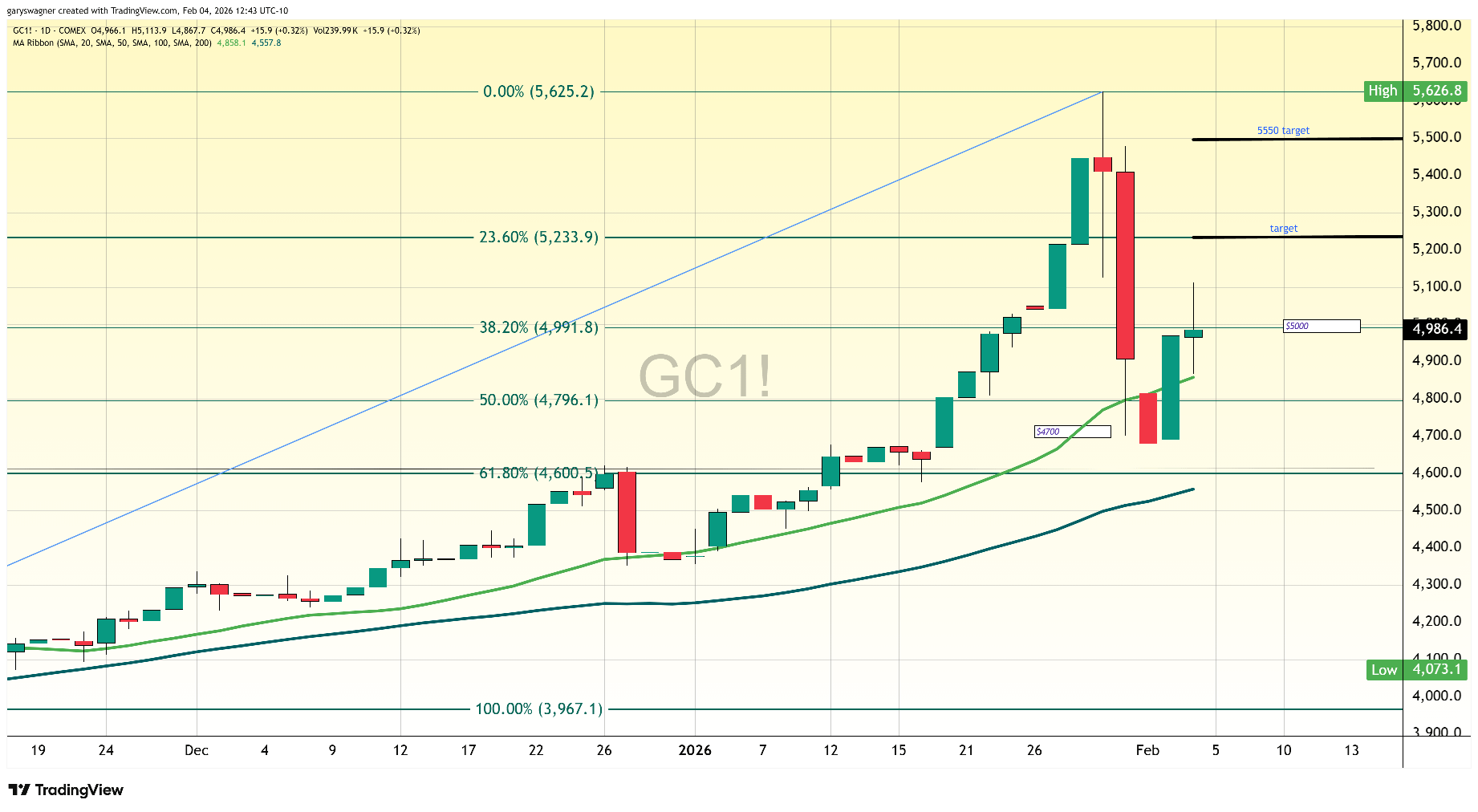

That is quite the rollercoaster for the metals market! It looks like we are seeing some historic price action—especially with Gold flirting with that $5,000 milestone.

The $5,000 Rebound

Gold didn't just walk back into the room; it made an entrance. After a brutal selloff last week, the yellow metal reclaimed the $5,000 psychological threshold, eventually climbing 3% to hit $5,070. It was a classic display of "buy the dip" conviction from investors looking for safety.

🥈 Silver Steals the Spotlight

While Gold was steady, Silver was sprinting. The "white metal" outpaced its big brother with a massive 8–10% surge, charging toward the $90 per ounce mark. It’s clear that when volatility hits, Silver remains the high-beta play for those with an appetite for risk.

📉 The "ADP Cooling" Reality Check

The party hit a speed bump at 9:30 AM. The ADP Employment Report dropped a cold towel on the rally, revealing a sharp slowdown in U.S. private-sector hiring for January. Businesses are officially pulling back, spooked by high financing costs and a slowing economy.

⚖️ The Fed’s New Headache

This disappointing labor data isn't just a "bad news" headline; it’s a puzzle for the Federal Reserve.

Conflict: Slower hiring usually means less wage pressure (good for fighting inflation), but it also signals a looming recession (bad for growth).

Result: Market participants are now scrambling to guess if the Fed will pivot to rate cuts sooner than expected or hold steady to ensure inflation is truly dead.

The Next 12 Hours

The technicals are screaming for a "make or break" moment. If Gold can hold above $5,000 despite the cooling jobs data, we might be looking at a structural floor. If it slips, the bears might take the wheel again.

#ADPDataDisappoints #WhaleDeRiskETH #EthereumLayer2Rethink? #TrumpEndsShutdown