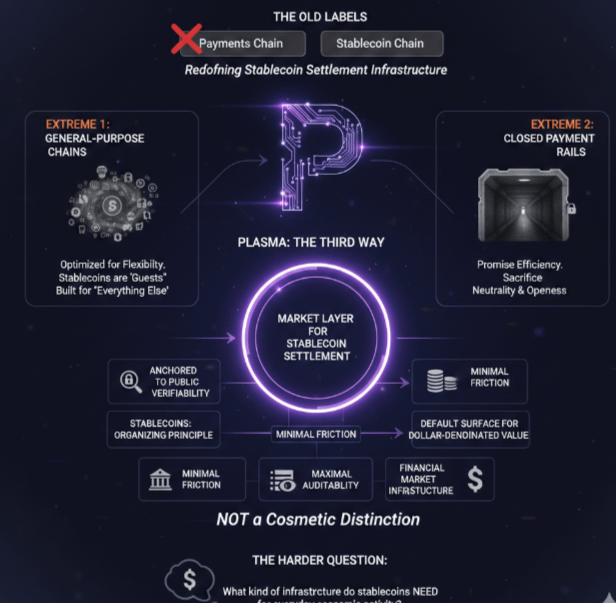

Most people call Plasma a payments chain. That label is too small and quietly misleading. Plasma is not trying to be another fast blockchain competing on speed charts; it is trying to redesign how stablecoins settle in public markets. The harder question is this: what kind of infrastructure do stablecoins actually need if they are going to carry everyday economic activity, not just speculative trades?

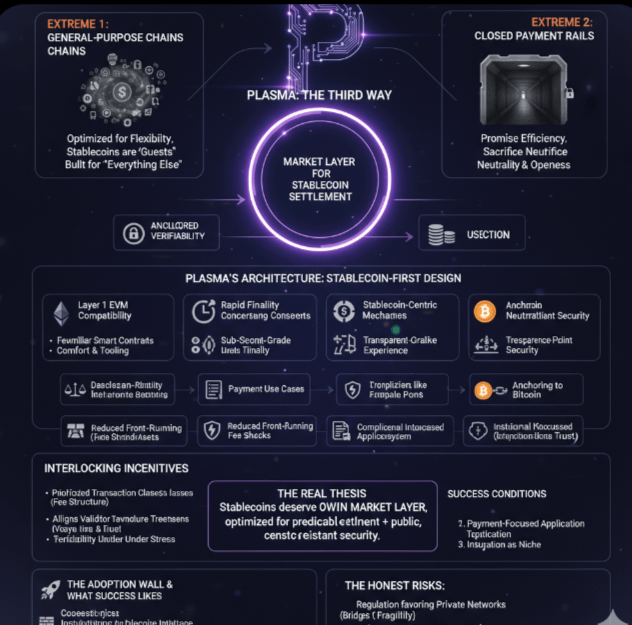

The industry has drifted into two extremes. On one side are general-purpose chains optimized for flexibility, where stablecoins are guests inside systems built for everything else. On the other side are closed payment rails that promise efficiency but sacrifice neutrality and openness. Plasma positions itself as a third way: a market layer engineered specifically for stablecoin settlement, but anchored to public verifiability. It treats stablecoins not as an application, but as the organizing principle of the system.

This is not a cosmetic distinction.

1. The Label People Get Wrong

Calling Plasma a “stablecoin chain” suggests a narrow utility, as if it were a specialized tool with limited scope. The project’s design is closer to a settlement venue that assumes stablecoins will be the dominant unit of account for on-chain commerce. That assumption changes everything from fee mechanics to security architecture.

Traditional labels hide the real ambition. Plasma is not competing to host the most applications; it is competing to become the default surface where dollar-denominated value moves with minimal friction and maximal auditability. In that sense, it resembles a financial market infrastructure project more than a typical smart contract platform.

2. The Trap in the Usual Approach

Most blockchains treat stablecoins as passengers. They inherit the same congestion, fee volatility, and execution priorities as every other token. During periods of stress, the very assets meant to provide stability are forced to compete with speculative traffic for block space.

At the opposite extreme, specialized payment systems often centralize control to guarantee performance. They reduce operational uncertainty by narrowing participation and governance. That trade-off can improve speed, but it weakens the neutrality that gives public blockchains their credibility.

The uncomfortable truth is this. Neither extreme fully respects the economic role stablecoins are starting to play.

Plasma’s architecture responds by embedding stablecoin-centric features directly into the protocol. Gasless transfers for certain stablecoin operations and a fee model that prioritizes these assets are not marketing flourishes; they are statements about what the system considers mission-critical. Combined with full EVM compatibility and sub-second finality, the design attempts to merge developer familiarity with payment-grade responsiveness.

3. The Real Thesis in One Sentence

Plasma argues that stablecoins deserve their own market layer, optimized for predictable settlement while remaining anchored to public, censorship-resistant security.

4. How the System Actually Works (Explain step-by-step in plain words)

At the base level, Plasma operates as a Layer 1 blockchain with full compatibility with the Ethereum Virtual Machine. Developers can deploy familiar smart contracts without relearning an entirely new execution model. This continuity matters because liquidity and tooling follow developer comfort.

Transaction ordering and confirmation rely on a consensus mechanism designed for rapid finality. Instead of waiting through long confirmation windows, the system aims to provide near-instant certainty that a transfer is settled. For stablecoin payments, where timing affects user trust and merchant acceptance, this speed is not cosmetic.

On top of this execution layer, Plasma introduces stablecoin-first mechanics. Certain stablecoin transfers are structured to minimize or remove direct gas friction for end users. The network internalizes part of the complexity so that sending a dollar-denominated token feels closer to sending a message than negotiating a fee market.

Security is reinforced through anchoring to Bitcoin. Periodic commitments to Bitcoin’s ledger are intended to inherit some of its neutrality and resistance to censorship. This anchoring does not replace Plasma’s own consensus, but it adds an external reference point that is difficult for any single actor to manipulate.

Here is the part most people skip. These components are not independent features; they are interlocking incentives. Developer compatibility attracts applications, fast finality supports payment use cases, and Bitcoin anchoring signals long-term credibility to institutions wary of purely internal security claims.

5. Where the Design Gets Serious (one overlooked design choice + why it matters)

An overlooked aspect of Plasma’s design is how it implicitly prioritizes transaction classes. By elevating stablecoin activity within the fee structure, the protocol is making a governance decision about what kinds of economic behavior deserve preferential treatment.

This is a second-order insight many observers miss. Fee markets are not neutral; they encode values. By smoothing the cost of stablecoin transfers, Plasma is nudging validators to treat payment flows as core infrastructure rather than optional traffic. That alignment between validator incentives and user experience is crucial. If validators earn predictable revenue from supporting stablecoin settlement, they have a structural reason to maintain reliability under stress.

6. Why This Matters in the Real World (front-running, data leaks, incentives, compliance)

Suppose a regional remittance company routes a significant share of its cross-border payments through on-chain stablecoins. During a period of market volatility, congestion spikes on general-purpose networks. Transfers slow, fees surge, and counterparties begin to question settlement certainty. The business risk is no longer abstract; it is operational.

A chain optimized for stablecoin flows changes that equation. Predictable execution reduces exposure to front-running and fee shocks that can distort transaction ordering. Sub-second finality narrows the window in which adversarial behavior can exploit pending transfers. For institutions operating under compliance constraints, the combination of transparent settlement and consistent performance simplifies reporting and audit processes.

If you only remember one thing, remember this. Infrastructure choices quietly shape market behavior.

By designing around stablecoins, Plasma is attempting to reduce the gap between blockchain settlement and the expectations of regulated payment systems. It does not eliminate compliance challenges, but it creates an environment where disclosure, monitoring, and risk controls can be layered more cleanly on top.

7. The Adoption Wall (why adoption is hard + what must be solved)

Technical elegance does not guarantee adoption. Plasma faces the familiar challenge of bootstrapping liquidity and trust in an ecosystem already crowded with alternatives. Stablecoin issuers, payment processors, and developers must see a clear advantage in migrating or integrating.

One barrier is interoperability. Even with EVM compatibility, moving meaningful volume requires bridges, custody solutions, and institutional-grade tooling. Each additional layer introduces operational risk that cautious participants will scrutinize.

Another challenge is perception. Specialized chains can be misread as niche experiments unless they demonstrate sustained usage under real economic load. Plasma must show that its stablecoin-first design holds up not only in controlled environments but in messy, high-volume market conditions.

8. What Success Would Look Like (3 concrete success conditions)

Success for Plasma would first appear as consistent settlement of large stablecoin volumes without fee spikes or confirmation delays, even during broader market stress. That resilience would signal that the architecture delivers on its core promise.

Second, a mature ecosystem of payment-focused applications would emerge, using Plasma as a default backend for remittances, merchant settlement, and treasury operations. The chain would become invisible infrastructure, noticed mainly when it fails to function.

Third, institutional participants would treat Bitcoin anchoring and transparent execution as credible components of their risk frameworks. Integration into compliance workflows would indicate that the system has crossed from experimental to operational.

9. The Honest Risks (not generic; specific to this system)

Plasma’s specialization is both strength and vulnerability. If stablecoin regulation evolves in ways that favor tightly controlled or private networks, a public stablecoin layer could face structural headwinds. Its value proposition depends on stablecoins remaining meaningfully active on open infrastructure.

There is also the risk of incentive imbalance. Prioritizing stablecoin transactions may unintentionally marginalize other forms of activity, limiting the diversity of applications and revenue streams that support validators. A network overly dependent on a narrow use case can become fragile if that use case shifts.

Finally, Bitcoin anchoring introduces its own dependencies. While it enhances perceived neutrality, it ties part of Plasma’s security narrative to an external system with its own governance and technical evolution. Coordination between layers is never trivial.

10. Closing: A Calm, Convincing Future (inspiring but not salesy)

Plasma represents a sober attempt to treat stablecoins as first-class financial infrastructure rather than experimental tokens. Its architecture reflects a view that settlement systems should be designed around the assets they carry, not forced to accommodate them as afterthoughts. Like a well-run port that quietly organizes the flow of goods, the chain aspires to make movement efficient without drawing attention to itself.

The future it sketches is not one of dramatic disruption but of gradual normalization. If Plasma and similar projects succeed, stablecoin settlement may begin to feel routine, dependable, and structurally embedded in everyday finance. That outcome would not make headlines. It would simply make markets work a little more smoothly.