Stablecoin payments might not grab headlines like the latest meme coin,but they’re honestly one of the most useful things blockchain tech has brought us.While the crypto world chases the next big hype cycle, stablecoins are out there actually moving money,settling debts,and making everyday transactions possible.And when you put stablecoins on Plasma,you get something more than just faster payments it’s a whole new approach to how money can travel.

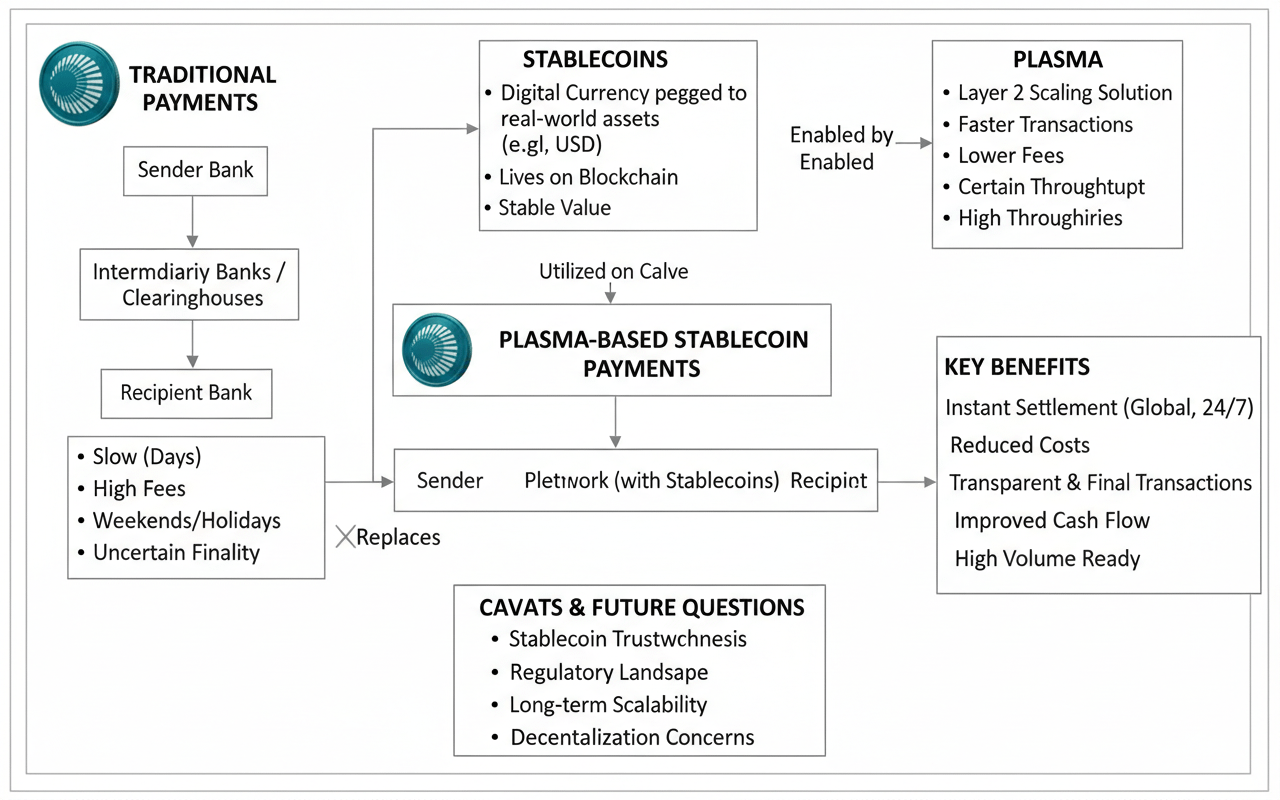

So what are stablecoins,really?Think of them as digital dollars (or euros,or whatever),built on blockchains instead of tucked away in a bank account.They’re pegged to real world currencies,but they live and move on the blockchain.Now,add Plasma to the mix,and suddenly these digital assets can zip around quickly,predictably,and with real finality.No waiting around,no“did it go through?” moments just money moving as smoothly as it should.

Why Plasma Makes a Difference

Traditional payments are a maze.You send money,and it bounces through banks, clearinghouses,messaging systems each step adding time,fees,and a bit of uncertainty.Even a simple transfer can turn into a waiting game.

Plasma cuts through all that.On Plasma, sending a stablecoin means the payment instruction and the value move together in one onchain step.The transaction gets confirmed,and that’s it settled, done,no extra reconciliation or mystery.The whole system is designed to process payments in a set order, so every update is clear and final.If you want payments you can trust,this is a huge upgrade.

How Plasma Stacks Up Against Banks

The real difference shows up when you try to send money across borders.Banks close on weekends,depend on a tangle of correspondent relationships,and often add hidden fees.Sometimes,your money takes days to arrive if you’re lucky.

Plasma doesn’t care about time zones or borders.You can send a stablecoin to someone halfway around the world,and it’ll settle just like a local payment.No banking hours,no middlemen,no delays.You pay a network fee,not a bank markup,and you can see the transaction settle right there on the blockchain.The big thing isn’t just speed it’s knowing,with certainty,that when the transaction is done,the money’s really moved.

Why This Actually Matters

All this sounds technical,but it makes a real difference for people and businesses. Companies can settle payments faster, manage cash flow better,and skip the headaches of dealing with banks or intermediaries.Regular folks get digital dollars they can send or receive instantly, anywhere,without jumping through hoops.

Plasma shines when payments happen often or at high volume.It’s built to handle lots of transactions without everything grinding to a halt.That’s perfect for things like payroll, remittances,or merchant payments places where reliability is everything.

And honestly,using Plasma based stablecoins just feels straightforward.You’re not wrestling with layers of banking infrastructure.You just send or receive value,plain and simple. That’s what will help stablecoins cross over from crypto niche to real world payment tool.

The Caveats And What’s Still Unclear

Of course,Plasma isn’t a silver bullet.The whole thing still depends on the stability and trustworthiness of the stablecoins themselves.How they’re managed,how redemptions work,and who’s running the show all that matters.

Then there’s the big picture stuff:Can Plasma keep scaling up without sacrificing security or decentralization?Will new regulations put up roadblocks for digital dollars?These questions are still playing out,and nobody has all the answers.

My Take

Personally,I see Plasma as the moment blockchain stops being just a playground for techies and speculators,and starts acting like real financial plumbing.