The most misleading question people ask about Plasma is the same question they ask about every new chain: “How many TPS can it do?” Because that question assumes the goal is to win a speed contest. It assumes the future of money is just the same crypto world we already know, but faster. And that assumption is exactly what Plasma seems designed to reject.

Plasma doesn’t feel like it was built to impress crypto Twitter. It feels like it was built to solve the kind of boring, humiliating problems that only show up when stablecoins stop being a speculative instrument and start becoming real-world plumbing. The moment stablecoins are used for payroll, supplier payments, remittances, and cross-border commerce, the conversation changes. Nobody cares how high your throughput ceiling is. They care whether settlement behaves like settlement. They care whether the network feels like a payment rail or like an experimental sandbox with unpredictable rules.

That’s what Plasma is really building: not a “high TPS chain,” but a discipline layer for stablecoin movement.

Stablecoins Don’t Need a Playground, They Need a RailwayMost blockchains still behave like digital cities built for tourists. They’re full of features, full of possibilities, full of optionality. But stablecoins are not tourists. Stablecoins are commuters. They don’t want to explore the ecosystem. They want to reach the destination without friction, without drama, and without needing to learn local customs every time they switch networks.

This is where Plasma’s philosophy becomes obvious. Plasma treats stablecoins as the default economic citizen, not a guest asset that happens to exist on-chain. And that difference is subtle but massive. It changes how the entire system should be optimized. If the main thing users do is “send dollars,” then every extra step becomes a tax on adoption.

In traditional crypto onboarding, the first experience is almost always absurd: you own USDT, but you can’t move USDT because you don’t own the chain’s gas token. That’s like having cash but being unable to spend it until you purchase a separate “permission coin.” Crypto people tolerate this because they’ve normalized it. But normal users see it for what it is: a broken design.

Plasma doesn’t try to educate users into accepting that friction. It tries to remove it.

Gasless USDT Transfers: Not a Gimmick, a Strategic Boundary

“Gasless transfers” is the kind of phrase that normally belongs in the same category as “instant 100x” it sounds like marketing. But Plasma’s implementation is interesting because it’s narrow, controlled, and intentional. It doesn’t claim that all activity should be free. It only subsidizes the most common action: simple USDT transfers.

That’s the key: Plasma isn’t offering a utopian free-for-all. It’s engineering a priority lane.

This is what most chains don’t understand. Payments networks cannot behave like general-purpose compute markets. They need different incentives. If every transaction is priced like an auction, the chain becomes unusable during congestion. If everything is free, the chain becomes spam bait. Plasma is trying to carve out a middle path: make the stablecoin transfer lane predictable and frictionless, while keeping the rest of the network economically disciplined.

And discipline is the real theme here.

The paymaster model isn’t just a UX feature. It’s an economic statement: stablecoin settlement should be treated as essential infrastructure, not as a luxury service. The moment you view stablecoin transfers as the base layer activity, subsidizing them becomes less like a giveaway and more like building roads before charging tolls for premium routes.

Stablecoin-First Gas: The Most Underrated Revolution in Crypto UXIf gasless transfers are the headline feature, stablecoin-first gas is the deeper one. Because this is where Plasma directly attacks the biggest psychological barrier to mainstream usage: the idea that users must care about the chain’s native token.

For the average person, money is not “assets.” Money is not “liquidity.” Money is not “tokenomics.” Money is a tool. If you’re sending $500 to a supplier, you don’t want to become a part-time trader just to buy enough gas to complete the transaction.

Plasma’s approach supporting custom gas tokens like USDT and potentially bridged BTC feels like a chain acknowledging the obvious truth: the unit people want to operate in is the unit they already trust.

This matters because it changes onboarding from a multi-step process into something closer to Web2 payments: deposit dollars, send dollars, done. That’s the real adoption unlock. Not “better wallets.” Not “more bridges.” Not “more chains.” Just fewer rituals.

And in crypto, rituals are often mistaken for decentralization.Finality Isn’t a Speed Metric It’s a Trust Metric

Most people talk about speed like it’s a bragging right. Plasma seems to treat speed like a requirement for emotional reliability.

There’s a specific moment every payment system has: the pause after you hit “send.” That pause is where trust is either reinforced or destroyed. If a transaction takes too long, even if it eventually confirms, the user feels uncertainty. And uncertainty is poison for payments.

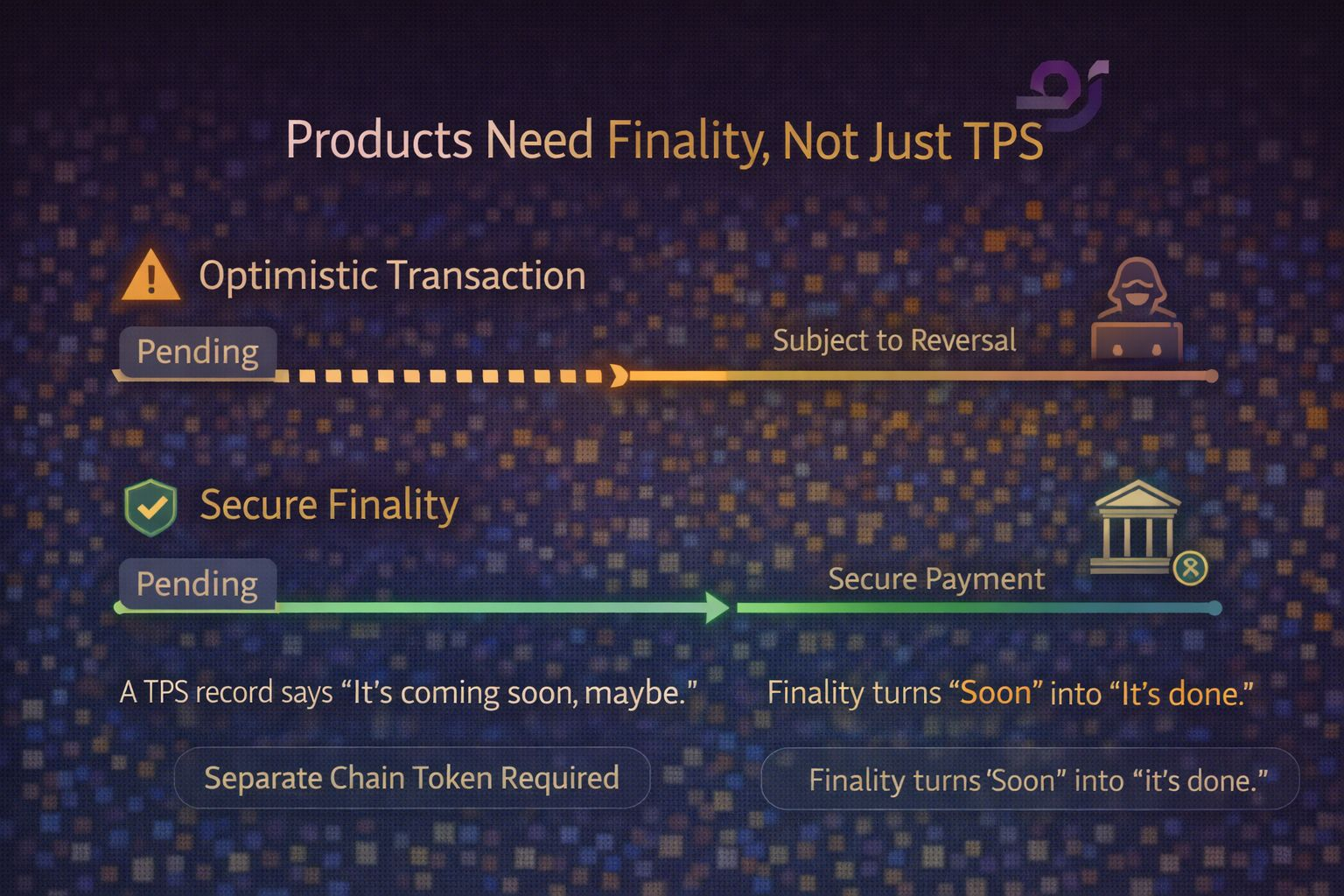

This is why deterministic finality matters more than raw TPS.

TPS is what you show on a benchmark chart. Finality is what determines whether a business can safely automate around your network. A merchant doesn’t care if you can theoretically process 100,000 transactions per second. They care whether their payment is settled fast enough that they can release goods without fear.

Plasma’s focus on sub-second blocks and BFT-style finality isn’t about flexing. It’s about shrinking the “doubt window” until the chain feels like real money infrastructure. When finality becomes fast and deterministic, stablecoin payments stop feeling like crypto experiments and start feeling like digital cash.

That’s not hype. That’s behavioral design.

EVM Compatibility: Because Payments Win by Being Boring

A lot of chains try to reinvent everything. Plasma doesn’t. Plasma chooses full EVM compatibility, which is not glamorous, but it’s smart. Payments don’t win by forcing developers into a new worldview. They win by being easy to integrate into existing systems.

If you want stablecoins to become global infrastructure, the chain cannot behave like a niche technology club. It needs to behave like an extension of existing tooling. Plasma’s decision to stick with familiar Ethereum execution environments is a strategic move: don’t create new developer friction while trying to eliminate user friction.

Because if the goal is settlement dominance, developer adoption is not optional.

Bitcoin Anchoring: A Political Move Disguised as a Technical One

The Bitcoin-anchoring narrative around Plasma is often misunderstood. People think it’s about “more security.” But the deeper reason is not purely technical. It’s credibility.

Stablecoin settlement rails are not neutral in the eyes of regulators, governments, and institutions. If Plasma succeeds, it will eventually be pressured. It will be asked to comply, censor, or adapt to political realities. Every payment network eventually faces that moment. That’s when decentralization stops being a philosophy and becomes a survival strategy.

Anchoring to Bitcoin is Plasma signaling that it wants to inherit Bitcoin’s most valuable asset: neutrality.

Not because Bitcoin is perfect, but because Bitcoin has proven something over time its resistance to control is not theoretical. If Plasma can genuinely connect itself to Bitcoin’s security assumptions through a functional bridge architecture, it gives itself a stronger posture in the inevitable political battles that come with being money infrastructure.

That’s why this part matters. Not for the tech nerds. For the future of who gets to influence the rails.

XPL Isn’t a Hype Token It’s a Maintenance Token

Most crypto projects treat their token as the product. Plasma treats the token like a system component. That’s a healthier design choice, even if it’s less exciting for speculators.

XPL exists to secure the network, align validators, and support the fee economy for non-sponsored transactions. Plasma almost seems happier if users never think about XPL at all. And that’s exactly what you’d expect from a chain that wants to be a stablecoin rail. In a perfect world, users interact with USDT, and validators interact with XPL.

This separation is underrated. It makes the network feel closer to real infrastructure. When people send a bank transfer, they don’t care what internal accounting token the bank uses. They care that the transfer clears.

Plasma is trying to build that same psychological invisibility.

The Real Endgame: Stablecoin Payments First, Credit Markets Next

The smartest thing about Plasma is that it doesn’t pretend payments are the final destination. Payments are the entry point. The real empire is credit.

Once stablecoins move smoothly, the next layer is lending, collateralization, yield infrastructure, and real-world credit loops. That’s when stablecoins stop being “digital dollars” and start becoming programmable financial primitives. Plasma’s emphasis on credit markets isn’t a side narrative. It’s the natural evolution of a chain that wants to become a monetary operating system.

Because in real economies, money movement is step one. Money multiplication through credit is step two.

And if Plasma becomes the settlement base layer where stablecoin liquidity naturally pools, then credit markets become inevitable. Liquidity sitting idle always becomes liquidity seeking yield.

Plasma’s Real Test: Can It Stay Disciplined Under Pressure?

Plasma’s biggest challenge isn’t speed, or marketing, or developer adoption. Its biggest challenge is whether it can maintain settlement discipline when growth arrives.

Gas subsidies can attract abuse. Bridges can become attack surfaces. Stablecoin issuers can impose constraints that chains can’t ignore. These aren’t small risks. They are structural risks. But Plasma at least feels like it was designed by people who understand those risks rather than pretending they don’t exist.

That’s the difference between a chain built for speculation and a chain built for survival.

Conclusion: Plasma Isn’t Competing With Chains It’s Competing With Chaos

The biggest misunderstanding about Plasma is thinking it’s trying to beat Solana, Ethereum, or any other chain in a performance race. Plasma is competing with something more real: the messy workaround economy people use today to move dollars.

Right now, stablecoin movement is held together by Telegram chats, OTC desks, centralized exchanges, unreliable bridges, network confusion, and constant gas friction. It works, but it works the way a hacked-together system works through tribal knowledge and repeated mistakes.

Plasma’s thesis is simple but powerful: stablecoin settlement should feel like infrastructure, not like a puzzle.

And that’s why Plasma isn’t about TPS.

It’s about whether stablecoins can graduate from being “crypto’s most useful product” into becoming the foundation of global digital money movement. If Plasma succeeds, it won’t feel revolutionary. It’ll feel like the obvious way things should have worked all along.

And in monetary infrastructure, that’s the highest form of victory: becoming so reliable that nobody talks about you because nobody has to.