One night I found myself staring at VanarChain’s dashboard as three boxes kept flickering: TVL, users, fees, and I realized what was keeping me up wasn’t the price, but a simpler question: which of these is actually telling the truth.

I’ve been through enough cycles to know the market is very good at falling in love with a single number, then abandoning it the moment the narrative changes.

TVL is the classic example, because it looks like “belief” locked in place. But honestly, TVL is often just capital rotating out of habit, parked here today, somewhere else tomorrow, sometimes looping around and coming back as if it never left.

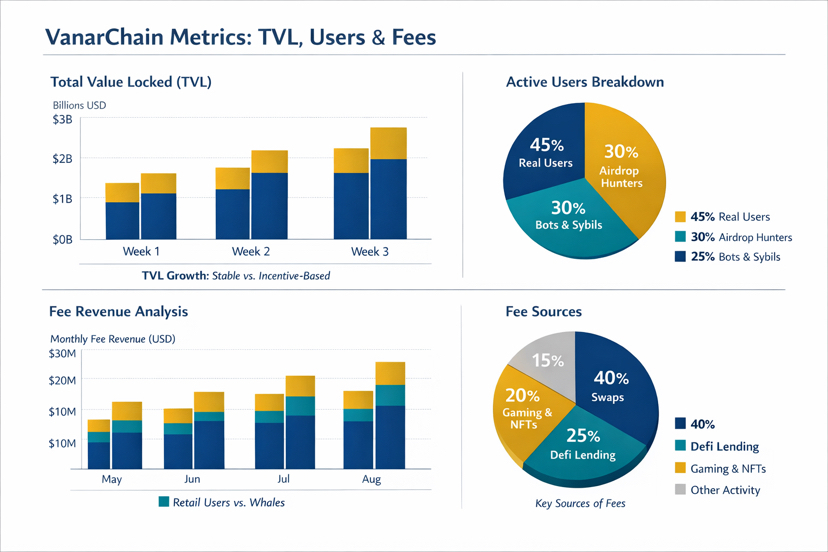

When I look at TVL on VanarChain, what I want isn’t a new peak, but durability: does that capital stay during quiet weeks, or does it only show up when incentives are thick and disappear when rewards thin out.

Then there are users, the number everyone loves to brag about. No one expects “users” in crypto to sometimes be a shadow: wallets created for airdrops, bots grinding quests, or a small group repeating the same behavior to optimize profit.

Maybe I’m overly picky, but I always separate “touched the chain once” from “actually living on the chain.” If VanarChain wants to prove it has real users, the trail should show up in return frequency, in smooth transaction journeys, in people staying for product and experience, not because a short campaign nudged them to click through a checklist.

But if I had to pick one metric I trust more than the rest, I’d look at fees, and I’d look in the uncomfortable way: who is paying, what are they paying for, and are they willing to pay again.

It’s truly ironic: fees are what everyone hates, yet they’re one of the most honest signals of demand. A chain can “buy” TVL, it can “borrow” users, but it’s hard to fake fee revenue without real activity. Of course, high fees aren’t automatically good, because it could simply be congestion, poor design, or users being forced to pay. What I care about is structure: are fees coming from a few whales playing games, or from many small flows, steady and persistent, like a city with real residents.

And this is where the story gets subtle: TVL, users, and fees don’t stand alone, they pull on each other like a triangle. When TVL rises but fees don’t move, I get cautious, because capital might just be sleeping. When users rise but fees drop, I get cautious in a different way, because it might be hollow traffic, or UX that brings people in and pushes them out. When fees rise but users fall, it may mean only the “people who must use it” remain, a small group paying because they have no alternative, and that’s not healthy expansion.

Maybe what VanarChain needs most isn’t to make one of the three numbers look prettier, but to make the relationship between them coherent and explainable.

As a builder, I add one more layer: are fees and transaction flow predictable enough that product teams can dare to commit to an experience.

If fees turn into a gamble, every design decision gets distorted, and real users eventually leave before they can even explain why. Or maybe VanarChain is standing at the same fork many chains have faced: chase short term data theater, or accept a slower rhythm to build longer arteries, where fees reflect value, users reflect habit, and TVL becomes the natural outcome of an ecosystem with a reason to exist, not a stage for brief bursts of excitement.

The most important thing I’ve learned, after all these years of seeing beautiful numbers unravel, is this: instead of asking which one is “higher,” ask which one is “hardest to fake” and “hardest to keep.” VanarChain can go very far if it manages to turn fees into a signal of real demand, users into a sign of returning behavior, and TVL into the natural consequence of an ecosystem that has earned its right to exist, rather than a stage for transient hype.

So if you’re looking at @Vanarchain today, which number will you choose to believe, and how long will you wait to see whether it still holds when the stage lights have finally gone out. #vanar $VANRY