Why Dusk Makes Sense for Banks—Not Just Developers

Most blockchains are made for developers. They’re built for code, flexibility, and experimentation, not for the way banks see the world. Developers get excited about things like accounts, smart contracts, and tokens—the basic building blocks that make building new stuff easy. But banks? They care about law, risk, audit trails, accountability, and jurisdiction. This is where Dusk stands apart. It’s not just about privacy or smart contracts—it’s about giving banks a system that actually feels familiar, without sacrificing decentralization.

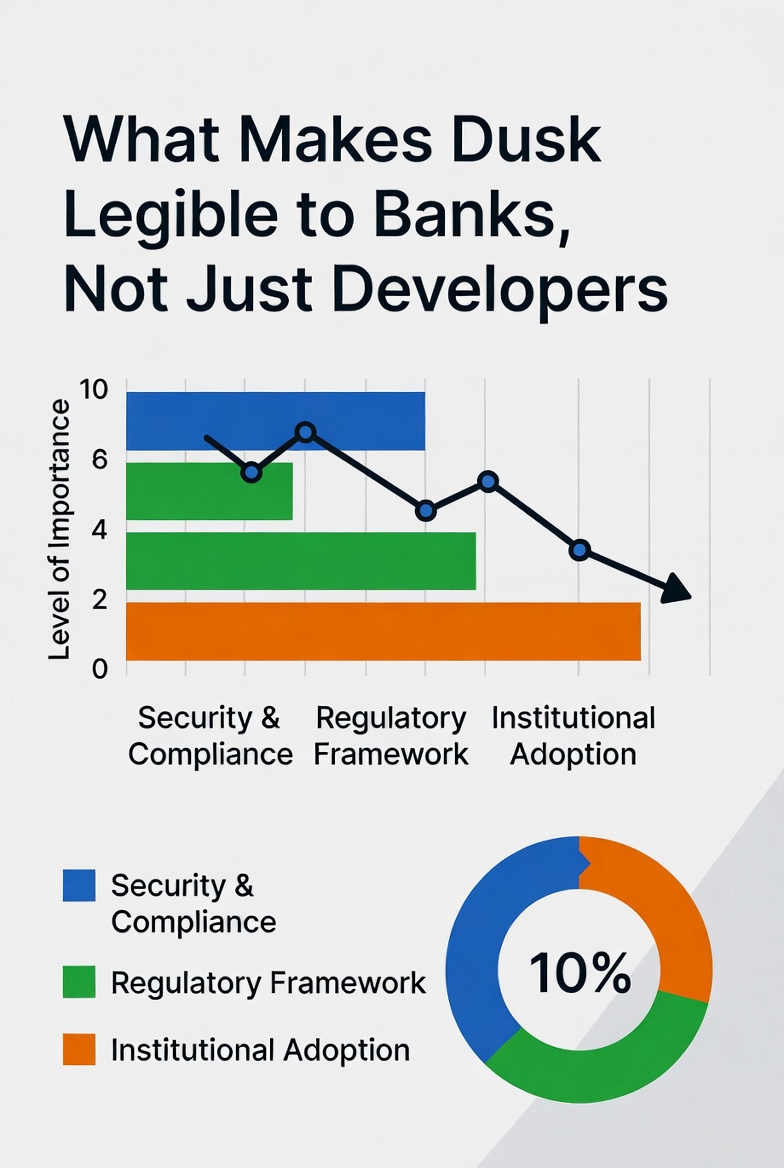

When we talk about Dusk being “legible” to banks, we mean it’s built so banks can understand, explain, and operate it using the frameworks they already trust. Dusk speaks their language.

1. Privacy That Actually Works for Banks

Most privacy-focused blockchains go all-in: everything’s hidden, identities are obfuscated, and compliance is someone else’s headache. That’s fun for cryptography geeks, but for banks, it’s a total nightmare.

Banks don’t get to pick and choose here. They have to:

Know exactly who they’re dealing with

Block illegal activity before it starts

Hand over records when regulators ask

Dusk takes a different approach to privacy. With selective disclosure, transactions are private by default, but banks can reveal details when the law requires. It’s a lot like traditional banking secrecy—things stay confidential, unless the law says otherwise.

Banks don’t have to jump through mental hoops. Privacy here isn’t about hiding from regulation; it’s about keeping things confidential in a way that lines up with the rules they already follow.

2. Identity That’s Actually Built for Compliance

On most blockchains, identity is an afterthought. You get wallets, maybe an ENS name, or some off-chain KYC service tacked on later. For banks, identity isn’t optional—it’s the first box to check.

Dusk bakes privacy-preserving identity right into the protocol. People can prove they meet regulatory requirements—like being accredited or from a certain jurisdiction—without putting all their personal details out there.

That matters because banks have to check for things like:

Money laundering

Customer verification (KYC)

Sanctions lists

Dusk doesn’t ask banks to skip these checks. Instead, it lets them handle compliance through cryptography—no need to turn the blockchain into a surveillance tool. Compliance teams can actually read and trust what’s happening, not just the engineers.

3. Assets That Still Look and Feel Like Securities

Most blockchains just turn everything into tokens. But banks don’t just manage tokens—they deal with shares, bonds, funds, structured products, all with their own legal specifics.

Dusk’s confidential asset model supports:

Transfer restrictions

Private ownership

Regulator access when necessary

So, real financial instruments can live on-chain without losing the legal clarity banks need. On Dusk, an asset isn’t just another token—it’s a real security, just in digital form.

That familiarity is what legal teams and regulators need if they’re going to trust a blockchain system.

4. Governance Without the Hype

Most blockchains have wild, unpredictable governance—token votes, social media drama, protocol updates pushed by the loudest voices. That might drive innovation, but banks can’t manage risk in that kind of environment.

Banks need:

Predictable upgrades

Clear separation between protocol and community noise

Real stability

Dusk keeps changes slow, deliberate, and easy to follow. The governance framework is structured and intentionally conservative. That doesn’t mean innovation stops—it just means change is handled carefully.

For banks, this feels more like how real financial infrastructure evolves: slowly, transparently, and with legal planning.

5. Auditability That Doesn’t Blow Privacy

On public blockchains, transparency usually means everything’s out in the open. For banks, that’s a nonstarter. Customer data, trading activity, settlement details—they can’t just let that leak.

Dusk gives authorized parties the power to audit transactions in full detail, but the public can’t peek at sensitive info. Regulators get what they need, but privacy stays locked down.

Conclusion: Speaking Banks’ Language

Developers judge blockchains by how elegant or fast they are. Banks care about risk, law, control, and accountability. Dusk bridges those worlds—but always puts institutions first. Privacy is conditional, identity is compliance-ready, and everything fits the systems banks already use. That’s why Dusk isn’t just another playground for developers—it’s the blockchain that finally clicks for banks.@Dusk #Dusk $DUSK