I know what you might be thinking, “Bear market now? We’ve been in a bear market for years. Where was the bull run? My portfolio hasn’t been green since Trump became president.”

Fair, because most of us were heavy in alts.

We diversified into “strong narratives” like AI, DeFi, and RWA, believing these projects could revolutionize the world. But what actually happened? One by one, they started crashing. Projects slowly died. $RENDER , $FET , $OM , $ONDO, almost all of them are down 80–90% from their all-time highs.

While these projects were collapsing quietly, something important was happening.

Bitcoin was still holding strong.

In fact, it kept climbing and even touched $125,000. That was a huge move. Bitcoin was, and still is, fundamentally stronger than everything else in the market.

But now the momentum feels different.

It’s not something scary or unusual — it’s simply how markets work. After pushing to new highs, buyers eventually get exhausted. Liquidity dries up. That’s when sellers

slowly take control.

slowly take control.

And that’s why I think Bitcoin has now entered a bear phase.

Here are a few key reasons.

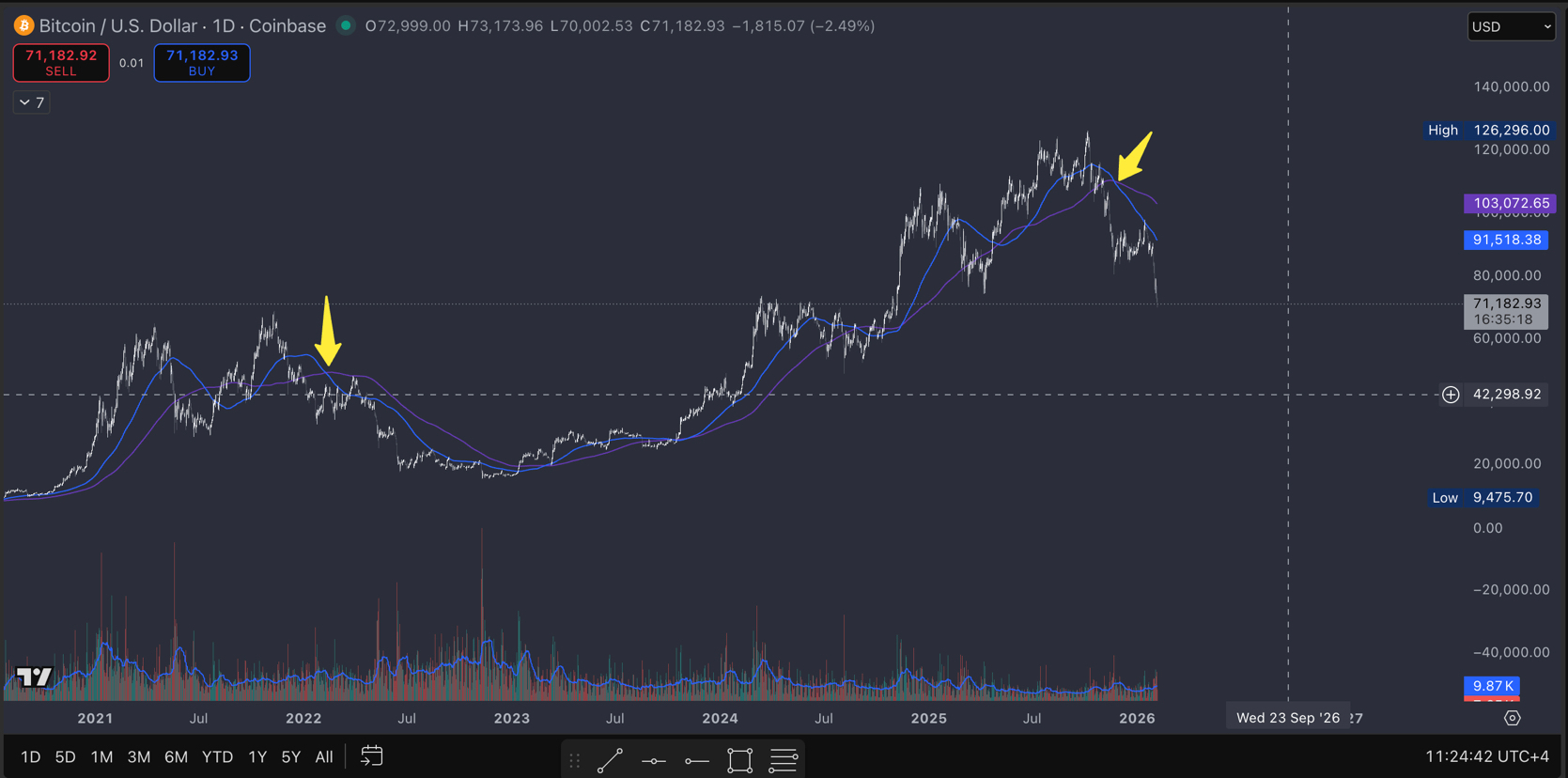

1. Constant lower highs

Last year Bitcoin was making new all-time highs almost every month. Then we topped around $125,000. Since then, price has been in a steady downtrend, forming lower highs again and again.

Bull markets don’t make lower highs.

Lower highs usually mean distribution.

2. Clean breakdowns below major supports

$106,000 was a key resistance that flipped into support. Every time price retested it, we pushed higher.

Then on Nov 4, we saw a clean breakdown below this level. No strong bounce.

On Nov 10, price tried to reclaim it, got rejected hard, and dropped to $81,000.

After that, we saw slow chop. Price kept getting rejected near $95,000 multiple times. On Jan 14, it looked like Bitcoin had reclaimed the level and even surged to $98,000, but it turned out to be a fake breakout. Within weeks, price crashed below $69K.

Recently it lost $74,500 support level.

That’s not normal pullback behavior. That’s sellers taking control.

3. Losing the 100 and 200 EMAs

Back in 2021, when Bitcoin lost both the 100-day and 200-day EMAs, that’s when the real bear market began. This time, in November 2025, price lost both again. Since then, it’s been a mess.

Bitcoin respects these levels a lot on higher timeframes. When they’re lost, it usually signals a regime shift.

4. The trendline break

For almost three years, Bitcoin respected its long-term uptrend that started near $16,000 in 2022. Every time price touched that trendline, we saw new highs.

But this November, price broke below it for the first time.

That was the first clear warning of a potential downtrend.

Then came the brutal rejection. On January 14, price pumped and gave hope of a reversal, but it rejected right at the trendline and crashed again.

Classic bull trap.

Blow-off top, lower highs, loss of the 100 and 200 MAs, and a slow bleed for months — this is exactly how bear phases usually begin. Not with one huge crash, but with a slow grind down that drains confidence.

This is just my view, and of course I can be wrong.

But what would convince me that we’re still in a bull phase?

1. Price needs to reclaim the $74,500 support and hold above it.

2. It needs to break the pattern of lower highs and lower lows.

3. It needs to get back above the EMAs.

4. And we need strong volume behind the move.