Executive Summary

Opinion Labs represents one of the most architecturally ambitious attempts to transform prediction markets from speculative betting venues into genuine economic infrastructure. With $25M total funding (including a recent $20M Series A from Jump Crypto and Hack VC), record-breaking growth metrics ($10B+ volume in 54 days), and a sophisticated four-layer stack combining AI oracles with unified liquidity, Opinion has positioned itself as a potential foundational layer for standardized economic risk trading. However, critical technical transparency gaps around oracle consensus mechanisms and unproven scalability during market stress temper near-term conviction. Verdict: High-potential emergent primitive requiring further technical validation before institutional allocation.

1. Project Overview

Opinion Labs (O.LAB) operates a high-performance prediction exchange on BNB Chain that transforms economic insights into tradable markets through AI oracles and on-chain infrastructure. The protocol has demonstrated explosive growth, reaching $10B trading volume within 54 days of mainnet launch and maintaining $122M-$144M open interest by January 2026. X

The core thesis positions Opinion as "The People's Terminal for Global Economic Trading" - aiming to democratize access to macroeconomic instruments traditionally reserved for institutional players with Bloomberg terminals and proprietary data feeds. Docs

Team Analysis: Led by CEO Forrest Liu, the team has demonstrated strong execution capability with rapid protocol development and ecosystem growth. The quality of investor backing (Jump Crypto, Hack VC) suggests sophisticated technical due diligence has been conducted, though the team maintains relatively low public visibility compared to protocol traction.

2. System Architecture and Market Abstraction Design

The Opinion Stack: Four-Layer Architecture

Opinion's architecture represents a significant advancement in prediction market design, moving beyond simple event contracts toward a comprehensive economic risk abstraction layer:

Opinion AI - Decentralized multi-agent AI oracle handling complex, unstructured data resolution and market creation validation. This component automatically verifies whether proposed markets meet resolvability standards and generates objective resolution rules. Docs

Opinion Metapool - Unified liquidity infrastructure that aggregates depth across related economic themes and ensures resolution trust. This layer addresses prediction market fragmentation by creating cross-market liquidity networks.

Opinion Protocol - Universal token standard enabling interoperability across prediction venues. While technical implementation details remain unspecified, this suggests a composable standard for economic risk tokens.

Opinion Trade - Execution and settlement layer featuring professional-grade trading infrastructure with limit orders, batch cancellations, and sophisticated risk management.

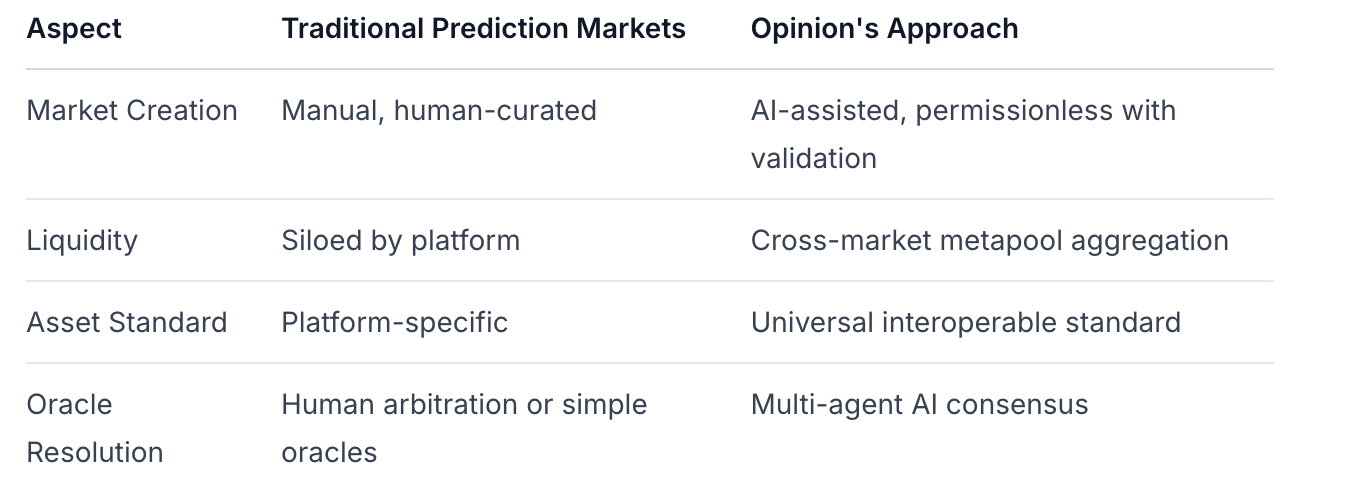

Architectural Comparison

This architecture positions Opinion closer to generalized economic risk abstraction than traditional prediction markets. The system resembles intent-based execution systems in its ability to parse complex economic queries and transform them into tradable instruments, while maintaining the composability of DeFi primitive.

3. Market Design, Oracle Resolution, and Asset Standardization

AI-Oracle Innovation and Limitations

Opinion's most significant technical advancement is its AI oracle system, which aims to solve critical prediction market limitations:

Market Creation Validation: AI agents automatically assess market proposals for resolvability, generating objective rules and verifying topic appropriateness. This enables permissionless market creation while maintaining quality control. Docs

Complex Resolution: The system handles unstructured data sources (news, economic reports, geopolitical events) that traditional oracles cannot process, potentially expanding the universe of tradable economic events.

However, critical transparency gaps exist: No public documentation details the multi-agent consensus mechanism, disagreement resolution protocols, or fallback procedures. The proprietary nature of this system creates significant validation challenges for institutional assessment.

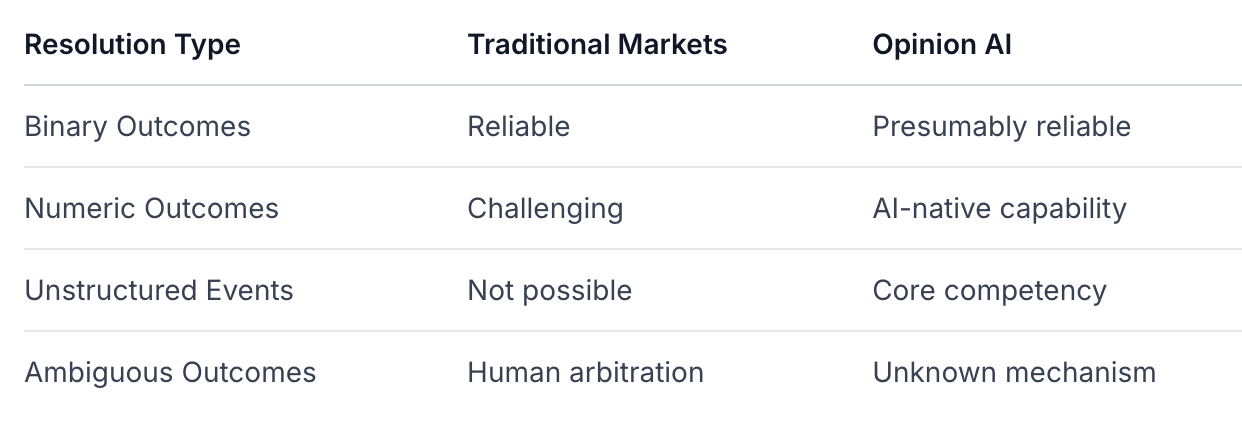

Resolution Trust Matrix

The absence of publicly audited resolution logic for edge cases represents a material risk for economic infrastructure claiming to handle trillions in notional value.

4. Economic Signal Routing and Market Efficiency Logic

Opinion demonstrates sophisticated economic signal processing through several mechanisms:

Macro-First Market Selection: The platform prioritizes economically significant events (Fed decisions, inflation reports, geopolitical developments) over recreational topics, aligning with its "economic terminal" positioning.

Cross-Market Correlation Engine: The Metapool architecture appears designed to capture relationships between economic events, allowing liquidity to flow between correlated markets and improving price discovery.

AI-Assisted Information Processing: By using AI to parse unstructured data, Opinion potentially enables faster incorporation of complex economic information into market prices than human-driven markets.

Efficiency Assessment: While direct price comparison data with Polymarket/Kalshi is unavailable, Opinion's rapid growth to $10B+ volume suggests market participants perceive value in its pricing mechanisms. However, the platform's focus on macro events makes efficiency validation challenging without comparative data from traditional markets.

5. Protocol Economics and Incentive Structure

Dynamic Fee Architecture

Opinion implements a sophisticated, probability-based fee structure that aligns incentives with market health:

Taker-Only Fees: 0-2% fee charged only to liquidity takers, with makers trading fee-free. This encourages liquidity provision and reduces market noise. Docs

Uncertainty-Based Pricing: Fees peak at 2% for markets trading near 50% probability (maximum uncertainty) and decrease toward 0% for certain outcomes, properly pricing matching complexity.

Fee Formula: Effective fee rate = topic_rate × price × (1 − price) × (1 − user_discount) × (1 − transaction_discount) × (1 − user_referral_discount)

This structure demonstrates sophisticated economic thinking, appropriately charging for value provided (matching complexity) while incentivizing desirable behaviors (liquidity provision, informed trading).

OPN Token Economics (Partial Information)

Limited data is available on the OPN token, but known elements include:

Binance Booster Program: 5M token airdrop (0.5% of supply) through social tasks

TGE Timeline: Polymarket odds suggest 63-70% probability of launch by February 28, 2026

Utility Speculation: Likely encompasses governance, fee sharing, and oracle security based on architectural needs

The $64M annualized fee revenue (as of January 2026) provides substantial fundamental value accrual potential, though tokenomics details remain undisclosed. DeFiLlama

6. Governance, Security, and Risk Analysis

Security Assessment

Audit Status: A single CertiK audit was conducted in December 2023, but no detailed report is publicly available. The absence of recent comprehensive audits for a system handling $100M+ creates material concern. CertiK

Oracle Risk: The proprietary AI oracle system represents both Opinion's key innovation and its largest risk vector. Without transparent consensus mechanisms and dispute resolution protocols, the system remains vulnerable to:

Coordination failures among AI agents

Adversarial manipulation of unstructured data inputs

Unresolvable ambiguous outcomes during crisis events

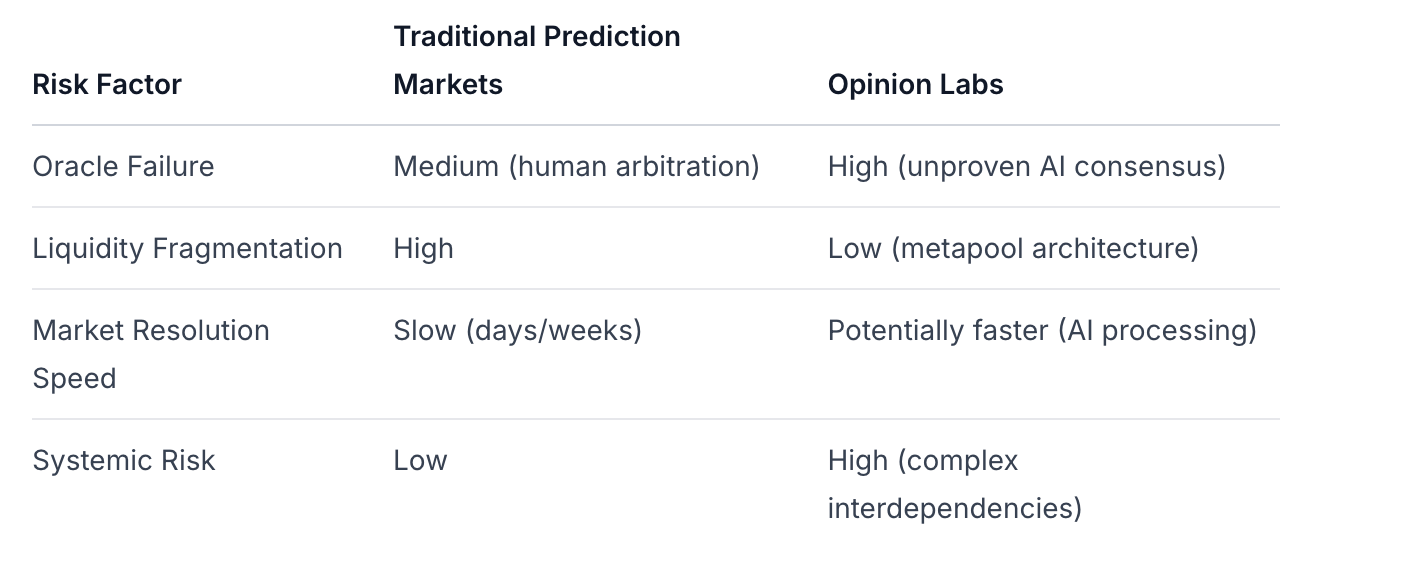

Comparative Risk Profile

Opinion's risk profile skews toward high-impact, low-probability events in its oracle system, which could trigger cascading failures across correlated markets during black swan events.

7. Adoption Signals and Ecosystem Potential

Growth Metrics and Validation

Opinion has demonstrated exceptional early adoption metrics:

Volume Growth: $10B+ cumulative volume in first 54 days, indicating strong product-market fit User Growth: 100K+ cumulative addresses with ~10% daily new user growth in December 2025 X Open Interest: $122M-$144M sustained OI, representing real economic weight rather than speculative volume

Builder Ecosystem Development

The Opinion Builders Program has attracted 270+ builders across multiple phases, with notable projects including:

Opinion HUD: Real-time intelligence layer and dashboard

X-Ray Trade: Analytical and trading bot with full functionality

Opinion Scan: Comprehensive analytics and discovery platform

Alpha Signals: Data analytics and signal generation

This ecosystem development suggests third-party validation of Opinion's infrastructure potential beyond native platform usage.

8. Strategic Trajectory and Market Fit

Addressable Market Expansion

Opinion aims to capture several converging market opportunities:

Traditional Macro Trading: The $5T+ daily FX market and derivatives trading represent massive addressable market for democratized access Institutional Prediction Markets: Growing institutional adoption of prediction markets for hedging and forecasting DeFi Composability: Economic risk tokens as primitive for structured products and portfolio management

Critical Milestones (12-24 Month Horizon)

Oracle Stress Testing: Successful resolution of complex economic events during high volatility

Liquidity Depth: Achievement of $500M+ open interest across diverse market types

Cross-Chain Expansion: Deployment beyond BNB Chain to capture broader liquidity

Institutional Adoption: Clear signals of professional trader adoption (API usage, large ticket sizes)

9. Final Investment Assessment

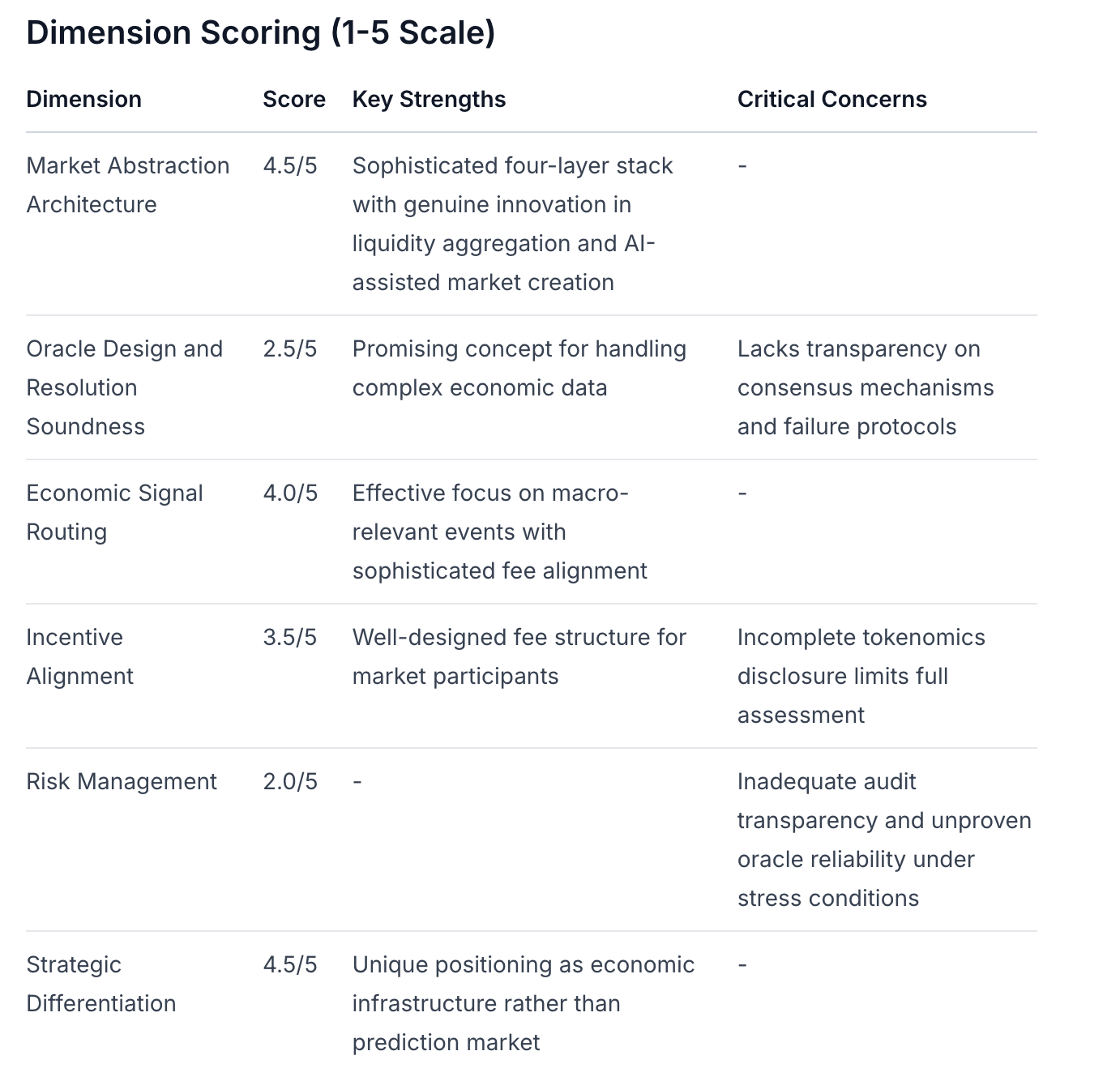

Dimension Scoring (1-5 Scale)

Overall Weighted Score: 3.5/5

Assessment Rationale

The scoring reflects OPINION's architectural sophistication and strategic positioning against significant technical transparency gaps. The high scores in Market Abstraction Architecture (4.5/5) and Strategic Differentiation (4.5/5) acknowledge the protocol's innovative four-layer stack and its ambition to transform prediction markets into genuine economic infrastructure.

However, the critical weaknesses in Oracle Design (2.5/5) and Risk Management (2.0/5) highlight substantial operational risks. The lack of transparency around consensus mechanisms and failure protocols, combined with unproven reliability under stress conditions, represents a material barrier to institutional adoption despite the sophisticated design.

The balanced scores in Economic Signal Routing (4.0/5) and Incentive Alignment (3.5/5) suggest well-designed economic mechanics for market participants, though incomplete tokenomics disclosure prevents full confidence in long-term sustainability.

Investment Implications

For Strategic Investors: The architecture warrants serious attention, but investment should be contingent on oracle mechanism documentation and successful resolution of complex economic events under live conditions.

For Developers: The Builders Program offers significant opportunity given the $20M funding backing and architectural ambition, but should be approached with technical due diligence.

For Traders: The platform provides unique macro exposure capabilities, but position sizing should be limited until oracle reliability is demonstrably proven.

Current Status: OPINION represents a high-risk, high-reward emergent primitive rather than a proven economic infrastructure layer. The 3.5/5 overall score reflects exceptional potential constrained by critical technical transparency requirements.

Investment Verdict

Opinion Labs represents a high-conviction bet on the transformation of prediction markets into generalized economic infrastructure, but requires substantial technical validation before institutional deployment.

The protocol's architectural sophistication, rapid traction, and quality investor backing suggest genuine innovation potential. However, the opaque AI oracle implementation and limited audit history create material technical risk that must be resolved before the system can handle material economic weight.

Recommendation:

For institutions: Allocate 1-2% portfolio to tracking position, increasing to 5%+ upon public oracle consensus documentation and successful resolution of complex economic events

For developers: Engage with Builders Program given substantial ecosystem momentum and funding support

For traders: Utilize platform for macro exposure but limit position sizes until oracle reliability demonstrated

Opinion has the potential to become foundational economic infrastructure, but currently remains a high-risk, high-reward emergent primitive rather than a proven system.