Most blockchains are built like glass offices: everything is visible, even when visibility is a liability. That’s fine for memes and simple transfers. It breaks the moment you try to run a real market. In regulated finance, information is not decoration, it’s edge. Expose identities, order sizes, allocations, or strategy and you don’t get “transparency,” you get front-running, compliance headaches, and participants who simply refuse to show up.

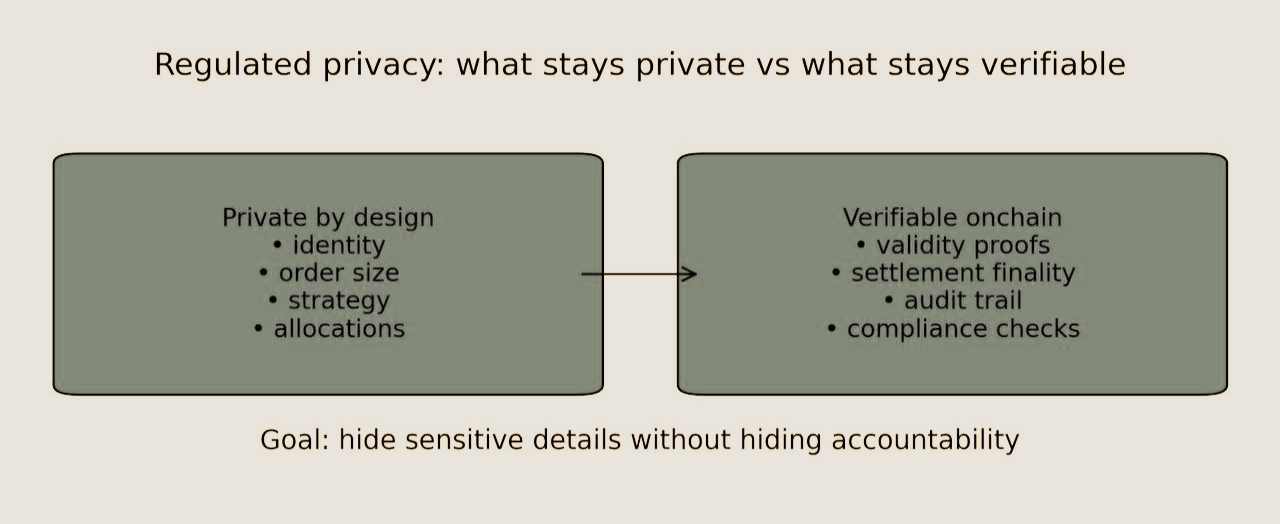

This is the niche @Dusk has been carving for years: a public network where confidentiality is native, yet accountability is non-negotiable. Dusk’s core premise is that regulated markets don’t want secrecy; they want selective disclosure. The chain should prove that rules were followed without forcing everyone to reveal their business.

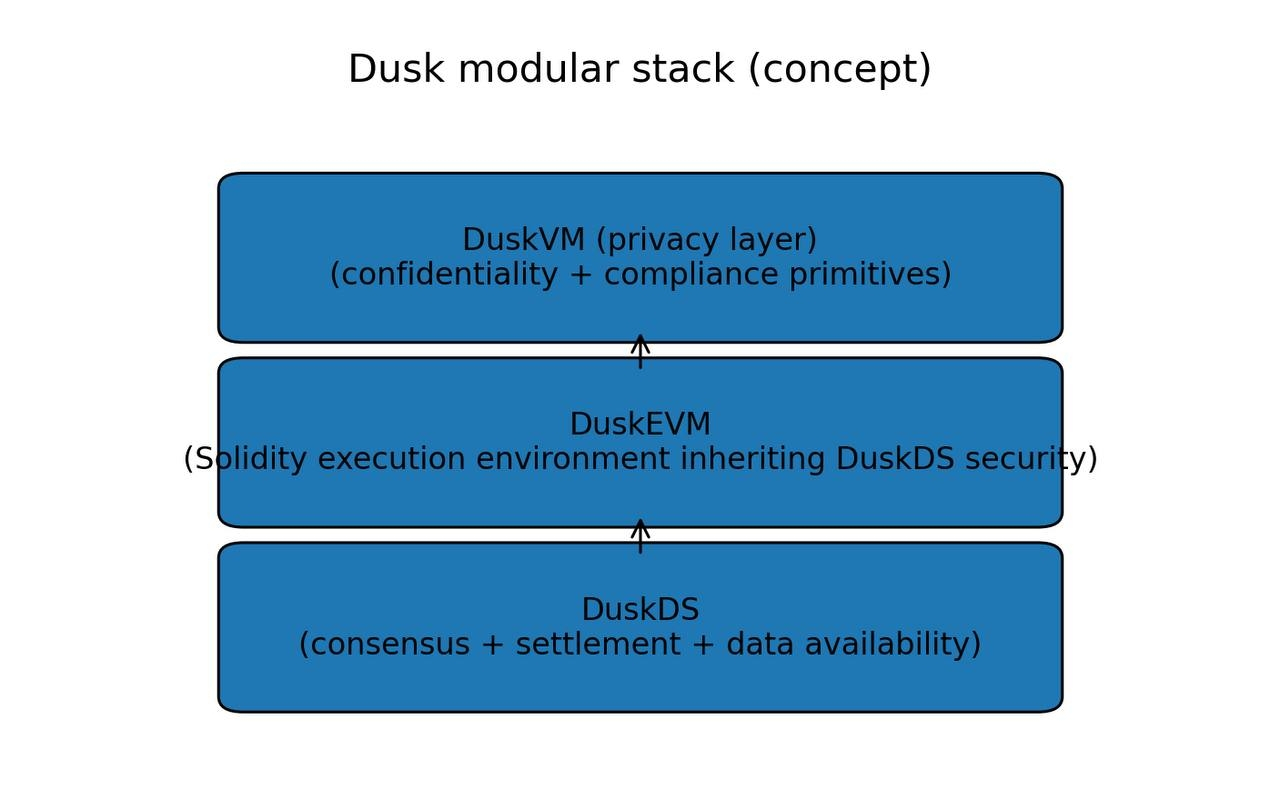

The architecture tells you they’re serious. Dusk has been evolving into a modular, multi-layer stack: a settlement layer (DuskDS) built for consensus, data availability, and finality, with an EVM execution environment (DuskEVM) on top for Solidity builders, and a privacy layer (often referenced as DuskVM) to bring confidentiality and compliance primitives into the same system. That’s not a cosmetic redesign; it’s an attempt to separate concerns the way financial infrastructure does: settlement stays robust and boring, execution stays developer-friendly, privacy stays explicit rather than “best effort.”

Why does this matter right now? Because Dusk is past the “promise” phase. The network has been pushing hard on production readiness: upgrades to the settlement layer and the rollout of DuskEVM so builders can deploy using familiar tooling while inheriting Dusk’s settlement guarantees. When a chain prioritizes regulated finance, the main feature isn’t a new opcode, it’s deterministic finality you can operationalize, and privacy you can defend to auditors.

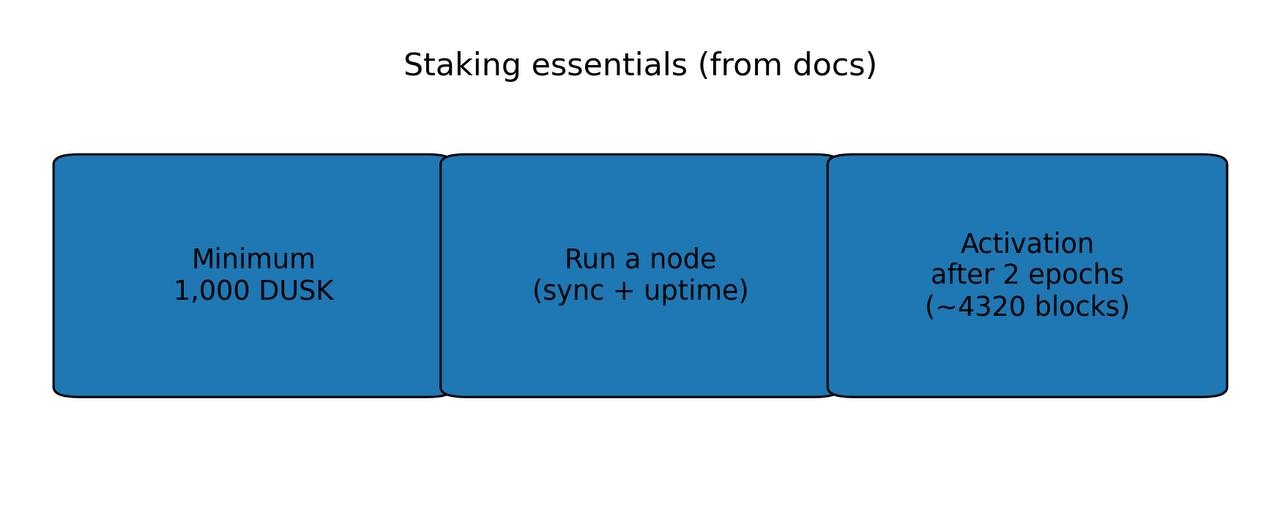

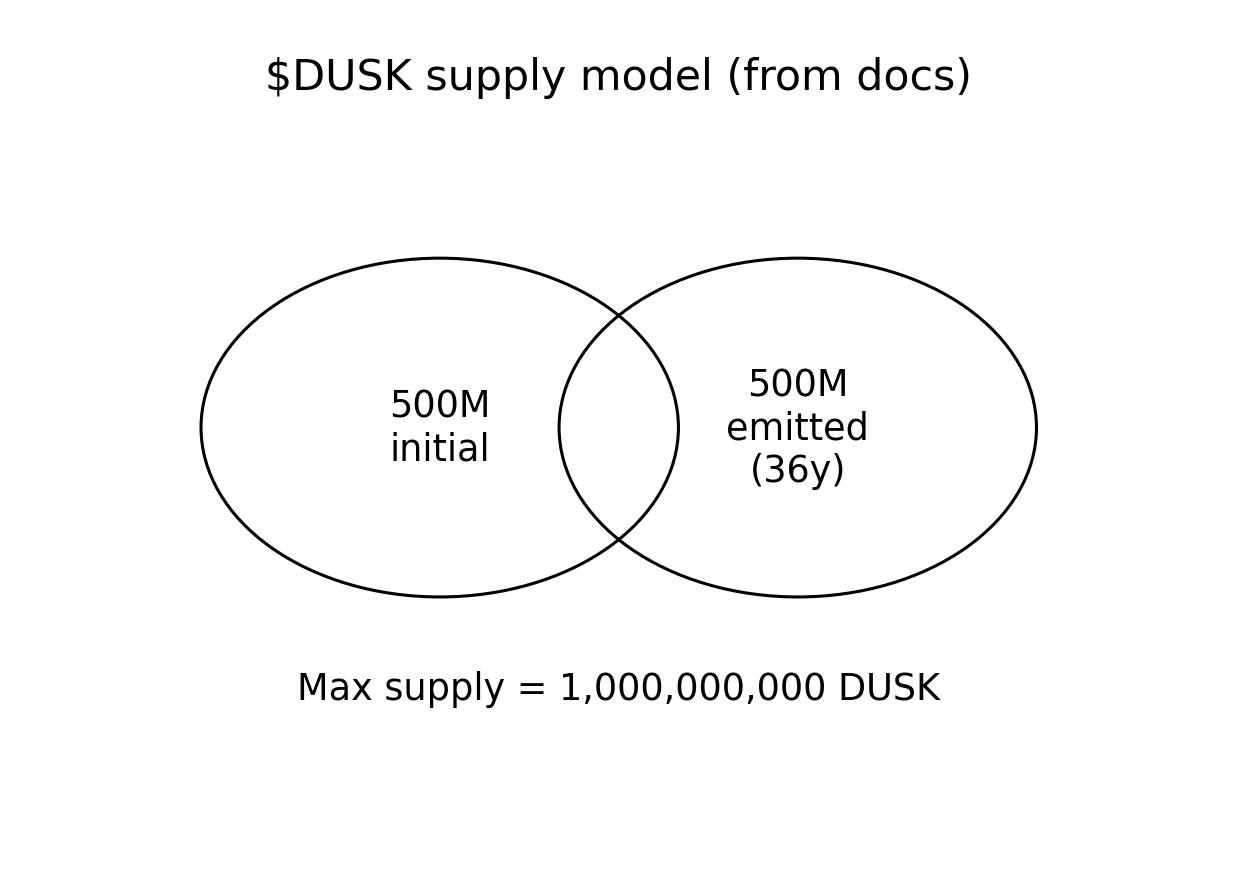

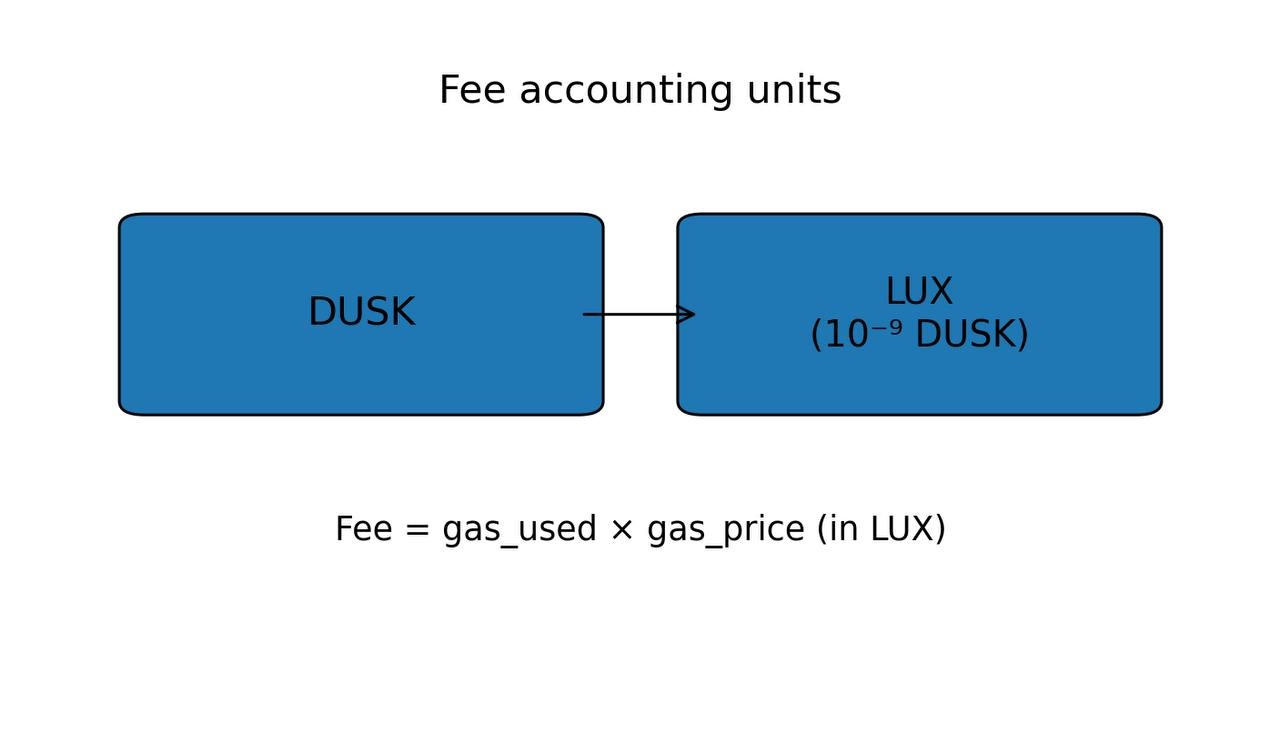

Then there’s token design, where Dusk is unusually transparent. The documentation lays out a max supply of 1,000,000,000 DUSK, made up of 500M initial supply plus 500M emitted over time to reward stakers over a long horizon. Gas accounting uses LUX, where 1 LUX = 10⁻⁹ DUSK, giving fine-grained fee pricing without rounding chaos. Staking isn’t hand-wavy either: the staking basics spell out practical requirements like a minimum threshold and activation after a short maturation period, reinforcing the idea that this network expects operators, not tourists.

So where does $DUSK sit in the story? It’s the network’s economic spine: staking aligns participants with security and uptime, fees anchor resource usage, and the emission schedule funds early security while the ecosystem matures. In Dusk’s world, the token isn’t a badge—it’s the collateral that keeps confidential markets from becoming private databases with a logo.

The most important mental shift is this: Dusk isn’t trying to make every transaction private. It’s trying to make markets functional. Some facts must stay hidden to prevent manipulation; other facts must be provable to satisfy regulation. Dusk is aiming for that intersection—privacy with receipts. If they get it right, Dusk won’t be known for “privacy tech.” It’ll be known as the chain where tokenized finance can actually behave like finance: compliant issuance, discreet trading, auditable settlement, and 24/7 access without forcing participants to publish their strategies to the world.

That’s the bet I’m watching: not whether Dusk can run smart contracts, but whether it can host real market microstructure, where confidentiality protects participants and proofs protect the system. If it can, $DUSK becomes the operating fuel for regulated onchain markets, not just another ticker on a list.

@Dusk $DUSK #Dusk