Why $ENSO/USDT Is Pumping 13% While the Crypto Market Is Bearish

When most cryptocurrencies are bleeding red, a sudden 13% surge in ENSO/USDT naturally raises eyebrows. While Bitcoin and major altcoins follow a bearish trend, ENSO’s move suggests that token-specific forces—not the broader market—are driving price action.

Below are the most likely reasons behind ENSO’s unexpected pump.

1. Token-Specific News or Fundamental Developments

One of the most common reasons a token pumps during a bearish market is project-level news, such as:

New partnerships or integrations

Protocol upgrades or roadmap milestones

Ecosystem expansion (new dApps, tools, or utilities)

Institutional or strategic interest

Even rumors or early leaks of such developments can trigger speculative buying. In bearish conditions, capital tends to rotate into projects showing progress, and ENSO may be benefiting from that rotation.

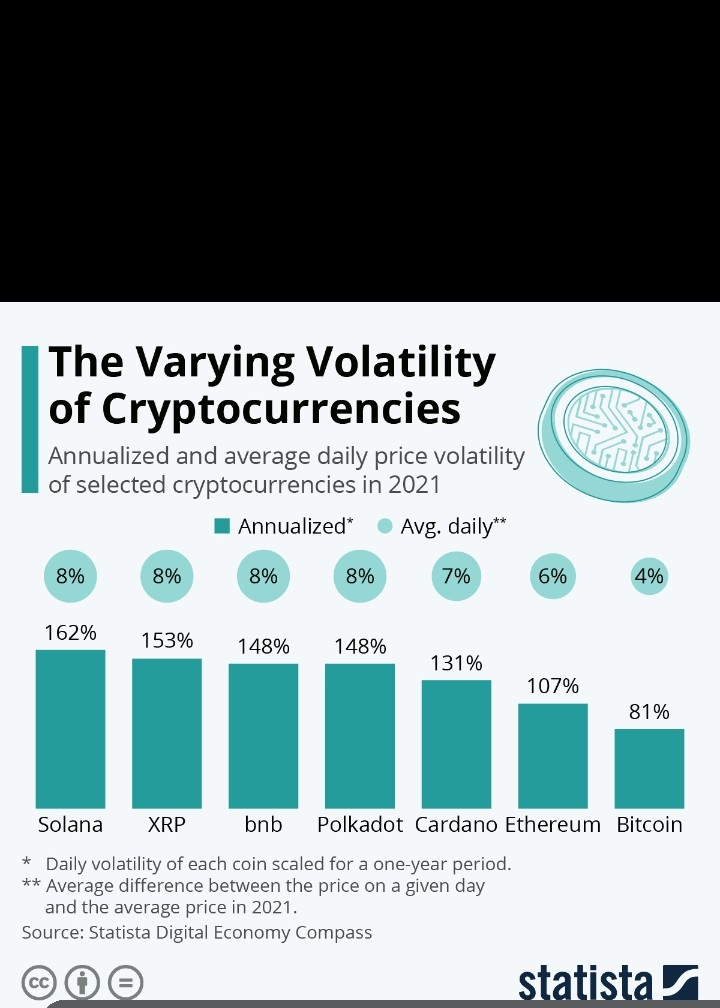

2. Low Market Cap + Thin Liquidity Effect

ENSO likely has a relatively low market capitalization compared to large-cap assets like $BTC or$ETH . This means:

Smaller buy orders can move the price significantly

Reduced sell pressure amplifies upward momentum

Volatility increases during low-volume market phases

In bearish markets, many traders step aside—making it easier for concentrated buying to push prices up sharply.

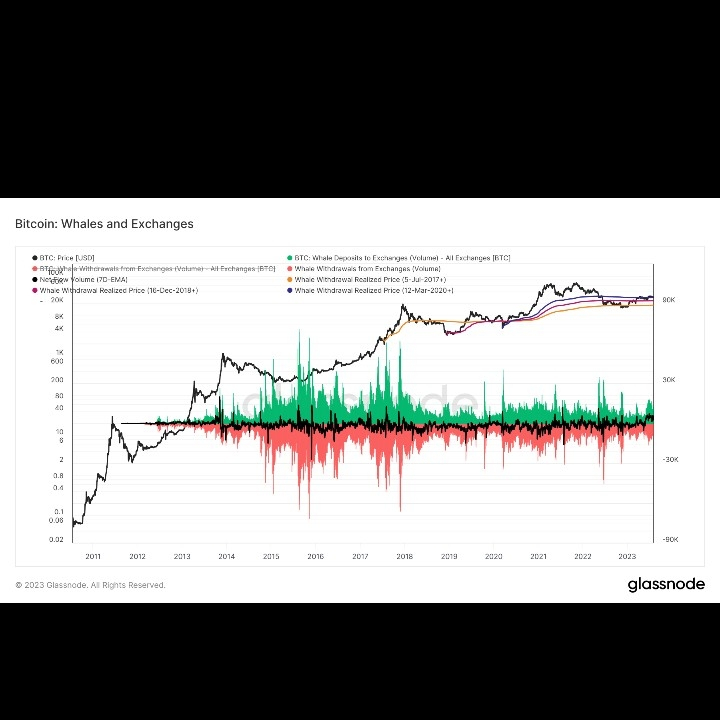

3. Whale Accumulation or Smart Money Entry

Another strong possibility is whale accumulation:

Large wallets quietly accumulating ENSO

OTC or spot market buys absorbed without major sell resistance

Price moves up once supply dries up

Whales often accumulate during bearish phases, betting on future catalysts rather than current sentiment. Retail traders usually notice the move after the pump begins.

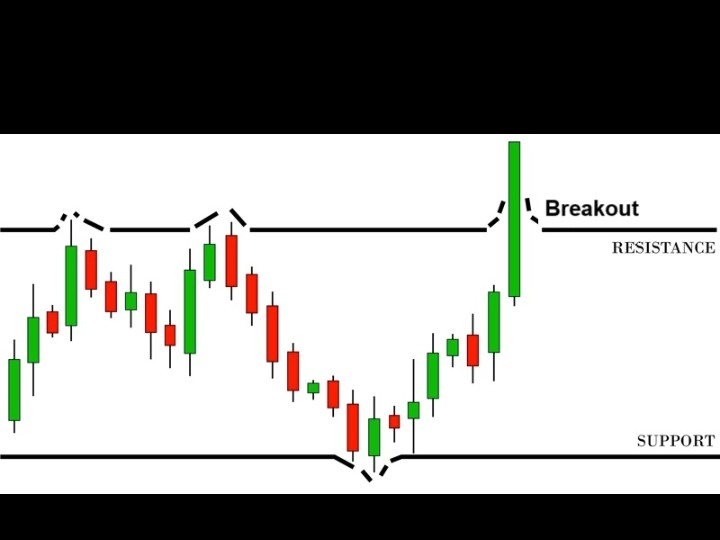

4. Short Squeeze or Technical Breakout

ENSO’s pump may also be driven by technical factors, including:

Breakout above a key resistance level

Liquidation of short positions

Bullish chart patterns (ascending triangle, falling wedge, etc.)

When short sellers are forced to close positions, buy pressure accelerates, causing fast and sharp price spikes—even in bearish markets.

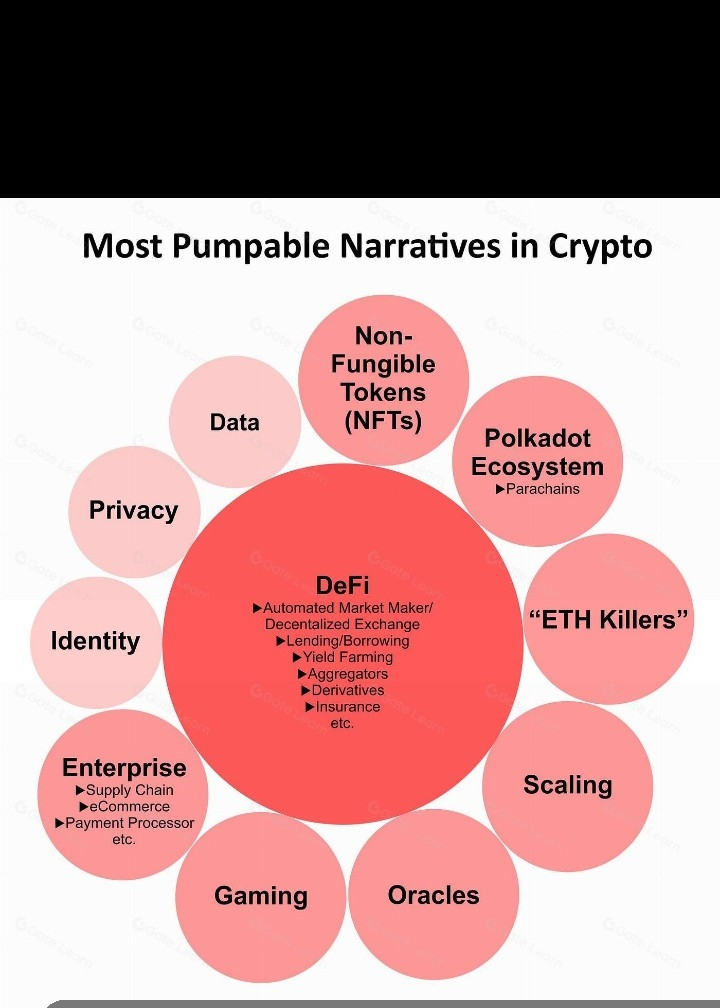

5. Narrative Rotation in a Bearish Market

In downtrending markets, investors often rotate capital into specific narratives, such as:

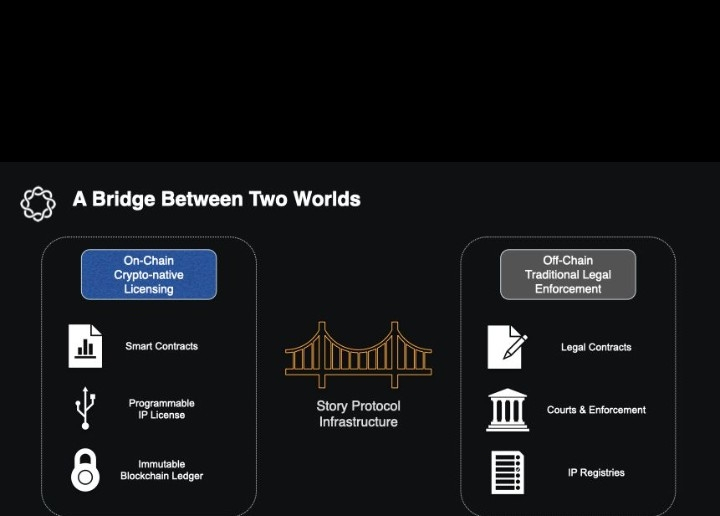

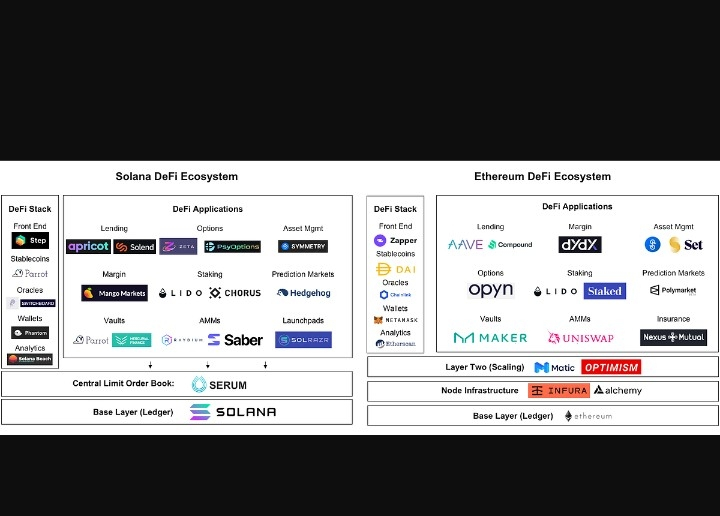

Infrastructure or middleware protocols

DeFi tooling and execution layers

Undervalued or overlooked projects

If ENSO aligns with a narrative gaining traction, it can outperform the market despite overall bearish sentiment.

Final Thoughts

ENSO/USDT’s 13% pump during a market downturn is likely not random. It’s probably driven by a combination of:

Project-specific developments

Low liquidity dynamics

Whale accumulation

Technical breakouts

Narrative-based capital rotation

Bearish markets don’t mean everything goes down—they mean money moves more selectively.

⚠️ As always, sharp pumps can come with sharp pullbacks. Risk management matters, especially in volatile condition

Please follow me for more and latest updates about crypto market news thanks