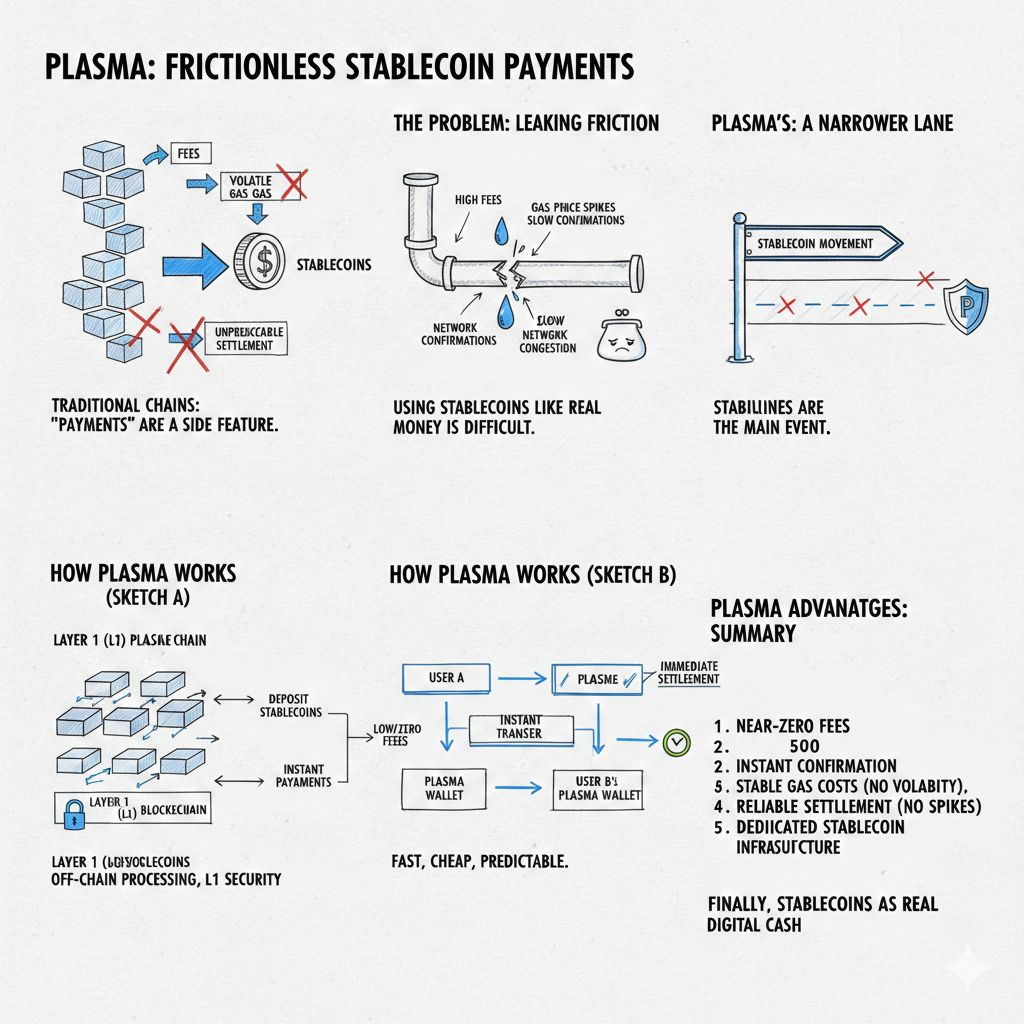

Plasma feels like a project built with a very specific frustration in mind, because almost every chain says it can support payments, yet the moment you try to use stablecoins like real money, the experience starts leaking friction through fees, volatile gas tokens, and unpredictable settlement when activity spikes, so Plasma chooses a narrower lane on purpose and treats stablecoin movement as the main event instead of a side feature that sits behind general purpose DeFi traffic.

At its core Plasma is positioning itself as a Layer 1 settlement network where stablecoins behave like first class citizens, meaning the chain is designed so sending and receiving stable value does not require a user to learn the usual crypto rituals like buying a separate gas asset first, swapping just to cover fees, or waiting while the network fights congestion, and that design choice matters because payment rails win by being boringly reliable while staying cheap and fast even when demand is high, especially in markets where stablecoins already act like a practical savings and transfer tool.

The technical direction behind Plasma supports that payments first posture in a way that is easy to understand if you look at it through the lens of user experience rather than only throughput numbers, because Plasma keeps an EVM environment so builders can deploy with familiar tools while the chain itself focuses on settlement speed and fee predictability, and the reason that combination matters is that payments adoption depends on two different types of confidence at the same time, the builder needs confidence that the stack is familiar and deployable without months of custom work, and the user needs confidence that sending value will not suddenly become expensive, slow, or confusing when the chain gets busy.

Where Plasma gets more interesting is the stablecoin centric feature set that tries to remove the biggest onboarding wall in crypto, which is the gas problem, because when a person wants to send a stablecoin they usually do not care about owning a chain token, and a merchant or payroll operator usually does not want treasury exposure to a volatile asset just to pay fees, so the project pushes toward stablecoin first gas mechanics and gas abstraction flows that let transactions be paid for in stablecoins through a paymaster style model, and when it works well it turns the first interaction into a simple stablecoin transfer instead of a mini course on how to acquire gas.

The gasless transfer direction, especially around stablecoin transfers, is not just a convenience detail, because it signals that the team is thinking about stablecoin payments like a product category that must compete with mainstream fintech expectations, and that forces a different kind of behind the scenes work where you need relayer infrastructure, sponsorship policy, abuse mitigation, rate limiting, and a careful definition of what gets sponsored and what does not, since anything free at scale becomes a target for spam, and the long term quality of this system will be measured by whether it stays smooth for legitimate users while resisting automated abuse without turning into a confusing maze of restrictions.

Plasma also frames itself around a Bitcoin anchored security direction, and even without overcomplicating the details, the motivation is clear because payment networks attract pressure as they grow, and anchoring narratives aim to strengthen neutrality and censorship resistance so the settlement layer feels harder to capture, but the real value here will always come down to execution, since the market can forgive a project that is still building but it will not forgive a payments rail that fails under stress, so the quality of bridging design, anchoring mechanics, and how the network behaves in edge cases will ultimately decide how much weight this narrative carries.

If you want to understand what is happening right now rather than only what is promised, the cleanest window is the explorer activity and the pace of onchain movement, because a chain built for payments should show signs of consistent throughput, steady block production, and ongoing transfers rather than only short bursts driven by incentives, and while raw transaction counts never automatically prove real adoption, a living network with visible activity does provide the baseline confidence that the chain is operational and processing traffic in the present, which is the first requirement before anyone can even debate whether usage is organic.

The XPL token sits inside this story as the network level asset that supports security and economics, and that creates an important balance because Plasma wants end users to feel stablecoin native flows and stablecoin gas, while the chain itself still needs a durable security budget and a way to coordinate incentives for validators and long term growth, so XPL becomes part of the backbone even if the surface experience aims to feel stablecoin led, and the practical way to think about it is that stablecoins are the product and XPL is the network machinery that keeps the product running at scale.

Token design always becomes real when you connect it to time, because allocation and vesting schedules shape how supply enters the market and how incentives align, and in Plasma’s case the structure highlights a large ecosystem and growth component that signals a heavy focus on partnerships, integrations, and adoption programs over time, while team and investor vesting dynamics create the usual supply events that traders and long term holders tend to watch closely, and the healthiest outcome is when those unlock periods overlap with genuine usage growth so the market absorbs supply through expanding demand rather than purely through speculation.

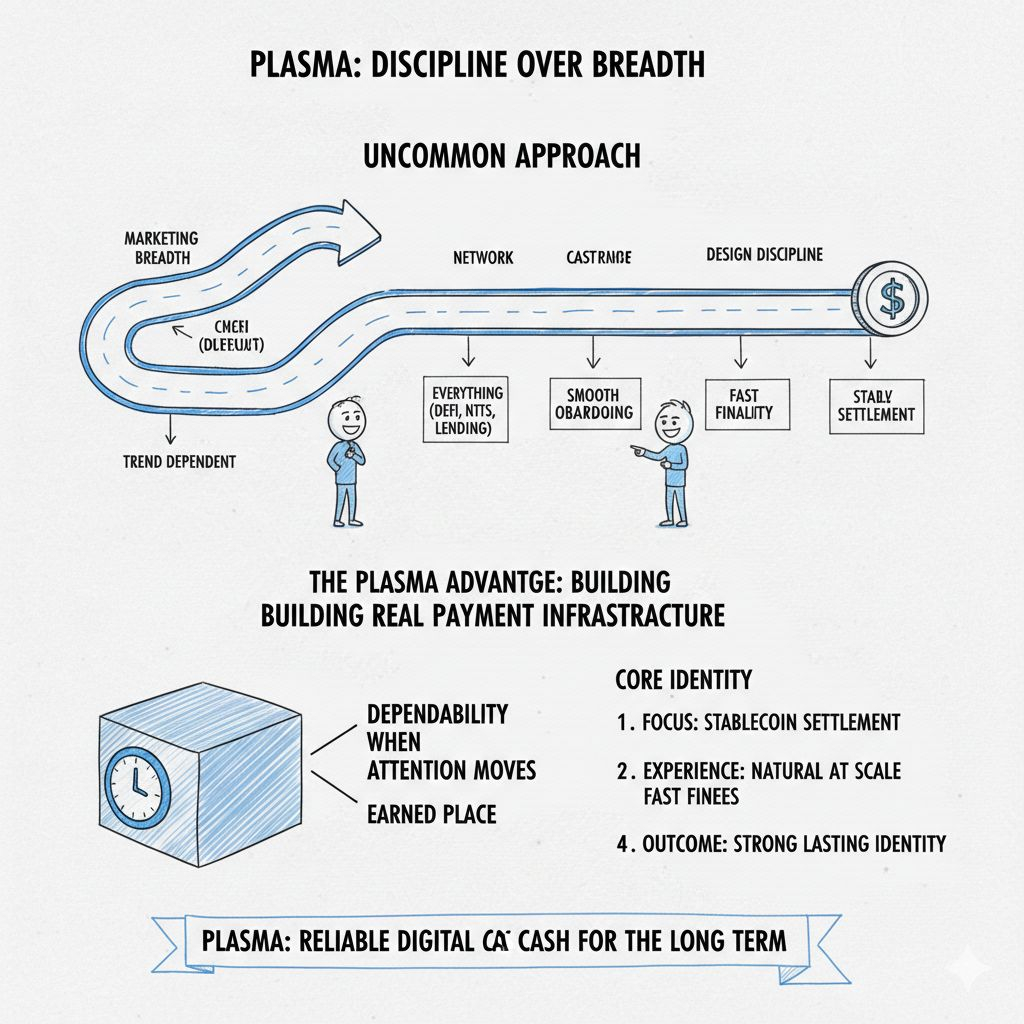

The benefits of Plasma become easiest to see when you imagine the target user not as a crypto native trader but as someone who wants to send stable value repeatedly without thinking, because the moment stablecoin transfers stop feeling like a technical activity and start feeling like a normal payment action, you unlock use cases that are larger than any single ecosystem narrative, including remittances, merchant settlement, payroll, creator payouts, cross border business transfers, and everyday savings movement, and Plasma is basically trying to compress the distance between stablecoins as an idea and stablecoins as a daily behavior.

At the same time the project’s biggest risks are exactly the risks that come with being serious about payments, because a payments chain cannot hide behind hype cycles, it must prove reliability through sustained activity, it must keep fee behavior predictable, it must harden its sponsored transaction systems against abuse, and it must show credible progress toward decentralization and resilient security as usage grows, since users tolerate experimentation in social apps and games but they do not tolerate uncertainty when the product is money movement.

What comes next for Plasma should be judged by milestones that change fundamentals rather than by noise, and the milestones that matter are the ones that expand security and decentralization, broaden stablecoin native fee coverage into more real payment flows, deepen the anchored security execution into something that is measurable and battle tested, and grow integrations that bring real transfer volume from payment style users rather than only liquidity seekers, because if Plasma is going to win its category it will win by becoming a default settlement rail that quietly works day after day.

is that Plasma is taking the uncommon approach of choosing discipline over breadth, because it is easier to market a chain that claims to support everything, but it is harder and more valuable to design around one high impact behavior and push that experience until it feels natural at scale, and if Plasma continues to focus on stablecoin settlement with smooth onboarding, fast finality, and stable fee behavior, then the project can carve out a strong identity that does not depend on trends, since real payment infrastructure earns its place by staying dependable when attention moves elsewhere.

Plasma For the last 24 hours specifically, what can be treated as truly dependable is the visible continuation of onchain activity through the explorer and the ongoing cadence of the network, while official announcement style updates depend entirely on whether the team publishes something new in that window, so the smartest daily tracking approach is to pair explorer signals like fresh blocks, transfer flow, and contract activity with confirmed official posts when they appear, and that way your updates stay grounded in what is happening rather than what people are guessing.