🚨 US TREASURY WILL DUMP MARKETS NEXT WEEK!!

Look at what hits next week.

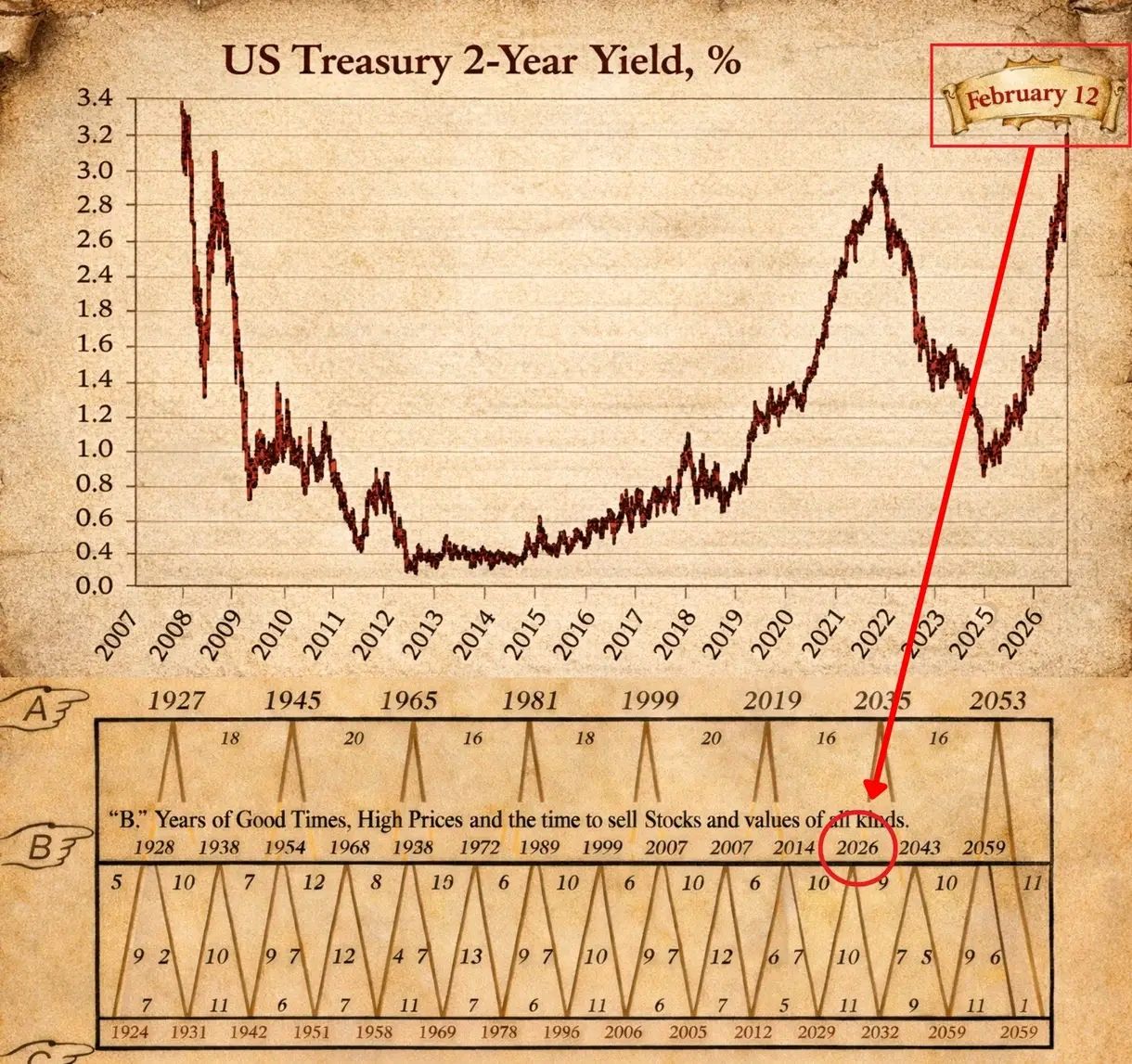

US Treasury is draining liquidity with a $125,000,000,000 refunding wave.

$58B in 3Y → Feb 10

$42B in 10Y → Feb 11

$25B in 30Y → Feb 12

Settlement: Feb 17

This is a WARNING you don't see in a calm market.

Let me explain this in simple words.

When Treasury sells bonds, buyers pay cash.

That cash gets pulled out of the system.

Liquidity gets lower.

And when liquidity gets low, risk starts choking.

THIS IS THE TRAP.

Because auctions are a stress test.

If demand is strong, auctions clear clean, yields stay calm, and risk can breathe.

If demand is weak, yields jump, liquidity gets thin, and selling feeds on itself.

That one fact explains a lot.

Because bonds move first.

Then stocks react.

Then crypto gets the violent move first.

Why this is GIGA BEARISH.

It's not about "new debt".

It's about timing.

Feb 10 to Feb 12 is when the system gets tested.

And Feb 17 is when the cash actually settles.

So if you think markets are safe just because some charts look fine...

YOU'RE WRONG.

I've studied macro for 10 years and I called almost every major market top, including the October BTC ATH.

Follow and turn notifications on.

I'll post the warning BEFORE it hits the headlines.

#GoldSilverRebound #ADPDataDisappoints #WhaleDeRiskETH #USIranStandoff