My first reaction was to be surprised when Binance announced on 30 January 2026 that the entire Secure Asset Fund for Users (SAFU) will be transferred off stablecoins and into bitcoin. SAFU is not a conjectural treasury; it is an insurance fund to compensate the customers, in case of a disaster that occurs on the exchange. Replacement by the most volatile crypto asset of this safety net of low-volatility stablecoins was like replacing a life raft with a surfboard.

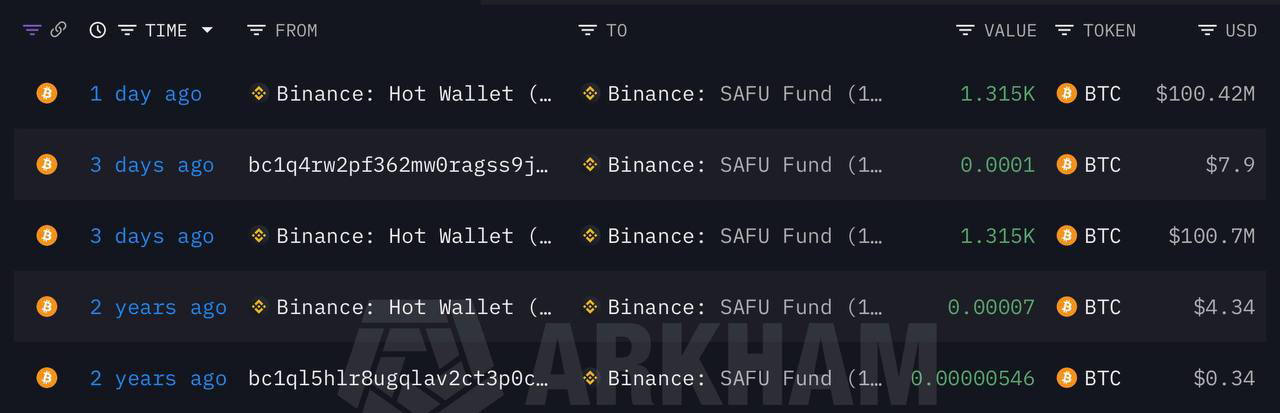

The blockchain reveals that Binance moved 1,315BTC (approximately 100 million dollars) to the SAFU wallet. This is not a promise but some evidence of execution.

The deeper I excavated the story, the more I saw that it is more subtle. It is a risky move by Binance on the long-term viability of bitcoin, which it is using as a marker of responsibility following a turbulent year. This paper will discuss what SAFU is, why Binance is actually switching, and what it will involve both to the users and the market at large. I have added charts and data where it is necessary to aid the visualization of the trends.

What is the SAFU fund?

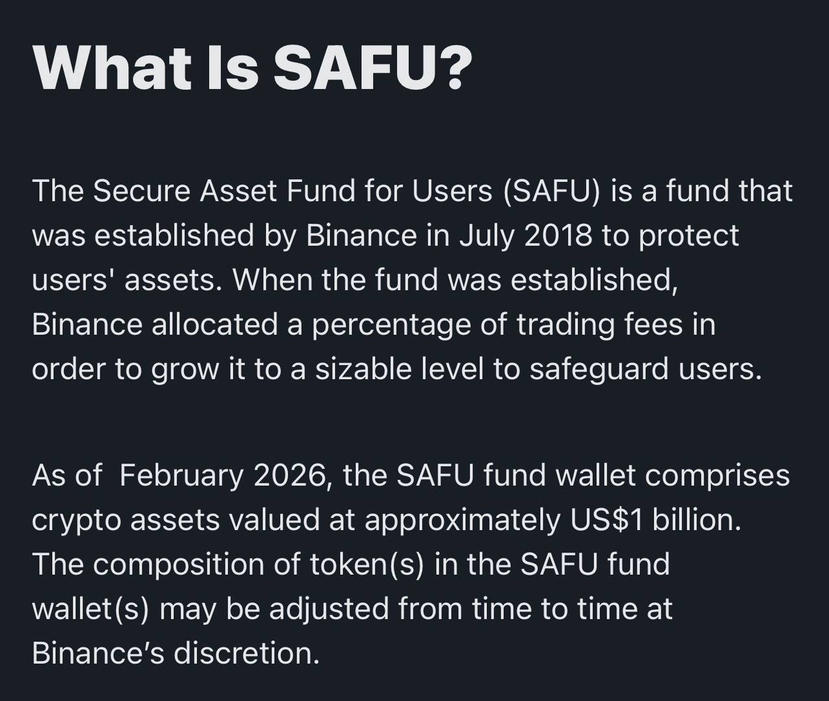

To provide customers with security against disastrous failures of exchanges Binance had designed SAFU. The business makes some investment of trading commissions in the fund and holds the assets in cold storage, not in the operational wallets of the exchange. SAFU is a self-insured pool; in case of hacking or other damages on Binance, the fund will be able to compensate consumers. With the exchange rate, the fund has been held at around $1 billion over the years, and increased when the markets are unstable. The reserve so far had a diversified portfolio comprising of US dollar pegged stablecoins and a little bit of bitcoin and BNB.

The name SAFU is also based on the meme funds are safu, a pun on safe. The phrase was popularized by Changpeng “CZ” Zhao in the course of a maintenance issue, and the community adopted it as the short term definition of reliability.

The conversion announcement

On 30 January 2026 Binance released an open letter to the crypto community stating that it was going to trade the entire 1b SAFU reserve of stablecoins to bitcoin within the next 30 days. The trade positioned the action as the component of the greater dedication to transparency and resiliency in the industry: “Bitcoin is the cornerstone of the crypto ecosystem and long-term value, the letter explained.

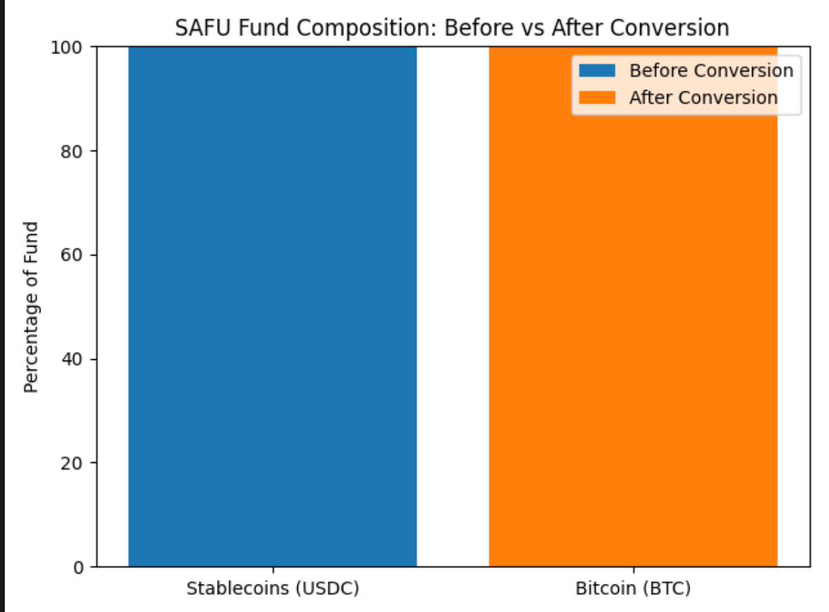

The plan involves the purchase of bitcoins daily as opposed to a big trade. This strategy restrains disruption of the market and it is consistent. With about 33 million dollars per day approximated to be converted, the conversion would be estimated to take 30 days hence about 11,900 BTC would have been purchased by early March. Another promise made by Binance is the rebalancing mechanism: once the value of a fund is reduced to less than 800 million dollars due to fluctuation in the price of bitcoin, the exchange will add more BTC to restore the reserve to the 1 billion goal. This is to say that Binance is vowing to purchase the dip with the help of its own revenues in the event of markets plummeting. The SAFU wallet address is transparent and therefore anyone can monitor the conversion process and ensure that the money is kept in segregation.

Why go all‑in on bitcoin?

It is possible to recognize multiple reasons that Binance makes this daring transition:

Signalling reliability and congruence. The exchange must restore credibility after a tumultuous 2025 that saw a 19 billion liquidation cascade and the Binance exchange being accused of having a monopoly on the market. Turning SAFU into bitcoin will put Binance on par with the industry, having its insurance fund concurrent with the asset that the majority of its users trust. It also demonstrates that Binance has a vested interest in the game, that is, in case bitcoin crashes, the fund is hit in the same way as users. In this regard the move is more of a PR message than a monetary one.

Transparency in terms of on-chain audit. Stablecoins are opaque - users trust the assertions of issuers concerning reserves. On-Chain verification A bitcoin-only fund can be verified on-chain. The SAFU wallet may be viewed by anyone, kept track of incoming transactions and ensured the balance does not drop below the $800 million mark. This openness overcomes the doubt over exchange proof -of-reserves and demonstrates that Binance cares about accountability.

Bitcoin as a store of value over a long time period. Binance is convinced that bitcoin is an improved long-term reserve compared to dollar-pegged tokens due to its hard-capped supply, and increased institutional adoption. The exchange notes that users are starting to view stablecoins not as long-term cash analogs but as an exchange rail and trading chips. By engineering the conversion of the fund to bitcoin, Binance implicitly bets on the future value of BTC which increases the insurance pool.

Possible threats and objections.

Although the benefits of signalling are obvious, the conversion brings in new threats:

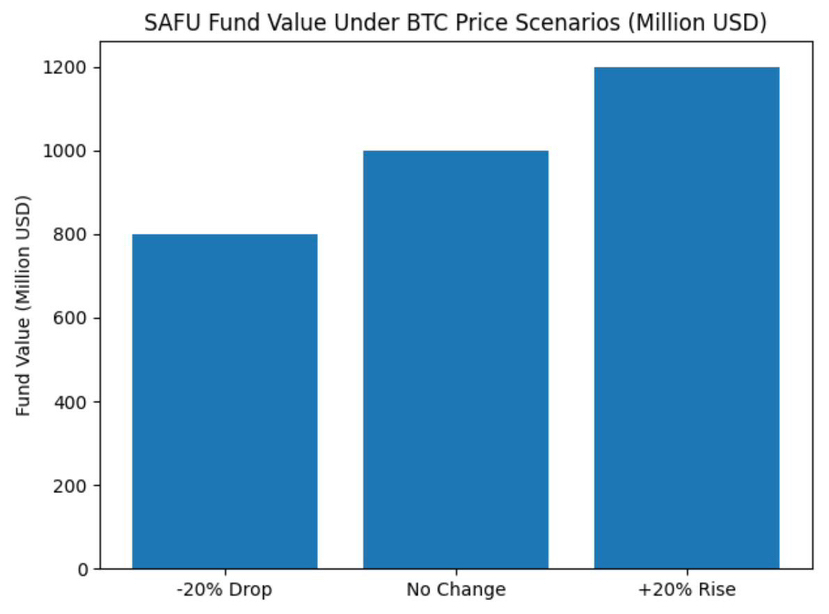

- It is volatile which diminishes reliability. The insurance funds are intended to finance any losses in case of crisis but crisis usually accompanies bitcoin sell-offs. According to CryptoSlate, a fund in the same falling asset may end up being a weaker backstop at the time when it is needed the most. Should bitcoin decline by 20 per cent, the SAFU fund will soon drop to the US800 million bottom, compelling Binance to inject cash at a time when liquidity is tight.

- Pro‑cyclicality. Writing a put option on bitcoin Binance is essentially committing to top up the fund in case the prices decline. During a market crash, the exchange is forced to purchase additional BTC to replenish the fund which increases its exposure. Pro-cyclical insurance structures may enhance stress on failure to fulfill promise.

- Governance and centralization. Binance, a privately owned company controls the SAFU wallet. Opponents believe that on-chain transparency will never reduce the custodial risk of a centralized fund. In addition, such conversion does not transform Binance into a publicly held company that is a bitcoin treasury; SAFU is a user-protection fund, not a corporate treasury.

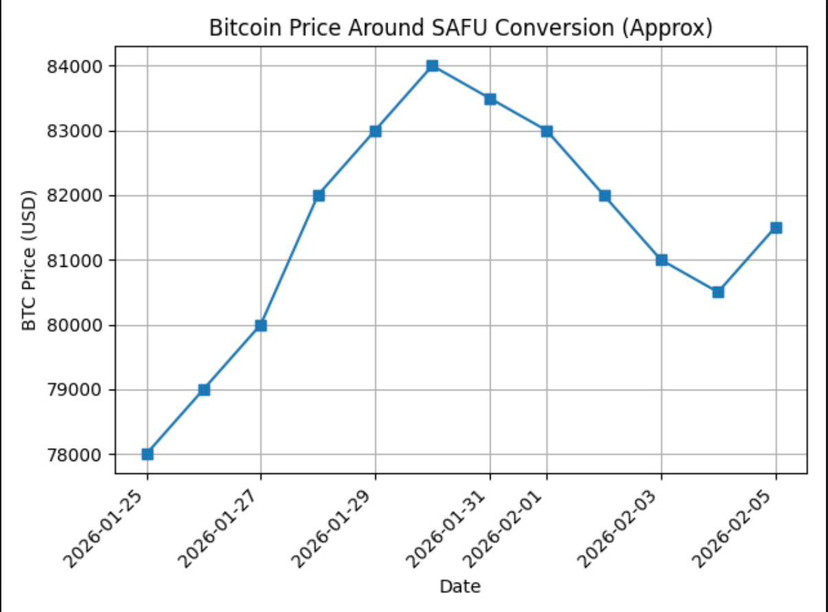

- Market impact. Other analysts thought that the announcement would increase the BTC prices. Practically, bitcoin failed to spike.

According to BeInCrypto, the prices remained lower than they had been recently and the news penetrated the market relatively quietly. Constant daily buying can be slightly supportive, but it has not caused a situation of a rally.

The contextualisation and visualisation of the SAFU conversion.

In order to be more aware of magnitude and consequences of the SAFU conversion, I referred to multiple charts. Such images provide rough or idea values to emphasize fashions and not hard market information.

Composition of the SAFU fund

The former chart is a comparison of the composition of the fund prior to the conversion and after. Prior to the announcement, SAFU had nearly a hundred percent of stablecoins (USDC) and a minor quantity of BTC. Once the conversion, it will be 100 per cent BTC.

Conversion progress

Binance is converting the fund at a rate of 30 days. The chart below represents an estimated BTC buying history, where the accumulation is in shapes of a step as the exchange makes daily purchases.

Bitcoin price pre-announcement.

The price of Bitcoin did not spike when the announcement was made. Indeed it went over sideways and even a little down in the first days of the conversion. The figure below illustrates a rough price movement towards the end of January and the first half of February 2026.

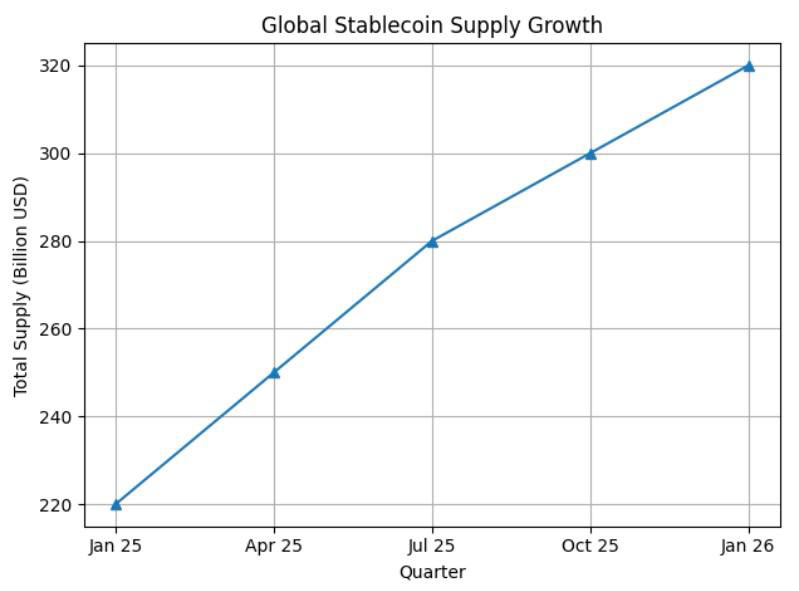

Wider market trends: tokenized assets and stablecoins.

Even though the SAFU conversion is about bitcoin, it is worth getting the bigger picture of the market. This supply of stablecoins has steadily increased over time, with the amount of coins in circulation of approximately US220 billion in January 2025, and estimated amounts of US320 billion in January 2026, as payment rails and an interface between fiat and decentralised finance. Meanwhile, tokenized real-world assets (RWAs) have grown at a rapid pace during just under US5.5 to over US24billion in the market in the same period. These tendencies show how on-chain assets become diversified and tokenisation gains more significance.

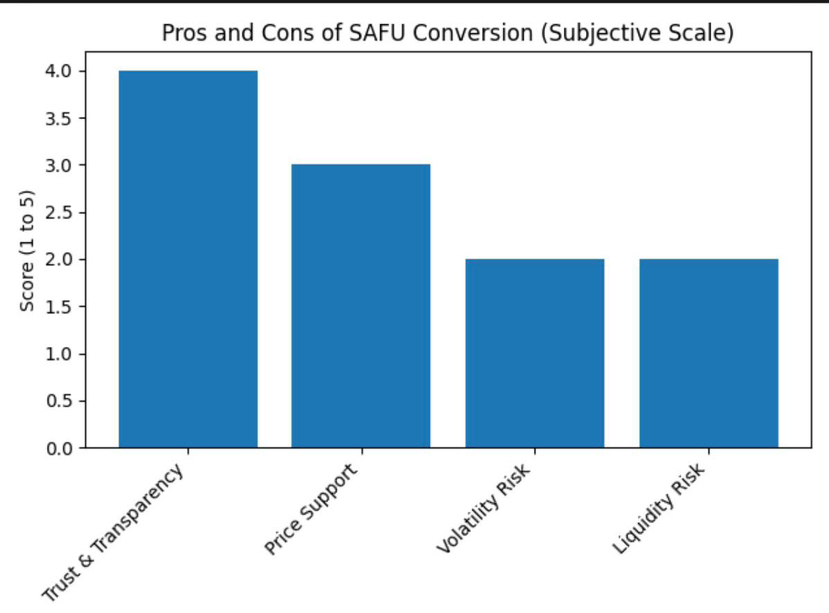

Advantages and disadvantages of the conversion.

In order to sum up the discussion, the chart below assigns some of the perceived advantages and dangers of the topic subjectively. Although the move obviously has excellent points on trust and transparency and moderate points on price support, it presents significant risks on volatility and liquidity management.

Rebalancing scenarios

The last chart shows the possible reaction of the fund value in cases of variation in the prices of bitcoins. At 20 percent loss in BTC, the fund will devalue to the US$800 million bottom and needs to be replenished. In case bitcoin does not increase, the value will remain at the vicinity of US$1billion. A 20 per cent jump would propel the value of the fund to about US 1.2 billion, which will provide Binance with more buffer.

Conclusion

The move by Binance to transform its stablecoins insurance fund into bitcoin in a move to convert the insurance fund is a sensational action. On the one hand it highlights the confidence of the exchange in the bitcoin as the foundational asset of the crypto ecosystem and is a signal of trust after a very difficult year. The shift further makes the fund auditing on-chain and puts the interests of Binance in line with those of bitcoin holders. Conversely, it brings volatility to an insurance pool that ought to be reliable in times of crisis and pro-cyclical commitment to acquire additional BTC at times of market stress.

In my opinion, conversion is not as much about seeking profits but rather about accountability and optics. It is Binance speaking by saying that it will put its money where its mouth is, meaning that its insurance fund is pegged on the same asset that its users have. The fate of this bet will be determined by the direction of the price of bitcoin and the capacity of Binance to meet the promise to replenish when it comes to pressure. At present, the SAFU fund is just an experiment to use blockchain transparency and create trust, which is going to be closely monitored by the whole crypto community within the next month.