As Bitcoin dropped below ~$70,000, two major corporate crypto treasury holders — Michael Saylor’s Strategy and Tom Lee’s BitMine Immersion Technologies — are now facing massive paper losses on their holdings.

As Bitcoin dropped below ~$70,000, two major corporate crypto treasury holders — Michael Saylor’s Strategy and Tom Lee’s BitMine Immersion Technologies — are now facing massive paper losses on their holdings.

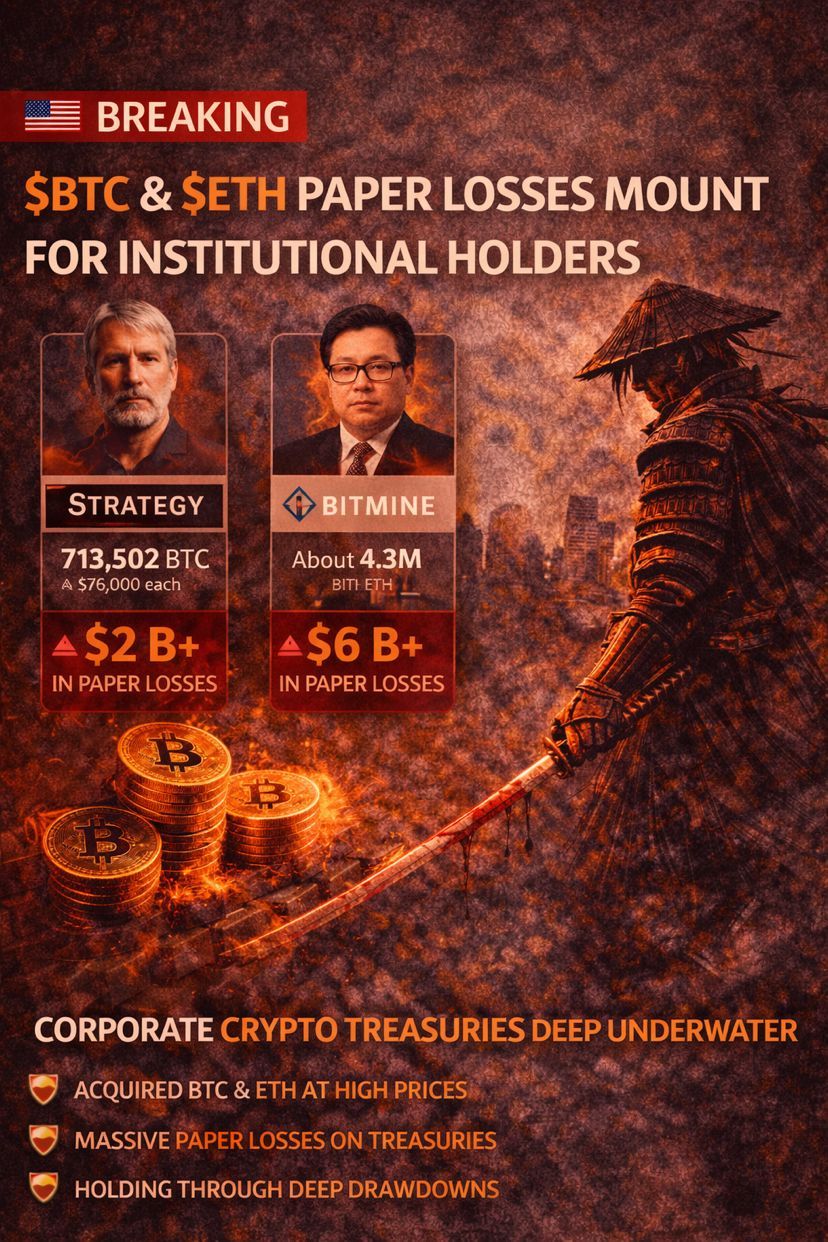

🔻 Strategy (BTC holdings):

• Strategy, formerly MicroStrategy, holds about 713,502 BTC on its balance sheet at an average cost near ~$76,000 per coin.

• With Bitcoin sliding under ~$71,000, the company’s Bitcoin stack has moved into unrealized losses, estimated in several reports to be in the multi-billion dollar range (several hundred million to several billion, depending on exact price).

• Strategy’s stock (MSTR) has also underperformed, reflecting the value hit to its Bitcoin treasury.

🔻 BitMine Immersion (ETH holdings):

• BitMine — chaired by Tom Lee — holds a large Ethereum treasury, with roughly 4.28–4.3 million ETH.

• Because Ethereum’s price has fallen sharply from higher levels, BitMine’s unrealized loss on ETH exceeds several billion dollars — with estimates north of $6 billion in paper losses on the position.

• The firm continues to accumulate ETH despite the drawdown, signaling a long-term accumulation thesis from its leadership.

💡 Market Context:

• These unrealized losses happen because both firms acquired their crypto treasuries at higher prices — BTC and ETH have both retraced significantly since late 2025.

• Paper losses don’t mean actual cash outflow — they’re unrealized and only impact balance-sheet valuation unless assets are sold.

• Both groups remain committed to their long-term strategy, still holding and even adding to their positions amid volatility.

📊 In simple terms:

Bitcoin and Ethereum’s recent downturn has pushed widely held corporate crypto treasuries into huge paper losses — a reminder that big balance sheets tied to digital assets can be volatile, even if long-term conviction remains.

• “Saylor’s BTC and BitMine’s ETH stacks underwater — but HODL continues.” $BTC

BTCUSDT

Perp

69,269

-8.64%

$ETH

ETHUSDT

Perp

2,052.89

-7.97%