Why $BANK/USDT Is Pumping 11% While the Crypto Market Is Bearish

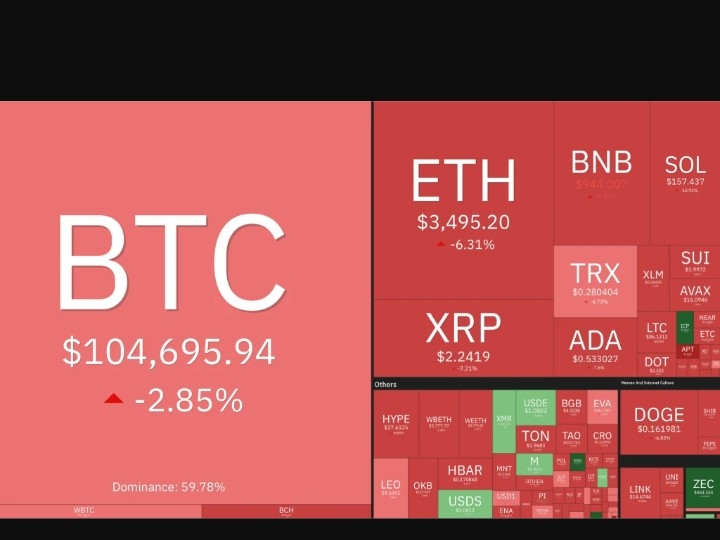

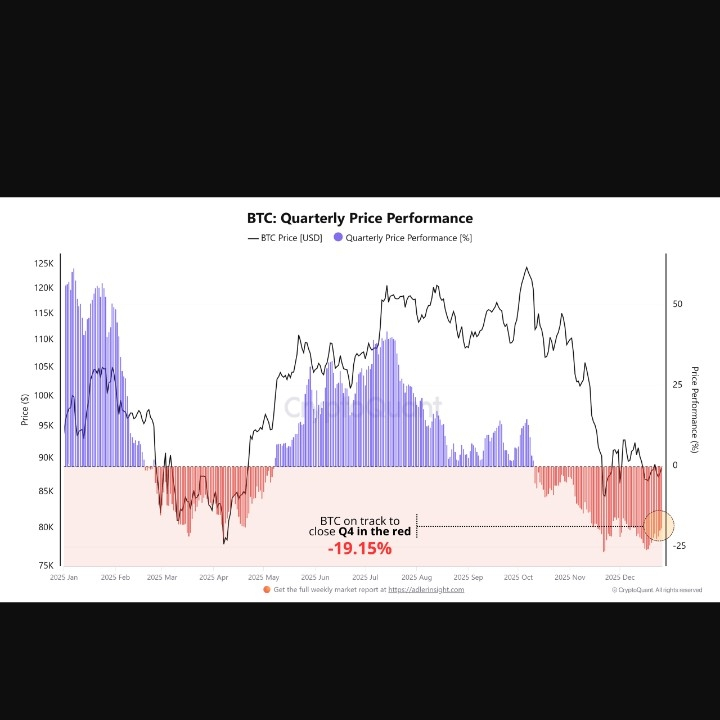

The crypto market is currently under pressure, with Bitcoin and most altcoins trading lower. Despite this bearish environment, $BANK/USDT has surged by nearly 11%, catching the attention of traders and investors alike.

This type of price action may seem unusual, but it often happens for specific reasons. Below are the key factors that can explain why $BANK/USDT is moving up while the rest of the market is moving down.

1. Independent Token Catalysts

Altcoins can move independently of the broader market when there is token-specific news or expectations. $BANK/USDT’s price increase may be driven by:

Upcoming product launches or updates

Announcements related to partnerships or ecosystem growth

New utility or use cases for the $BANK token

Community or governance proposals gaining traction

When a catalyst is strong enough, it can override general market sentiment—at least temporarily.

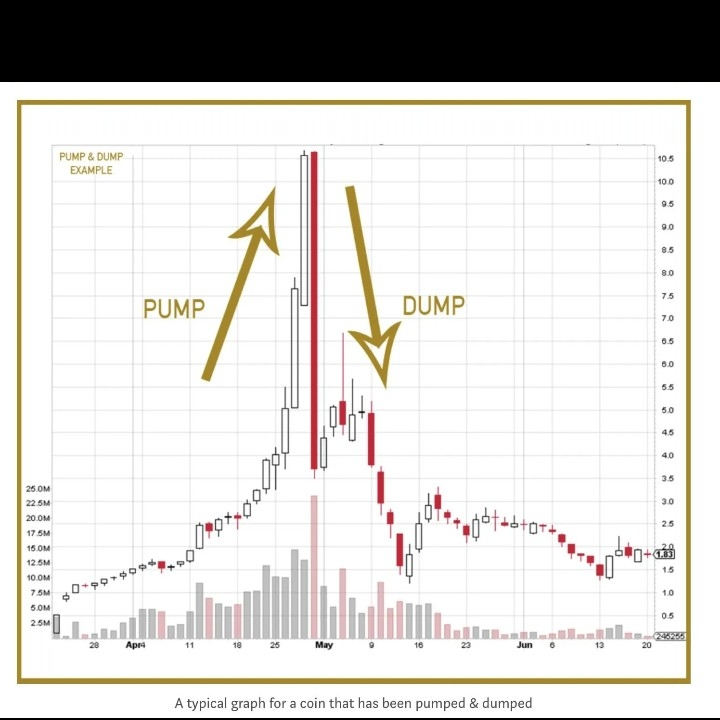

2. Low Market Cap and Liquidity Effect

BANK/USDT may have a relatively low market capitalization or thin liquidity compared to major cryptocurrencies. In such cases:

A small increase in buying volume can cause large price moves

Whales or coordinated traders can push price up quickly

Stop-loss hunting and short liquidations can accelerate pumps

This makes double-digit percentage moves more common, even during bearish market phases.

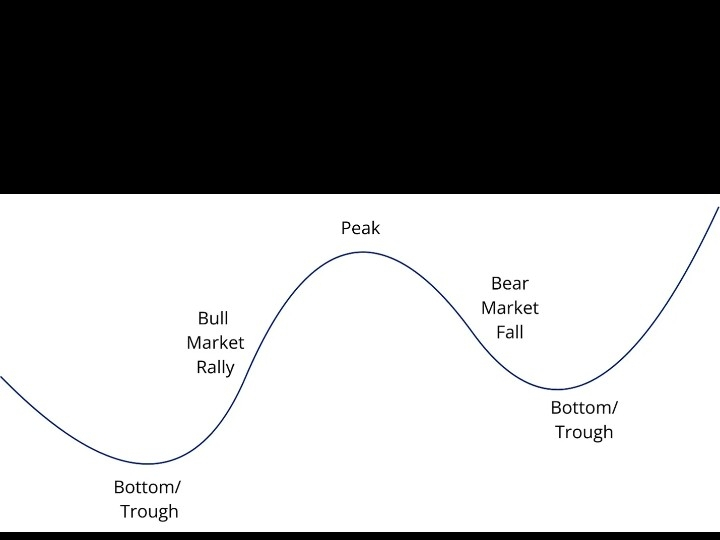

3. Capital Rotation Within the Crypto Market

When Bitcoin and large-cap altcoins weaken, traders often rotate capital into selective altcoins that show relative strength.

This rotation happens because:

Traders look for short-term opportunities

Some tokens lag behind and then “catch up”

Others are seen as temporarily undervalued

BANK/USDT may currently be benefiting from this internal capital rotation, not from overall market strength.

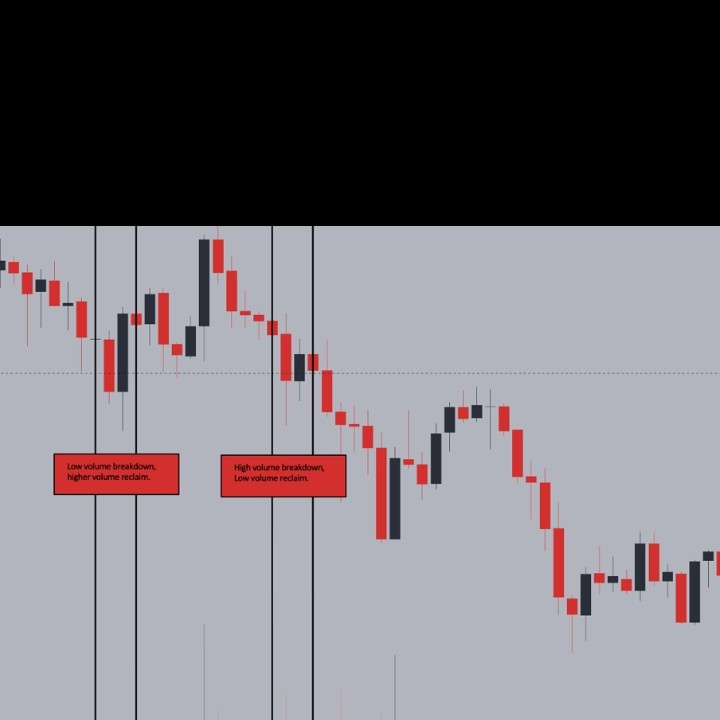

4. Technical Breakout or Chart Pattern

From a technical perspective, BANK/USDT may have:

Broken a key resistance level

Formed a bullish pattern (range breakout, falling wedge, or accumulation zone)

Experienced a volume spike confirming buyer interest

Technical traders often enter positions regardless of market sentiment if a chart setup is strong enough.

5. Short Squeeze and Derivatives Activity

If many traders were betting against BANK/USDT, a sudden upward move could trigger a short squeeze.

This occurs when:

Short sellers are forced to buy back positions

Liquidations push price higher rapidly

Momentum traders join the move

Short squeezes can produce sharp rallies even in strongly bearish markets.

6. Psychology: Strength Attracts Attention

In a red market, any green candle stands out.

As BANK/USDT starts pumping:

More traders notice it

Fear of missing out (FOMO) increases

Momentum buying pushes price further

This psychological effect often fuels rapid but temporary price spikes.

Conclusion

BANK/USDT’s 11% pump during a bearish crypto market is not unusual. It is likely the result of token-specific catalysts, low liquidity, technical breakouts, capital rotation, or short-term market psychology rather than a full trend reversal.

While such moves can offer trading opportunities, they also come with higher risk—especially if the broader market remains weak.

In crypto, individual tokens can still pump—even when the market is going down or bearish.

Please follow me for more and latest updates about crypto market news thanks