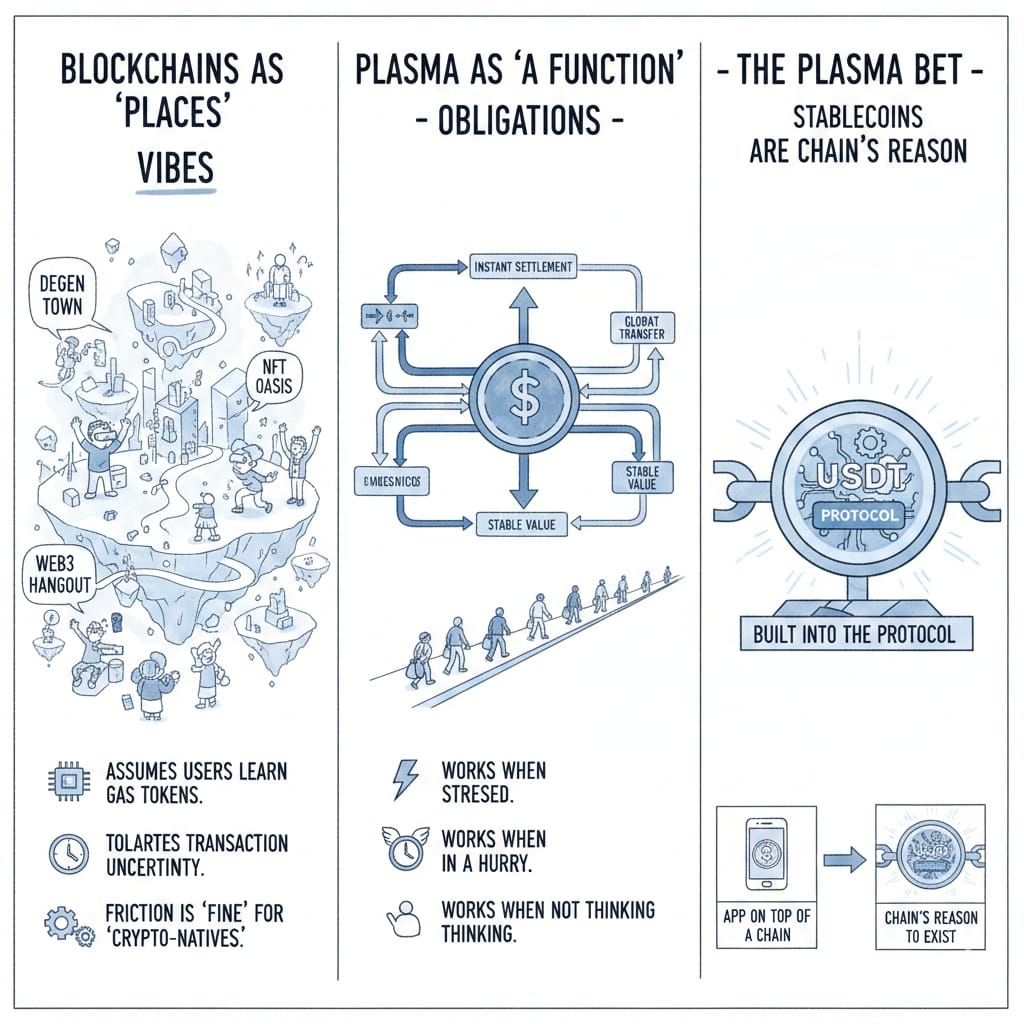

I keep coming back to this idea that most blockchains are trying to be a place while Plasma is trying to be a function.

A place has vibes. A function has obligations.

If you’ve ever built anything in payments (or even just watched how people actually use money day-to-day), you know the bar isn’t “cool tech.” The bar is: it works when you’re stressed, it works when you’re in a hurry, it works when you’re not thinking about it. Stablecoins are already used like that in a lot of the world especially USDT—but the blockchains underneath them often still behave like hobbyist infrastructure. They assume users will learn gas tokens. They assume people will tolerate uncertainty while a transaction “cooks.” They assume friction is fine because the audience is crypto-native.

Plasma’s bet is pretty blunt: stop treating stablecoins like an app on top of a chain, and start treating them like the chain’s reason to exist. That sounds like a branding line until you look at what they’re actually building into the protocol.

Plasma is trying to make stablecoins feel like texting. Not “texting with a separate prepaid phone card you forgot to buy,” not “texting after you convert your airtime into the correct denomination,” just… texting. Send, delivered, done.

The first place Plasma gets unusually honest is where stablecoin UX actually breaks: the very first transaction. Most normal users don’t fail because they don’t understand private keys; they fail because they have the money (USDT) but don’t have the toll token (native gas). The system says, “You can’t move your dollars until you go acquire a different asset.” That’s not a technical requirement from the user’s perspective—it’s a trap door.

Plasma’s chain-native “zero-fee USDT transfers” is basically a refusal to accept that trap door as normal. It’s not trying to make everything free forever; it’s very specifically sponsoring the simplest action people do with stablecoins: sending them. Plasma’s own docs frame it as a native feature aimed at removing fee friction and eliminating the “wallet needs gas tokens” problem in the highest-frequency flow.

What’s more interesting to me than “gasless” as a concept is what it signals about priorities. In most ecosystems, gas abstraction is treated like a wallet feature or a startup idea. In Plasma, it’s treated like a base-layer expectation: if stablecoins are the center of the economy, then “moving them” shouldn’t be a premium experience.

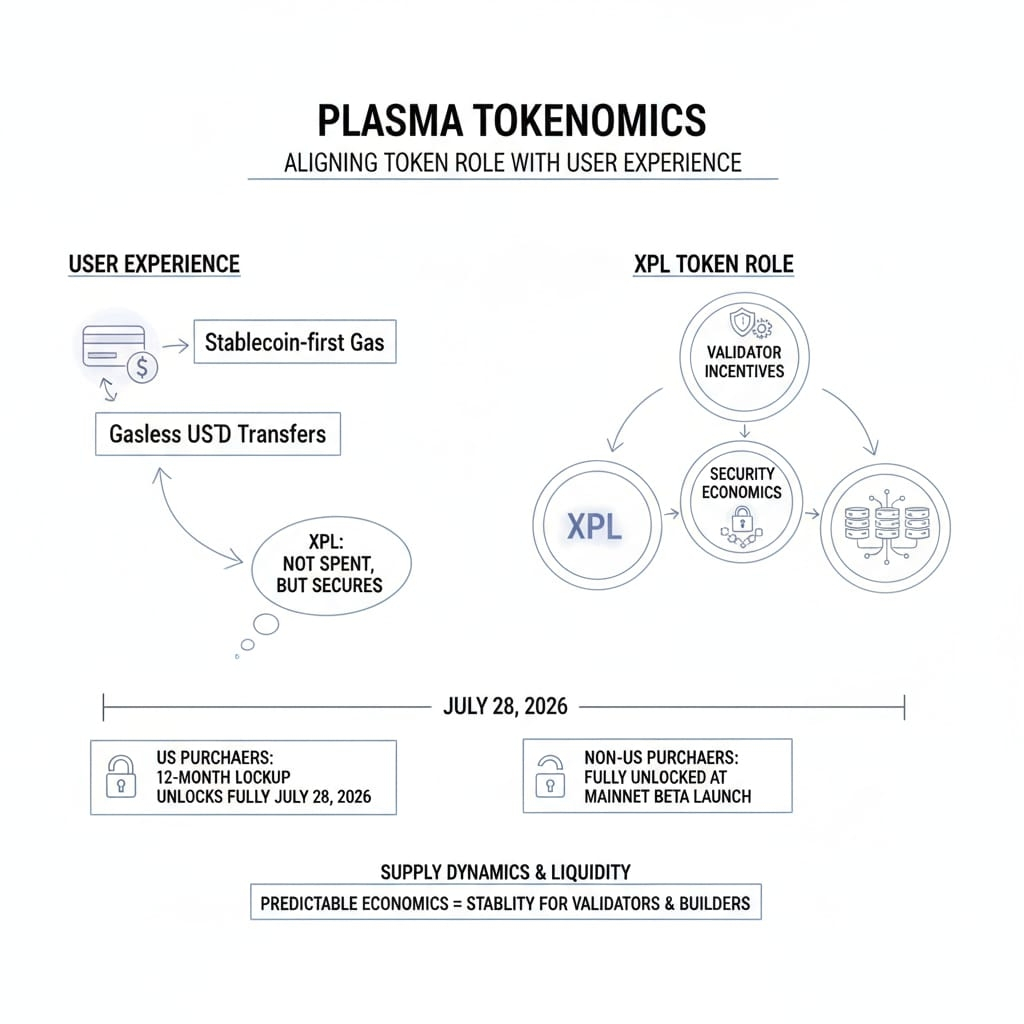

Then Plasma takes it a step further with stablecoin-first gas, and this is where the project starts to feel like it’s thinking in payment-operator terms rather than crypto terms. The idea is simple: let users pay transaction fees using whitelisted ERC-20 tokens like USDT (and even BTC) so they don’t have to hold XPL just to do normal activity. This is powered by a protocol-managed ERC-20 paymaster, meaning the abstraction is meant to be consistent and available without every app reinventing the same infrastructure.

If you’ve ever helped someone new to crypto, you’ll recognize how big that is. The “gas token puzzle” is not just confusing—it’s socially embarrassing. People feel like they did something wrong. They don’t blame the protocol; they blame themselves. Stablecoin-first gas changes the emotional texture of using a chain. It turns fees into something like “a service cost” rather than “a second asset you forgot to buy.”

Underneath all this UX, Plasma is also making a performance promise that lines up with how payments feel in the real world. Retail payments are not forgiving about latency. Merchant settlement is not forgiving about uncertainty. “Final enough” is not a phrase people accept when they’re trying to close a transaction. Plasma’s pitch combines full EVM compatibility (they’re using Reth) with faster finality through PlasmaBFT, so developers can bring familiar tooling while the chain tries to behave more like a settlement system than a slow-moving shared computer. (That split—EVM correctness plus aggressive finality—is the kind of pragmatic architecture choice that tends to matter more than flashy ecosystem announcements.)

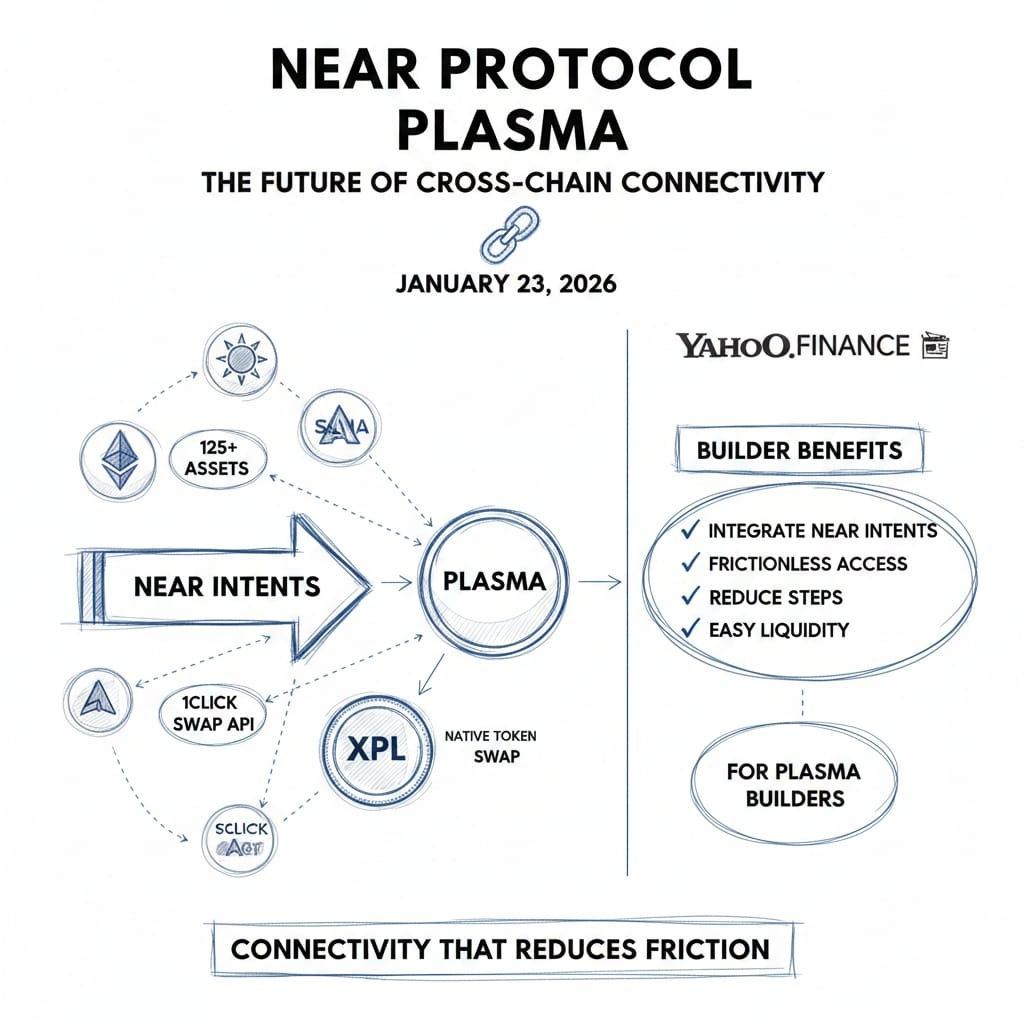

And speaking of announcements, the most meaningful “latest update” is not a new partnership logo or a vague ecosystem post—it’s connectivity that reduces the number of steps required to move value in and out of Plasma.

On January 23, 2026, NEAR Protocol posted that Plasma is live on NEAR Intents, enabling users to swap 125+ assets across 25+ chains to and from Plasma’s native token XPL. Yahoo Finance’s coverage of the same integration highlighted that Plasma builders can integrate NEAR Intents through the 1Click Swap API to give users more frictionless access across chains.

Here’s why I think that matters more than it sounds: if Plasma wants to be stablecoin settlement infrastructure, it can’t just be fast “inside its own borders.” The painful part of stablecoin movement is often the border crossing—bridges, routes, liquidity fragmentation, multi-step swaps. NEAR Intents is basically one of the emerging ways to paper over those borders by letting users express what they want (“get me USDT0/XPL on Plasma”) without caring about the path. So this integration is less like a marketing partnership and more like a distribution rail: it makes Plasma reachable without asking users to become part-time bridge operators.

That’s also where Plasma’s stablecoin-first design becomes more than a local feature set. If users can arrive on Plasma without a five-step bridge dance, and then transact without hunting for gas tokens, you’ve removed two of the most common points where stablecoin payment experiences fall apart.

I also like grounding all of this in something you can actually observe, because the crypto world is very good at “feels true” narratives. PlasmaScan currently shows a network running at about 1.00s block time, around 4.8 TPS, and about 148.77M transactions (these figures update as the explorer updates). Those numbers don’t automatically mean “mass adoption,” but they do mean the chain has enough activity that you can stop arguing purely in hypotheticals. There is a living on-chain system to inspect.

On the token side, I don’t think the most important story is price or hype. It’s whether the token’s role aligns with the chain’s intended user experience. If Plasma really succeeds at stablecoin-first gas and gasless USDT transfers, then XPL shouldn’t feel like “what users spend.” It should feel like “what keeps the rails honest”: validator incentives, security economics, and network operations. Plasma’s tokenomics docs also give a concrete timeline detail that matters for anyone watching supply dynamics: XPL purchased by US purchasers is subject to a 12-month lockup and will be fully unlocked on July 28, 2026, while non-US purchasers are fully unlocked upon launch of the Plasma Mainnet Beta.

That date is the kind of boring detail that ends up being important. Supply events shape liquidity and staking participation. And for a chain positioning itself for payments and institutions, predictable token economics matter because they influence validator stability and the cost assumptions builders quietly bake into their business models.

Now, the part that’s harder to summarize in a quick pitch—but is honestly the part I’m most curious about long-term—is Plasma’s stance on neutrality and censorship resistance. Plasma talks about Bitcoin-anchored security as part of the design goal: increase neutrality, reduce capture risk, and make the settlement layer harder to push around. That’s not the sort of thing you can validate with one dashboard screenshot. But it is a meaningful signal of intent: Plasma seems to expect that stablecoin settlement will be pressured, and it wants structural defenses rather than just optimism.

If I had to put Plasma’s whole approach into a non-crypto analogy, it would be this: most chains build a fancy train station and then hope someone decides to run trains through it. Plasma is building the track gauge that trains already need stablecoins then making the station boring, fast, and predictable. It’s not romantic. It’s not trying to be a culture. It’s trying to be infrastructure that disappears.

And maybe that’s why it stands out. Because if stablecoins are going to keep eating payments retail in high-adoption markets, and institutional settlement in finance—then the winners probably won’t be the chains with the loudest stories. They’ll be the ones that quietly remove failure points until sending money feels normal.