The easiest way to understand Plasma Chain is to step away from the typical crypto mindset and think about how people actually use money in daily life. Most individuals are not interested in trading tokens, studying blockchain architecture, or navigating complicated fee structures. They simply want money to move quickly, reliably, and affordably. Plasma approaches blockchain infrastructure from this very practical perspective. Instead of treating stablecoins as just another asset class within a broader ecosystem, Plasma treats them as the foundation of its entire network design.

Across many existing blockchains, stablecoins function as applications built on top of smart contract platforms. They are important tools, but they are not the central focus of network architecture. Plasma reverses this logic completely. The chain is designed around stablecoins as the primary medium of value transfer, essentially positioning them as digital money rails rather than speculative instruments. This structural shift may appear subtle at first glance, but it reflects a much deeper attempt to align blockchain technology with real-world financial behavior.

From the very beginning, Plasma’s development has centered on optimizing how digital dollars move across borders, wallets, and applications. The goal is not simply speed or scalability for its own sake, but rather creating a system that reduces friction in everyday financial interactions. In many ways, Plasma is trying to bridge the gap between decentralized technology and the expectations people already have from modern fintech platforms.

The Practical Impact of a Stablecoin-First Design

One of Plasma’s most noticeable and user-friendly features is its zero-fee USDT transfer model. Traditional blockchain transactions often require users to hold a native token to pay network fees. For experienced crypto users, this may seem normal, but for mainstream adoption, it creates an unnecessary barrier. Plasma addresses this issue through a paymaster system that absorbs gas fees for simple stablecoin transfers.

In practical terms, this means users can operate entirely with stablecoins without needing to purchase or manage additional tokens. This small design choice dramatically simplifies the user experience. Someone sending remittances to family members, paying merchants, or transferring savings between wallets does not need to worry about fee tokens, fluctuating gas costs, or transaction complexity.

This simplification brings blockchain transactions much closer to traditional digital payment systems. It reduces confusion for newcomers and removes a psychological barrier that has historically slowed crypto adoption. When financial tools become easier to use, they naturally expand their audience. Plasma seems to understand that mass adoption is less about technological complexity and more about removing friction from user interaction.

Mainnet Launch and Early Liquidity Strength

Plasma’s mainnet beta launch on September 25, 2025, represented an important milestone for the project. At launch, the network reportedly hosted over $2 billion in stablecoin liquidity. While large numbers are often used in crypto marketing, this level of liquidity served a practical purpose. It demonstrated that the network launched with real capital and functional activity rather than empty infrastructure waiting for adoption.

Strong initial liquidity plays a crucial role in blockchain ecosystems. It ensures smoother trading, better settlement efficiency, and higher confidence among developers and users. Plasma’s early liquidity suggests that the network received coordinated support from its community, deposit initiatives, and integrations within decentralized finance ecosystems.

This type of structured launch is significant because many new blockchains struggle with the “ghost chain” problem. They launch with advanced technology but lack meaningful economic activity. Plasma appears to have prioritized real financial participation from day one, positioning itself as an operational payment layer rather than an experimental platform waiting for adoption.

Architecture Built for Payment Efficiency

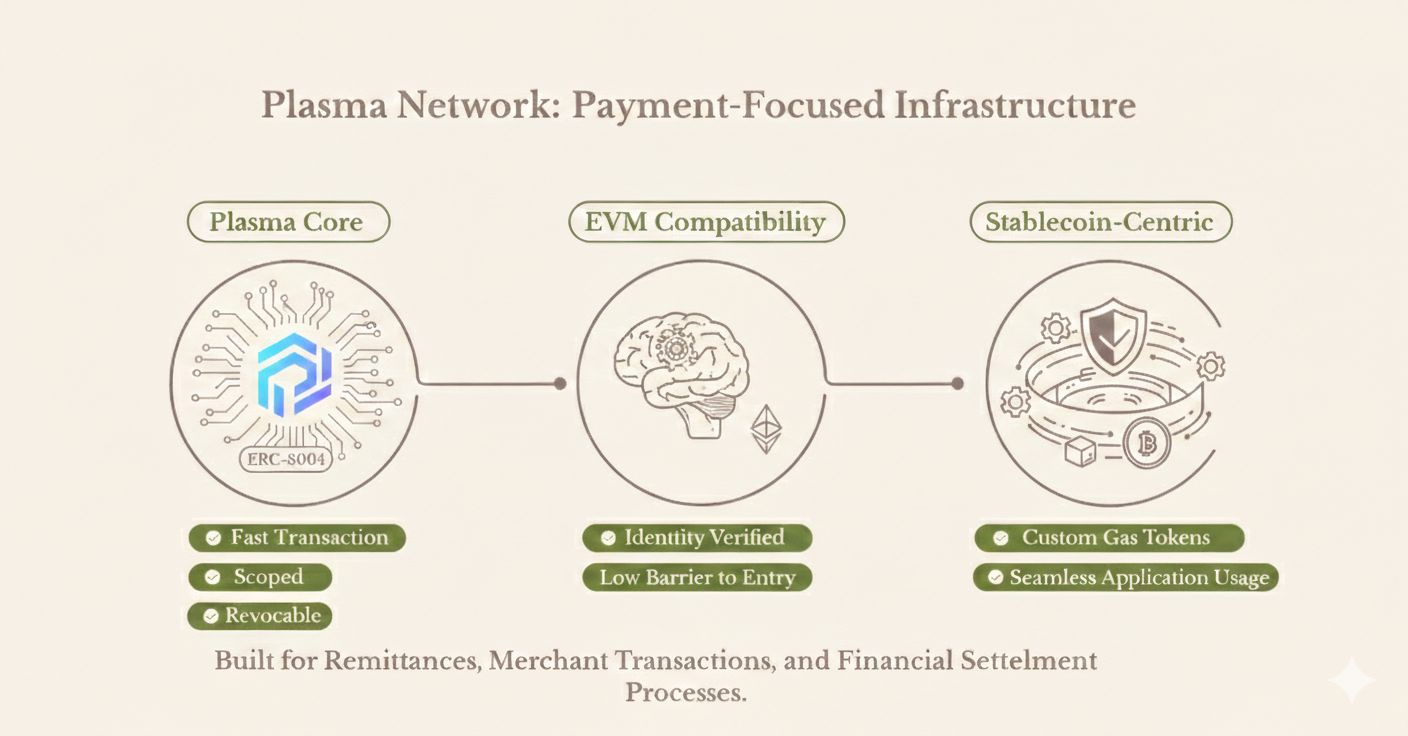

Plasma’s technical infrastructure reflects its payment-focused philosophy. The network uses PlasmaBFT consensus, designed to provide fast transaction finality and high throughput. For payment systems, speed alone is not enough. Reliability and predictability are equally important. Users sending money expect transactions to settle quickly and consistently, even during periods of high network demand.

By focusing on throughput stability and rapid confirmation, Plasma attempts to deliver a smoother transaction experience for stablecoin transfers. This design aligns with the requirements of payment-heavy workloads such as remittances, merchant transactions, and financial settlement processes.

Another key aspect of Plasma’s architecture is its EVM compatibility. By supporting Ethereum Virtual Machine standards, Plasma allows developers to deploy familiar Solidity smart contracts without learning entirely new programming frameworks. This lowers the barrier to entry for developers and encourages faster ecosystem expansion.

Developers can migrate or expand their applications using existing tools, wallets, and infrastructure. This compatibility also strengthens Plasma’s potential to attract decentralized finance projects, payment applications, and financial services built around stablecoin usage.

Plasma also supports custom gas tokens, allowing transaction fees to be paid in assets other than the native token. This flexibility enhances the stablecoin-centric philosophy by enabling applications to operate seamlessly without forcing users into a specific token economy.

Understanding the Role of $XPL

The XPL token plays a fundamental role within Plasma’s ecosystem. While it may be traded in markets like any other crypto asset, its purpose extends far beyond price speculation. The token is deeply integrated into the network’s operational and governance structure.

Validators stake XPL to secure the network and maintain transaction integrity. This staking mechanism helps ensure decentralization and reliability while incentivizing participants to maintain honest behavior. Beyond network security, XPL is also used for gas payments in more complex contract interactions that go beyond simple stablecoin transfers.

Governance is another critical function of XPL. Token holders can participate in decision-making processes that shape protocol upgrades, network parameters, and long-term development strategies. This governance structure aligns community participation with network growth, allowing users and stakeholders to influence Plasma’s evolution.

By connecting staking, governance, and advanced transaction utility to $XPL, Plasma creates a token model where network activity and token demand are naturally interconnected. This integrated design helps prevent the token from becoming disconnected from real network usage.

Cross-Chain Expansion and Liquidity Connectivity

Plasma’s ambitions extend beyond operating as an isolated blockchain. The network has already begun exploring cross-chain integrations, including connections with NEAR Intents. These integrations aim to simplify multi-chain asset movement and liquidity sharing without requiring users to understand technical complexities across different blockchain ecosystems.

Cross-chain liquidity is becoming increasingly important as the blockchain industry evolves toward interconnected financial networks. Plasma’s integration strategy suggests a long-term vision where stablecoins can move seamlessly between ecosystems while maintaining speed and cost efficiency.

These integrations are typically built for infrastructure durability rather than short-term market excitement. They support long-term settlement functionality and improve overall liquidity efficiency across chains. Plasma’s focus on interoperability aligns closely with its broader goal of positioning stablecoins as universal digital payment tools.

Looking Beyond Market Volatility

Like every emerging blockchain project, Plasma and its token experience market fluctuations. Price volatility is a natural aspect of the crypto industry. However, discussions around Plasma often focus heavily on short-term market movements rather than evaluating its potential to solve real financial challenges.

Stablecoins already represent one of the most widely used asset classes in crypto. They serve as trading pairs, settlement tools, and value storage mechanisms. If blockchain finance continues expanding into mainstream payment systems, the demand for infrastructure specifically designed for stablecoins is likely to increase significantly.

Plasma’s core concept focuses less on speculative cycles and more on building foundational infrastructure for digital money movement. This infrastructure-focused approach may prove more sustainable if adoption continues shifting toward real-world financial applications.

What Will Define Plasma’s Long-Term Success

Plasma’s future success will depend heavily on execution rather than promotional narratives. Planned upgrades such as confidential payment features, deeper DeFi integrations, and potential Bitcoin bridging could significantly strengthen the network’s position if implemented effectively.

Confidential payment tools may enhance privacy while maintaining compliance requirements, which is particularly important for institutional financial adoption. DeFi integrations could expand liquidity usage and create new financial products built around stablecoin flows. Bitcoin bridging could connect Plasma to one of the largest liquidity sources in the crypto ecosystem.

At its current stage, Plasma can be viewed as an infrastructure experiment designed to move stablecoins beyond speculation and into everyday financial usage. The network’s long-term relevance will depend on how effectively it can maintain reliability, attract developers, and expand financial utility.

The Bigger Picture

Plasma represents a different philosophy within blockchain development. Instead of building a general-purpose ecosystem and later integrating stablecoins, it starts with the assumption that stablecoins already function as digital dollars. By designing infrastructure specifically around this concept, Plasma attempts to make blockchain payments feel as natural and efficient as traditional financial transactions.

The network’s zero-fee transfer model, strong initial liquidity, developer-friendly compatibility, and governance-driven token utility all contribute to this vision. Each design choice reflects an effort to reduce complexity while maintaining the benefits of decentralization and transparency.

Bottom Line

Plasma is a Layer-1 blockchain that places stablecoins at the center of its design rather than treating them as secondary assets. By focusing on zero-fee transfers, payment efficiency, strong liquidity foundations, and infrastructure-driven development, Plasma positions itself as a utility-focused financial network. The XPL token is not just a tradable asset but a core component powering network security, governance, and advanced transaction capabilities.

If stablecoins continue evolving into a global digital payment standard, infrastructure like Plasma could play a crucial role in shaping how money moves across the internet. The project represents a calculated attempt to build dedicated rails for digital dollars, moving blockchain technology closer to practical everyday finance.