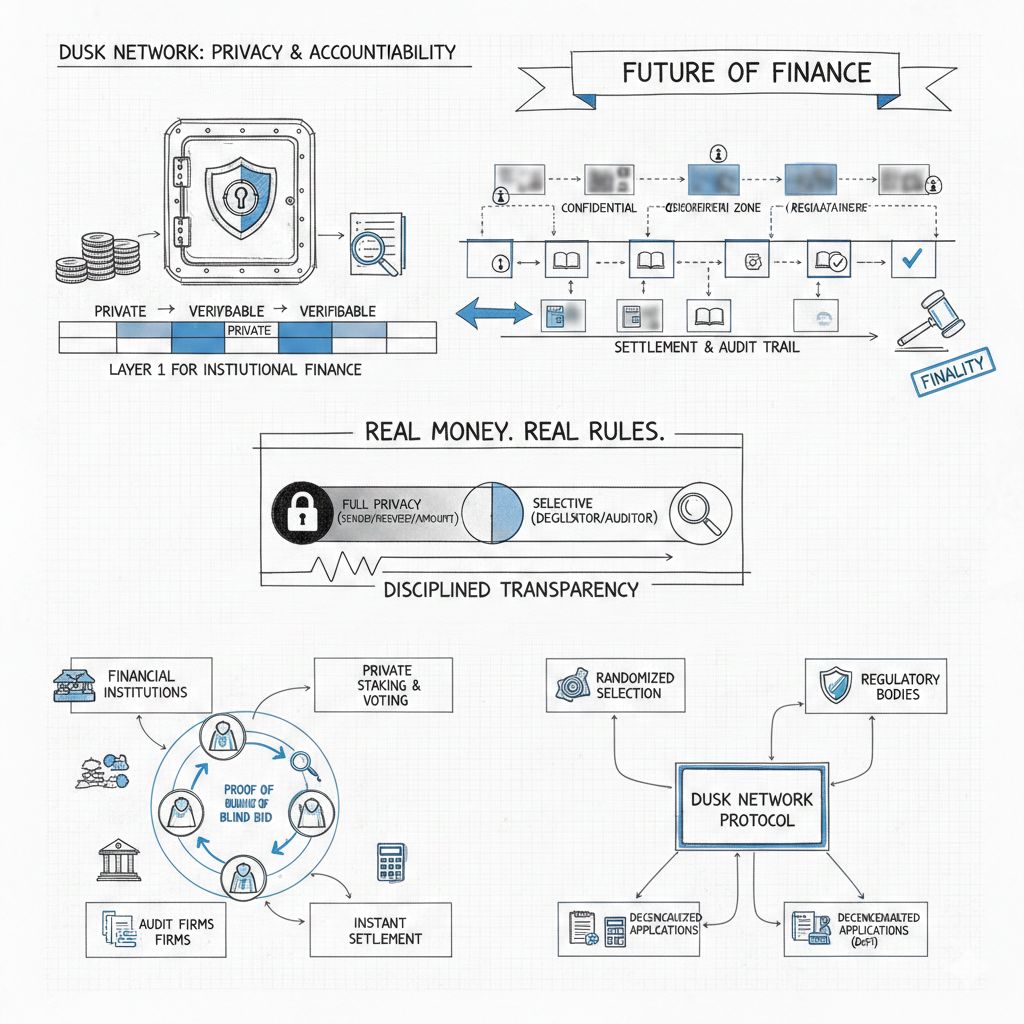

Dusk Network because it is one of the rare Layer 1 projects that feels like it was designed for how finance actually behaves when real money, real rules, and real accountability enter the room, because in that world you cannot live with full transparency and you also cannot hide everything, so the chain has to support privacy with discipline while still leaving room for verification, audits, and final settlement that does not depend on trust.

When I say privacy here, I do not mean a simple hide the balance narrative, because Dusk is trying to build a settlement layer where confidential activity can exist without collapsing the requirements that regulated systems carry, and that is exactly why the project keeps talking about financial market infrastructure, confidential smart contracts, and standards that can support assets which are closer to regulated instruments than to casual tokens.

The deeper logic becomes clearer when you look at how Dusk approaches transactions, because the network leans into the reality that markets operate through more than one lane, so Phoenix represents the privacy oriented model that enables confidential transfers and confidential smart contract behavior through a note based structure, and that matters because it is built to reduce linkability and leakage at the transaction layer rather than pretending that privacy can be added later with surface level tricks, while the broader architecture also acknowledges that some flows must remain transparent for operational and compliance reasons, which is why the ecosystem narrative includes a transparent account based lane that can coexist with Phoenix instead of fighting it.

This dual lane mindset is not a cosmetic feature, because in a regulated environment you often need selective disclosure and controlled visibility, meaning some participants must be able to verify certain facts without exposing everything to everyone, and a chain that cannot navigate this reality will either become unusable for institutions or become so restrictive that developers avoid it.

Where Dusk feels most intentional is in its focus on assets and rules, because the project is not only claiming it can move value privately, it is building toward private compliant assets, and that is where Zedger and the Confidential Security Contract standard known as XSC become central to the story, since security style assets carry lifecycle requirements such as issuance constraints, eligibility logic, transfer restrictions, corporate actions, reporting paths, and controlled settlement, and most ecosystems struggle to support those rules without leaking sensitive information or forcing everything into public state transitions that reveal the market.

Zedger is described as a hybrid privacy preserving model built on Phoenix concepts but optimized for the needs of security tokens, which is a crucial distinction because tokenized real world assets are not just programmable money, they are programmable instruments that must obey constraints, and XSC sits as the contract standard layer that aims to make those constraints enforceable while keeping confidentiality and auditability in the same design space, which is exactly the sort of foundation that can support institutional grade use cases without turning privacy into an obstacle.

Another reason I take Dusk seriously is how it treats settlement finality, because markets do not tolerate ambiguity at the base layer, so the project emphasizes deterministic settlement properties and low fork probability, which is not a flashy marketing angle but it is a critical requirement if you want the chain to be used for settlement instead of speculation, since finality is where disputes either disappear or multiply.

On the execution side, the DuskEVM direction matters because it provides a practical path for builders who already understand EVM tooling, while still anchoring settlement guarantees to the Dusk base layer, and that combination can reduce friction for developers without forcing the network to abandon the privacy plus compliance thesis that makes it distinct.

The token story is easiest to keep grounded when you separate representation from destination, because the ERC20 DUSK contract on Ethereum exists as a widely accessible representation that supports historical distribution and broader ecosystem movement, while the long term destination is native usage where the token sits at the center of staking, consensus participation, and network economics, meaning the token is intended to secure the chain and pay for usage rather than simply exist as a transferable asset.

From the perspective of benefits, what stands out is the way Dusk tries to deliver three things together that rarely coexist in practice, which are confidential execution through Phoenix, compliance aligned asset behavior through XSC and Zedger driven design, and a modular structure that can support both confidential and transparent requirements without forcing every application into the same narrow template, because the moment you want real financial workflows onchain you need flexibility without chaos and you need privacy without darkness.

When I look at risks, I focus on what could realistically slow the thesis, because privacy and compliance are technically heavy and they demand strong tooling, clear documentation, stable infrastructure, and an ecosystem that can actually ship applications that use these primitives instead of merely referencing them, and there is also the operational surface area that comes with bridges and cross system connectivity, which is a known high risk zone across the industry, so it becomes essential that Dusk treats operational security and incident response as part of product quality rather than as a side task.

What I expect next is a phase where the network keeps hardening core infrastructure while the ecosystem proves real workflows, meaning not just a demonstration of confidential transfers but a demonstration of regulated asset behavior that feels like issuance, trading, settlement, and reporting, because once those patterns become repeatable and simple to implement, the value proposition stops being theoretical and starts becoming a standard that other builders can rely on.

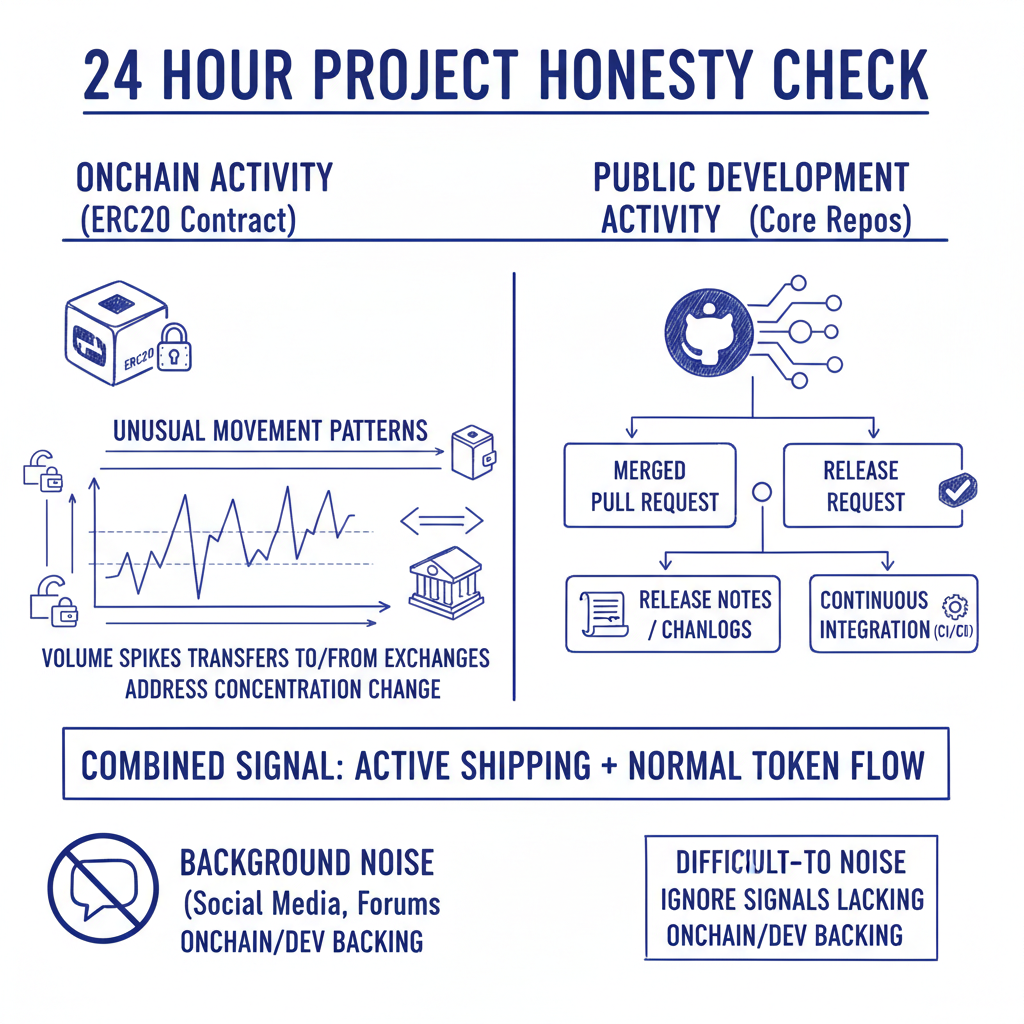

For the last 24 hours view, the cleanest way to stay honest is to track signals that are difficult to fake, so I watch onchain activity around the ERC20 contract for unusual movement patterns and I watch public development activity across core repositories for merged work, release notes, and continuous integration runs, because that combination shows whether the project is actively shipping and whether the token is experiencing normal flow or sudden pressure, and I treat any social noise that lacks these signals as background rather than as evidence.

Dusk is not trying to win by being everywhere, because it is trying to be the place where regulated finance can actually operate onchain without exposing the entire market to public surveillance, and if the team keeps executing on infrastructure reliability while the ecosystem ships credible XSC and Zedger aligned use cases, then Dusk can sit in a category that tends to grow slowly but endure strongly, since the demand for privacy with discipline in financial markets does not disappear, it only becomes more urgent as tokenization expands.