In the world of virtual currencies Bitcoin is knows as the "Digital Gold". Same as Bitcoin we can call Ethereum as "Digital Silver". The Reason behind it is there performance. Gold is also called store of value where silver is also know as the Industrial utility asset. The same difference of gold and silver we found in Bitcoin and Ethereum. Interestingly, this analogy becomes even more relevant when we look at how ETFs impacted these assets.

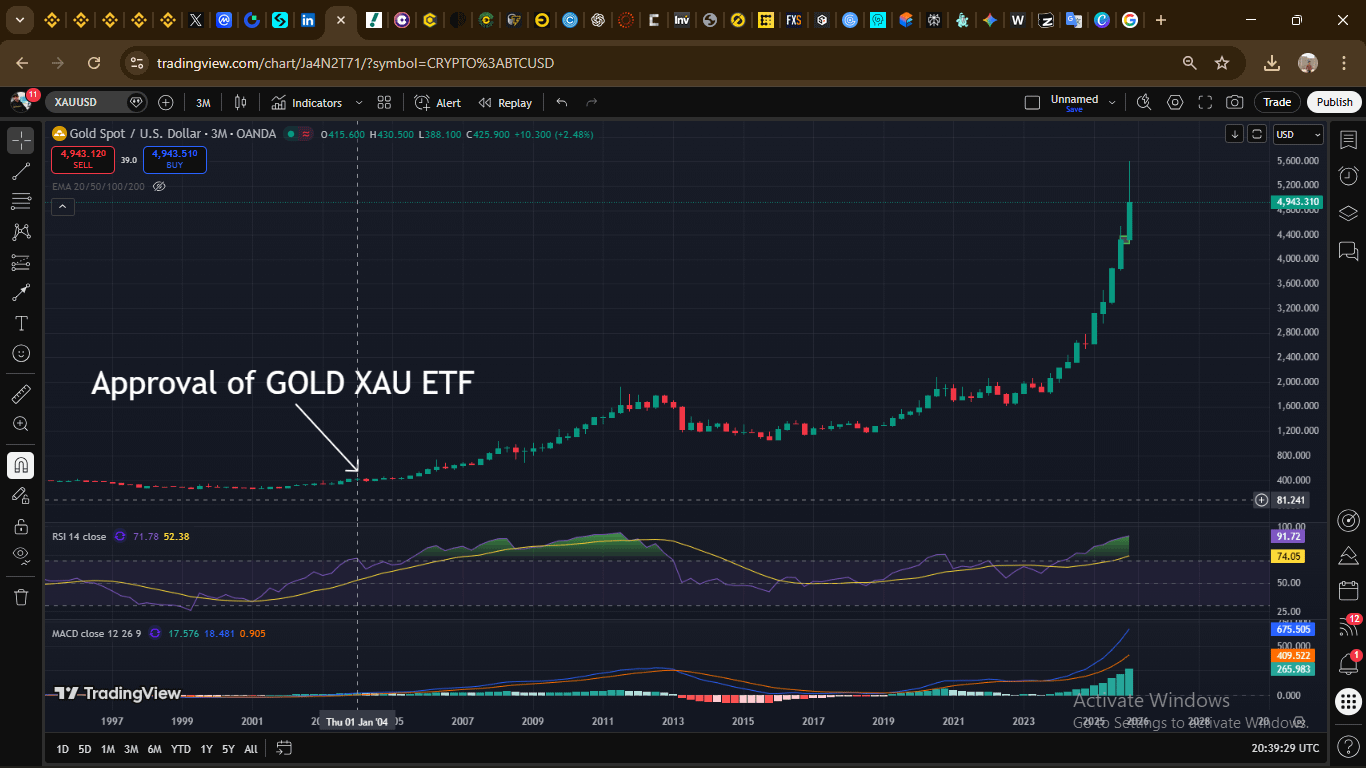

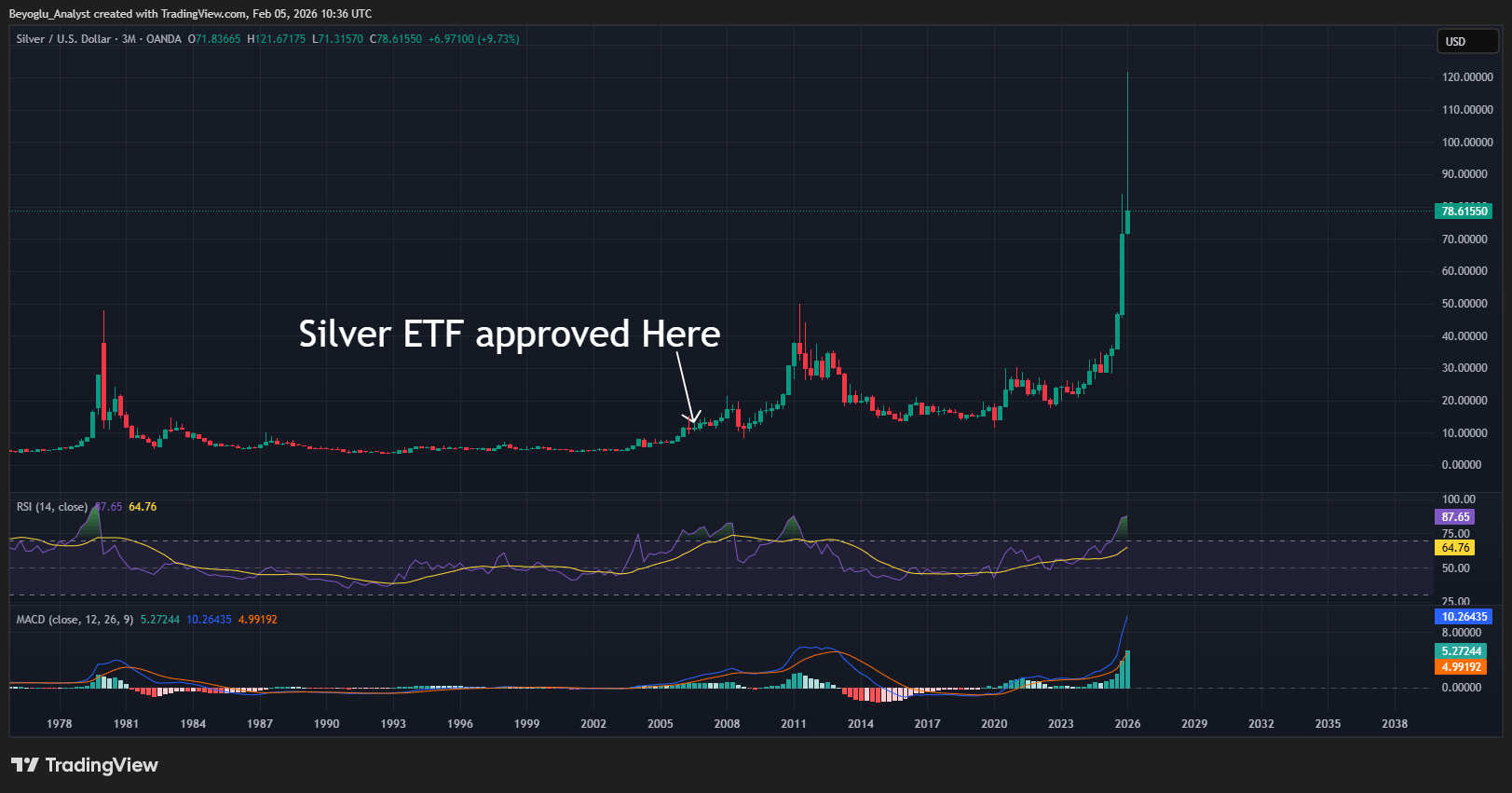

Gold and Silver Performance after ETFs launched.

When gold ETFs were launched, they turned gold into a mainstream investment. Institutional capital poured in, liquidity increased, and gold entered a long-term bullish phase. Silver ETFs brought attention to silver, but silver never managed to surpass gold’s consistency and dominance. Despite high volatility and occasional surges, silver remained in gold’s shadow.

Gold $XAU after ETF Approval.

Silver $XAG after ETF Approval.

It took 5 years for silver to retest the previous all time high.

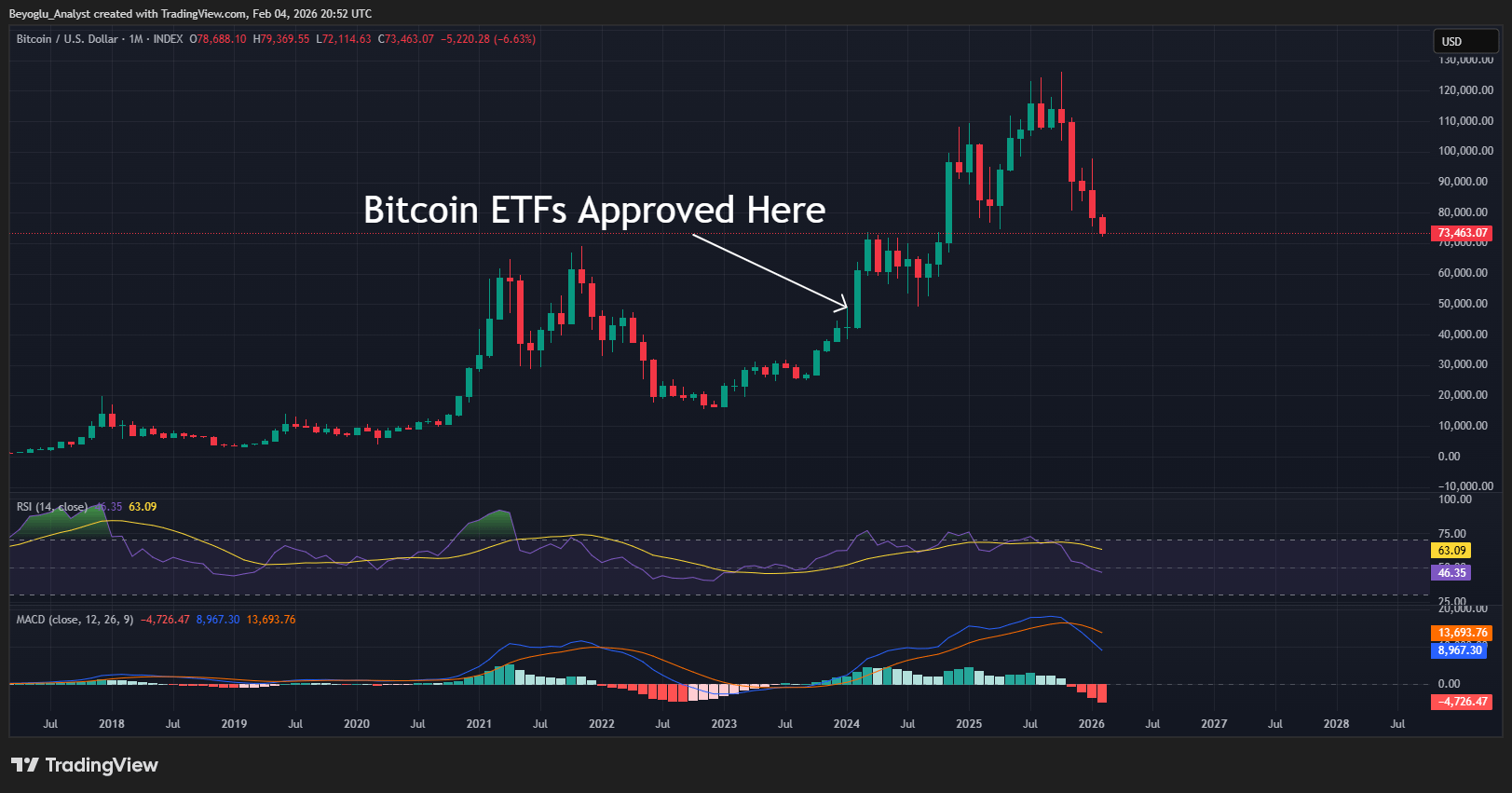

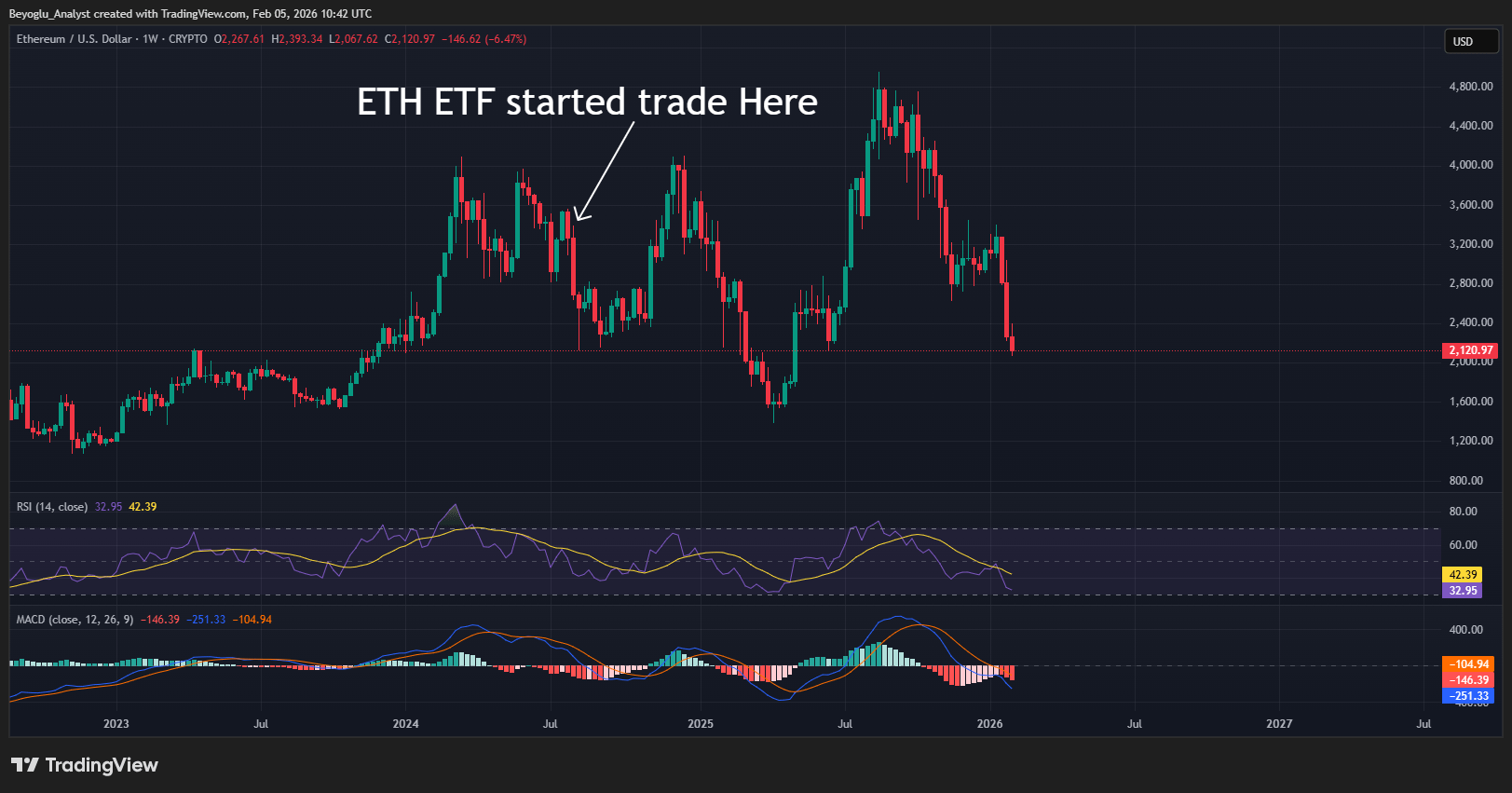

Now the Turn Comes for Bitcoin and Ethereum ETF Comparison.

The approval of Bitcoin spot ETFs is a historic moment. It validated Bitcoin in the eyes of traditional finance, unlocked massive institutional inflows, and reinforced Bitcoin’s narrative as a digital store of value. Prices soared, demand strengthened, and Bitcoin once again proved why it is considered the backbone of the crypto market.

Bitcoin after ETF Approved.

Ethereum after ETF Approved.

Eth took nearly 1 year to retest the previous all time high.

Just as silver ETFs haven’t elevated silver to gold levels, Ethereum ETFs haven’t pushed ETH to perform like Bitcoin. While Ethereum is technically superior in many ways—powering smart contracts, DeFi, NFTs, and Web3—this complexity works against it as an ETF asset. Institutions value simplicity, clarity, and predictability, characteristics that are far more aligned with Bitcoin than Ethereum.

Another key difference is in the narrative. Bitcoin’s value proposition is straightforward: fixed supply, decentralization, and a hedge against inflation. Ethereum’s changing monetary policy, staking mechanics, and frequent upgrades make it difficult for traditional investors to consider it a “safe” asset. This uncertainty limits the aggressive capital inflows that Bitcoin ETFs have enjoyed.

Moreover, Bitcoin dominates mindshare. In times of institutional adoption, capital typically flows first and most heavily into the strongest asset. Just as gold remains the primary hedge while silver plays a secondary role, Bitcoin continues to lead while Ethereum follows.

That doesn’t mean Ethereum has failed. Silver is still valuable, just as Ethereum is a key pillar of the crypto ecosystem. But value and performance don’t always go hand in hand. ETFs reward assets that are easy to understand and easy to trust, and in both traditional and digital markets, gold — not silver — wins that race.

Ultimately, the ETF era has reinforced an old truth in a new market:

Bitcoin shines like digital gold, while Ethereum, like digital silver, supports the system — but doesn’t lead it.