger than any single chain. The privacy conversation has shifted from “how do I vanish?” to “how do I stay compliant without doxxing my entire balance sheet?” That’s not me editorializing industry coverage has been explicitly framing the next privacy phase as selective disclosure rather than pure anonymity. Traders feel it in a different way: the more capital that moves on-chain, the more alpha gets extracted by people who can see your intent early. If you’ve traded anything thin or size sensitive, you know how brutal that can be.

Technically, Zedger sits in a stack where Dusk uses a privacy oriented transaction model called Phoenix. Phoenix is based on a UTXO like design (Dusk calls them “notes”), where transactions consume old notes and create new ones. The network prevents double spends using “nullifiers” basically one way markers that prove a note was spent without revealing which note it was. If you’re coming from account based chains like Ethereum, think of it as building privacy into the plumbing: it’s harder for outsiders to follow the money because the protocol isn’t organized around public account balances in the first place.

Where Zedger becomes “finance native” is in how it’s positioned for regulated assets and operations that normal DeFi barely touches. Dusk has tied Zedger to compliance concepts like MiFID II (a major EU framework for financial markets), explicitly describing Zedger as an account based transaction model for tracking securities balances in a compliant way. In the same breath, Dusk points to features around the lifecycle of an asset things like explicit approvals, dividend payouts, voting, whitelists, and even the ability to revert certain transactions at the contract level. That’s the kind of boring sounding tooling institutions actually ask for, and it’s also the kind of functionality that’s hard to reconcile with a fully transparent public ledger.

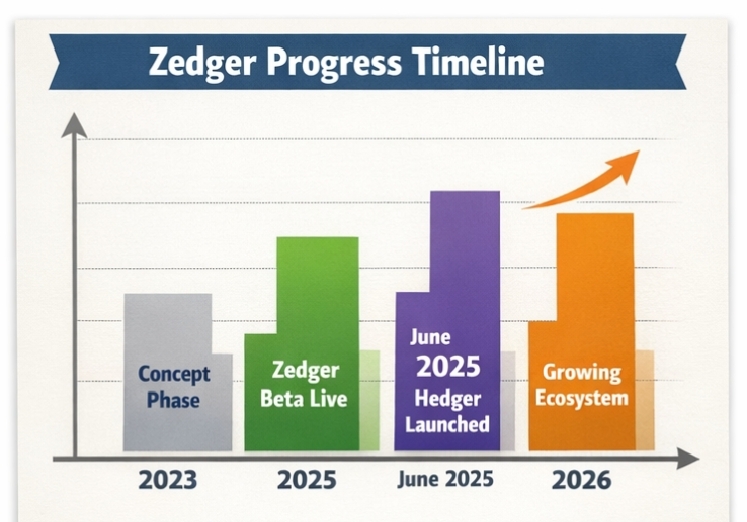

Progress wise, the cleanest timestamp to anchor on is January 7, 2025, when Dusk announced mainnet went live and listed “Zedger Beta” as a Q1 2025 highlight, framing it as groundwork for tokenizing real-world assets like stocks, bonds, and real estate. Since then, the story has evolved in a way I find telling: Dusk introduced Hedger on June 24, 2025, described as a privacy engine for DuskEVM that combines homomorphic encryption with zero-knowledge proofs, aiming for confidentiality plus auditability while being compatible with standard Ethereum tooling. That doesn’t replace Zedger it shows the direction of travel. Zedger is the regulated-asset brain, and the broader ecosystem is building execution environments where confidentiality can work with the tools developers already use.

One detail that jumped out to me as a trader is the emphasis on market structure. Hedger’s write up talks about supporting obfuscated order books (the kind of thing you’d want if you don’t want to telegraph size), and it even mentions fast client-side proving “under 2 seconds” for certain circuits. While that’s Hedger, not Zedger, it’s part of the same thesis: privacy isn’t just a human rights debate, it’s also a mechanism to reduce information leakage and manipulation in markets where the biggest players don’t trade in public.

So when people say “Zedger is a new way to handle private financial data on blockchain,” I interpret it as a very specific bet: that the next wave of on-chain finance won’t be pure cypherpunk anonymity, and it won’t be full glass house transparency either. It’ll be configurable privacy with receipts proof when needed, silence when not. As someone who’s watched narratives come and go, I’m cautious by default. But I’ll say this: once you’ve had your on-chain activity used against you in real time, “selective disclosure” stops sounding like a compliance buzzword and starts sounding like basic market hygiene.