The precious metals market is entering a critical window.

Gold and silver are not just moving.

They are being tested.

What happens next may define short-term direction.

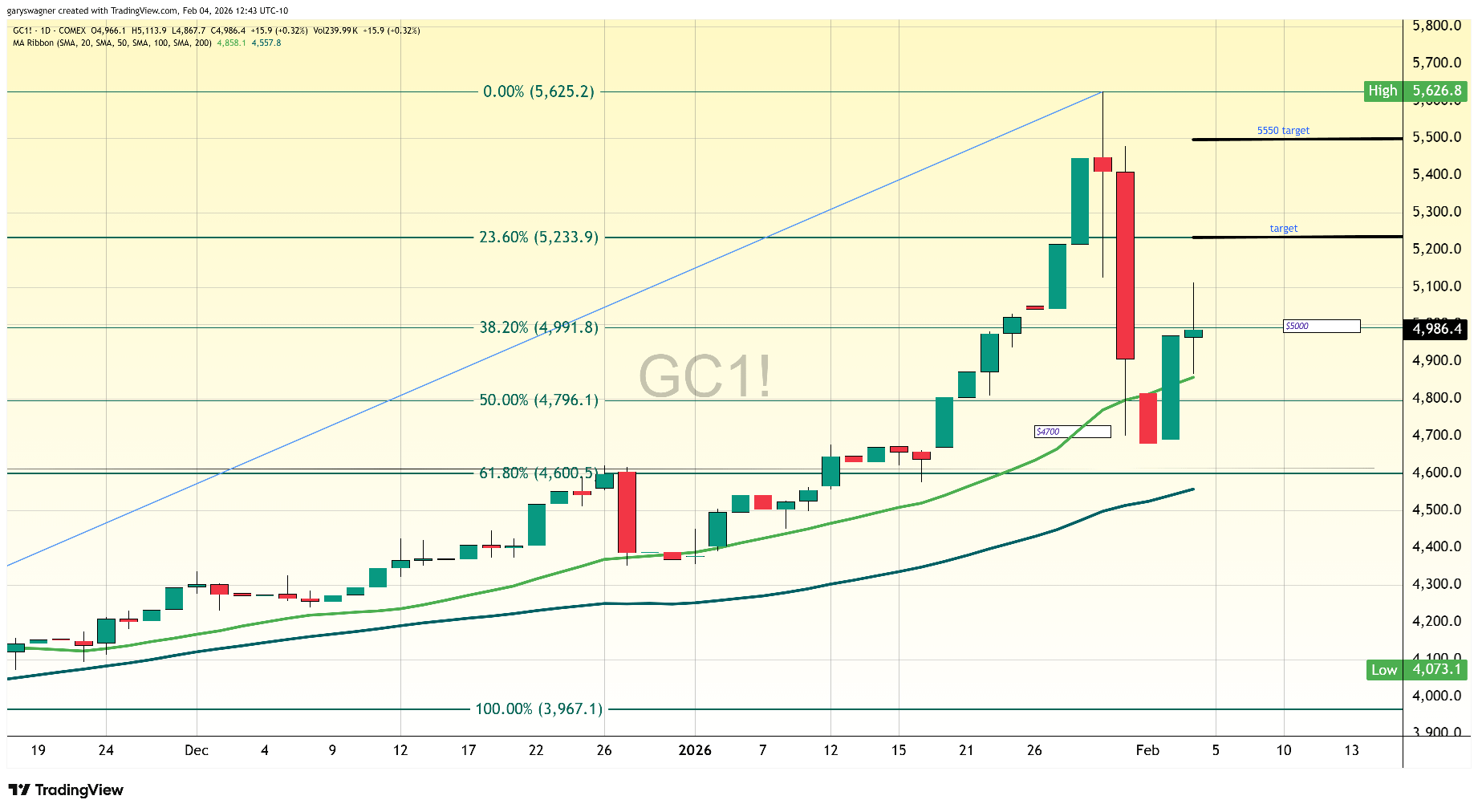

Gold’s Sharp Return Above $5,000

Gold did not recover quietly.

It snapped back with force.

After last week’s heavy selloff, buyers stepped in aggressively.

The $5,000 level — a powerful psychological zone — was reclaimed fast.

Gold surged nearly 3%

Price briefly touched $5,070

Dip buyers showed strong conviction

Safe-haven demand re-emerged

This was not algorithmic noise.

It was intentional buying.

Silver Takes the Lead

Gold was steady.

Silver was explosive.

The white metal once again proved why it is the volatility king.

Silver jumped 8–10%

Prices raced toward $90 per ounce

Momentum traders piled in

Risk appetite clearly favored silver

In turbulent markets, silver behaves like leverage on gold.

Higher risk.

Higher reward.

ADP Jobs Data Changes the Mood

The rally met resistance mid-session.

At 9:30 AM, the ADP Employment Report shifted sentiment.

The data showed a sharp slowdown in U.S. private hiring.

Key signals from the report:

Businesses are pulling back

High borrowing costs are biting

Economic momentum is cooling

Labor demand is weakening

This was not a soft miss.

It was a warning.

A New Problem for the Federal Reserve

The Fed now faces a familiar but dangerous dilemma.

Slower hiring brings mixed signals.

Fewer jobs → less wage pressure

Less wage pressure → lower inflation risk

But slower hiring → recession risk rising

Markets are conflicted.

Should the Fed cut rates sooner?

Or hold firm to fully crush inflation?

Expect volatility.

Expect fast reactions to headlines.

The 12-Hour Technical Test

This is the critical phase.

Gold is sitting on a knife edge.

Above $5,000 → confidence builds

Structural support may form

Buyers stay in control

But if gold slips below:

Momentum weakens

Short-term bears gain ground

A deeper pullback becomes possible

Silver will amplify whatever happens next.

Bottom Line

This is not a normal consolidation.

This is a decision point.

Gold is testing belief

Silver is testing risk tolerance

Macro data is testing the Fed

The next 12 hours matter more than the last 12 days.

Markets are watching.

So should you.