Most blockchains still force you into an awkward choice: either everything is public forever, or everything is hidden inside a privacy box that outsiders can’t really verify. That choice might work for internet experiments, but it doesn’t map cleanly to how finance actually operates.

In real markets, confidentiality isn’t optional. Trading desks don’t publish positions. Market makers don’t expose inventory. Funds don’t want their treasury moves turned into a public signal. If you make balances, flows, and order behavior fully visible, you don’t create “trust”—you create a playbook for competitors and opportunists.

At the same time, regulated finance can’t live inside a black box. Risk teams, auditors, and regulators don’t accept “trust us, it’s private.” They need proofs. They need controls. They need a way to demonstrate that rules were followed, especially when something goes wrong or when reporting is required.

That’s the core tension Dusk is built around: privacy and compliance at the same time. Not privacy as ideology, and not compliance as surveillance—more like the normal default of finance: keep sensitive information protected, but be able to prove correctness and lawful behavior when required.

The simplest way to describe Dusk’s idea is this: sensitive data should stay hidden, but transaction validity and compliance should still be provable. You don’t have to publish everything to be trustworthy, and you don’t have to hide everything to be private. You need controlled disclosure.

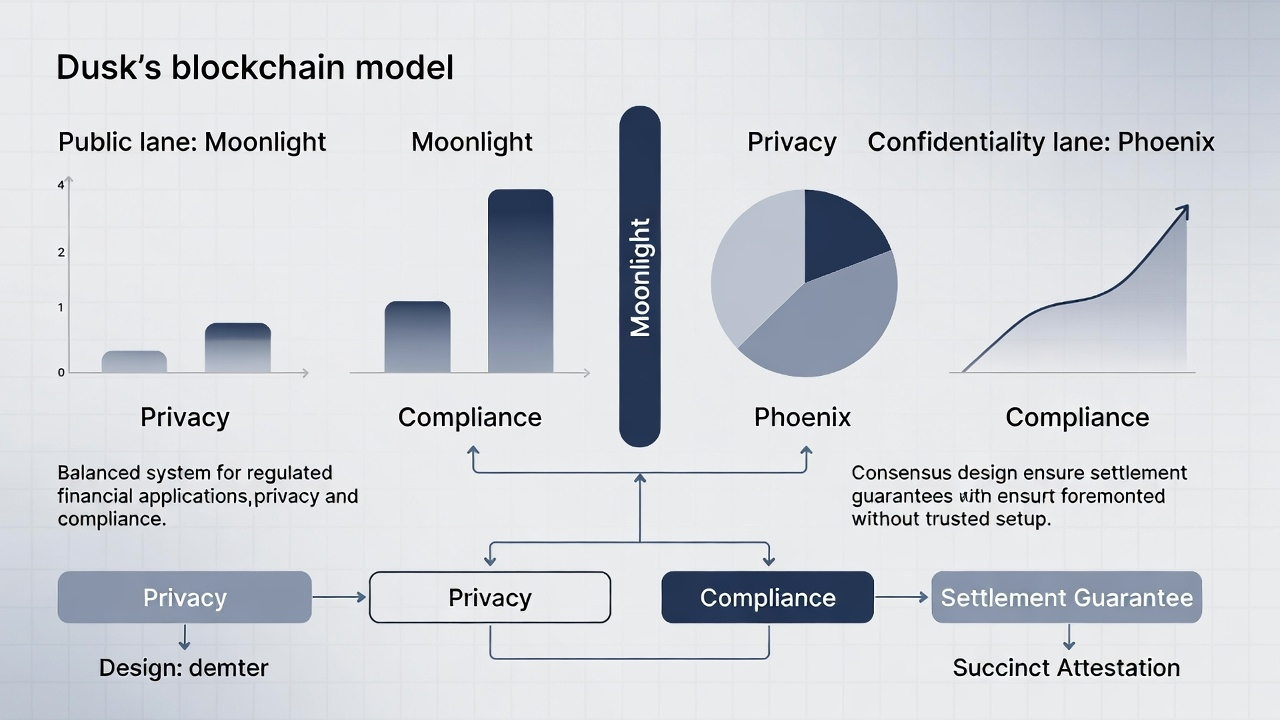

A practical way Dusk approaches this is by not trying to squeeze all activity into one transaction model. It supports two native “lanes” that settle on the same network. One lane is built for compatibility with today’s infrastructure, the other is built for confidentiality.

The public lane is Moonlight. It’s account-based and designed to feel familiar to exchanges, wallets, and standard integrations. The point isn’t to reinvent how deposits, withdrawals, and normal account flows work. It’s to make sure the chain can plug into existing systems without asking everyone to become privacy experts on day one. A lot of institutional adoption is boring work: custody flows, reconciliation, exchange rails, compliance reporting. Moonlight exists because that world needs something recognizable.

The confidentiality lane is Phoenix. It’s note-based with a UTXO-style mindset and aims to protect sensitive transfer information while keeping correctness enforceable. The important nuance is that it’s not framing privacy as “nobody can ever know anything.” It’s selective disclosure rather than total anonymity. That is a very finance-shaped requirement: keep information private by default, but retain the ability to reveal what’s necessary under the right conditions.

When you zoom out, you can see what Dusk is trying to avoid. Public chains leak too much information for serious markets. Pure privacy systems often struggle with compliance and auditability. Dusk is trying to land in the middle: confidentiality that can still produce proofs.

Finality is another place where Dusk’s framing feels closer to settlement infrastructure than crypto performance marketing. Most chains pitch finality like a speed metric—how fast a block is produced, how quickly something “probably won’t be reversed.” Finance doesn’t think in “probably.” It thinks in settlement guarantees. When can collateral be released? When does the ledger become authoritative for reporting? When does a trade become irreversible in a way that operations teams can actually rely on?

Dusk’s consensus design—Succinct Attestation—uses committee selection and a structured propose → validate → ratify flow to force deterministic decisions. That structure is basically an attempt to make finality legible and decisive. The narrative is not “look at our TPS.” It’s “this is a settlement layer and it behaves like one.”

Then there’s the modular strategy, which is another practical choice that tends to matter more in the real world than in crypto debates. Settlement has to be stable. Execution environments can evolve. Dusk treats its base layer (DuskDS) as the source of truth: staking, consensus, data availability, final settlement guarantees. On top of that, it introduces execution layers that serve different needs.

DuskEVM is the “meet developers where they already are” move. Instead of asking every builder to adopt a new model immediately, it provides EVM-equivalent execution so existing tooling and Solidity knowledge remain useful. That matters because adoption doesn’t happen just because a chain is technically elegant; it happens when teams can ship without retraining their entire organization.

DuskVM represents the longer-term direction: an environment for fully privacy-native applications as the stack matures. That’s the idea of not only supporting privacy at the transfer layer, but eventually making privacy a first-class building block for applications themselves.

Compliance is where a lot of blockchain narratives fall apart, mostly because identity processes are messy and leaky. In many systems, compliance means duplicating sensitive data everywhere: onboarding documents, KYC checks, repeated submissions, multiple vendors holding the same personal information. That creates risk and cost at the same time.

Dusk’s identity and compliance direction—Citadel—leans toward proof-based claims. The goal is to minimize how much raw data needs to be copied and stored across counterparties. Instead of constantly sharing identity details, a participant can prove statements like “this entity is verified,” “this wallet is eligible,” or “this transfer satisfies restrictions,” without exposing everything. That approach fits the compliance world’s real desire: evidence and controls, not mass exposure.

Markets introduce another layer of confidentiality needs. Even if transfers can be private, market structure can still leak through order flow and behavior. If you can see a desk’s activity, you can trade against it. If you can infer inventory, you can worsen execution. If everything is visible, you make professional liquidity provision harder, not easier.

That’s why Dusk’s Hedger concept matters in the narrative. It’s aimed at bringing confidentiality into the EVM execution context while remaining auditable. The intention is to protect order flow, positions, and execution quality without turning the system into something unverifiable. It’s a hard balance, but it’s also the balance that institutions actually require.

When people ask “what is the token for,” the non-hype answer is straightforward: DUSK is intended to secure the network via staking, align incentives around finality and correct behavior, and serve as a unified fee/gas backbone so value doesn’t fracture across layers. In modular systems, fragmentation is a real failure mode—security and incentives get diluted. Dusk’s framing is that one coherent economic backbone supports one coherent settlement guarantee.

If you want to evaluate whether any of this is real, you don’t look for slogans. You look for friction reduction. Can normal developers build and deploy on DuskEVM without needing a specialist team? Can privacy features be used in a way that feels like engineering rather than research? Do integrations get easier over time instead of becoming bespoke one-offs? Does network activity start to resemble settlement behavior rather than speculative churn?

That’s the honest pitch: Dusk isn’t trying to win by being louder. It’s trying to become credible infrastructure for regulated finance—where confidentiality is standard, compliance is mandatory, and settlement guarantees matter more than vanity metrics.