Bitcoin fell below $70,000, hitting lows near $69,900 on some exchanges amid a broader risk-off move in global markets.

The drop erased much of the post-2024 bull gains, with sentiment plunging into “extreme fear” on the Fear and Greed Index at 11.

Miners face intensified pressure as BTC trades ~20% below estimated production costs around $87,000, while ETF outflows and liquidations add to downside risks.

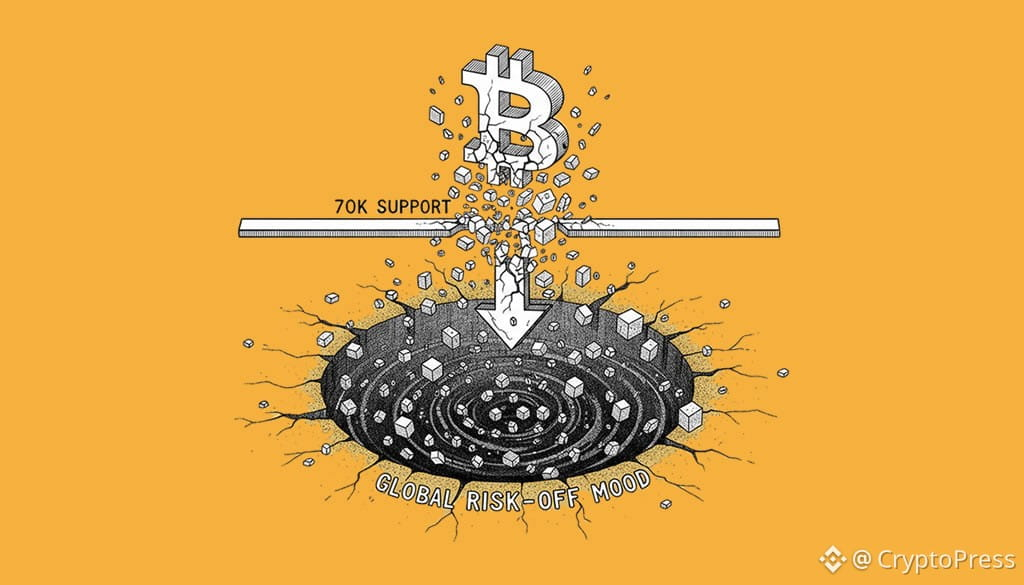

Bitcoin dropped below $70,000 on Thursday, extending a sharp selloff that has seen the leading cryptocurrency shed over 7% in the past 24 hours and retreat to levels last seen in late 2024.

The decline, which took BTC to as low as $69,917 on CoinDesk data and $69,101 on Bitstamp, aligns with weakness in global technology stocks and a broader deleveraging across risk assets. Precious metals like silver also plunged sharply, underscoring a flight from growth-oriented investments.

Extreme fear has gripped the crypto market, with the Crypto Fear and Greed Index falling to 11—a rare level indicating heightened panic. On-chain metrics show fading spot demand, reduced participation, and tightening liquidity, while open interest in BTC futures has contracted significantly. Analysts note this as full bear-market signals, with rebounds proving fragile.

Miner stress has intensified, as Bitcoin’s price hovers roughly 20% below the estimated average production cost of around $87,000. Historically, such conditions have preceded capitulation phases in bear markets, potentially leading to hashrate adjustments despite recent rebounds from drawdowns.

The selloff has also triggered substantial liquidations, wiping out millions in leveraged positions, and contributed to continued outflows from U.S. spot Bitcoin ETFs. Traders are watching for potential deeper corrections toward $67,000 or lower, though some view the reset as healthy before eventual recovery in volatile conditions. (news.bitcoin.com)

“Bears have taken firm control,” noted one market observer, highlighting the breach of $70,000 support as a psychological turning point amid thin liquidity and coordinated selling pressures.

For context on Bitcoin’s price dynamics, see this related overview at Cryptopress.site coins. As the dust settles, the move underscores ongoing correlations with traditional risk assets and the need for caution in leveraged DeFi and futures positions.

Disclaimer: This article is for informational purposes only and does not constitute advice of any kind. Readers should conduct their own research before making any decisions.

The post Bitcoin Breaks $70K Support in Sharp Correction Tied to Global Risk-Off Mood appeared first on Cryptopress.