In the recent Twitter Space hosted by @Dusk Foundation, the conversation centered on a major question in crypto today: How can we bring true financial privacy to EVM without breaking usability or compliance? The answer discussed throughout the session was Hedger, Dusk’s privacy engine designed to transform how transactions and trading work on EVM-compatible infrastructure.

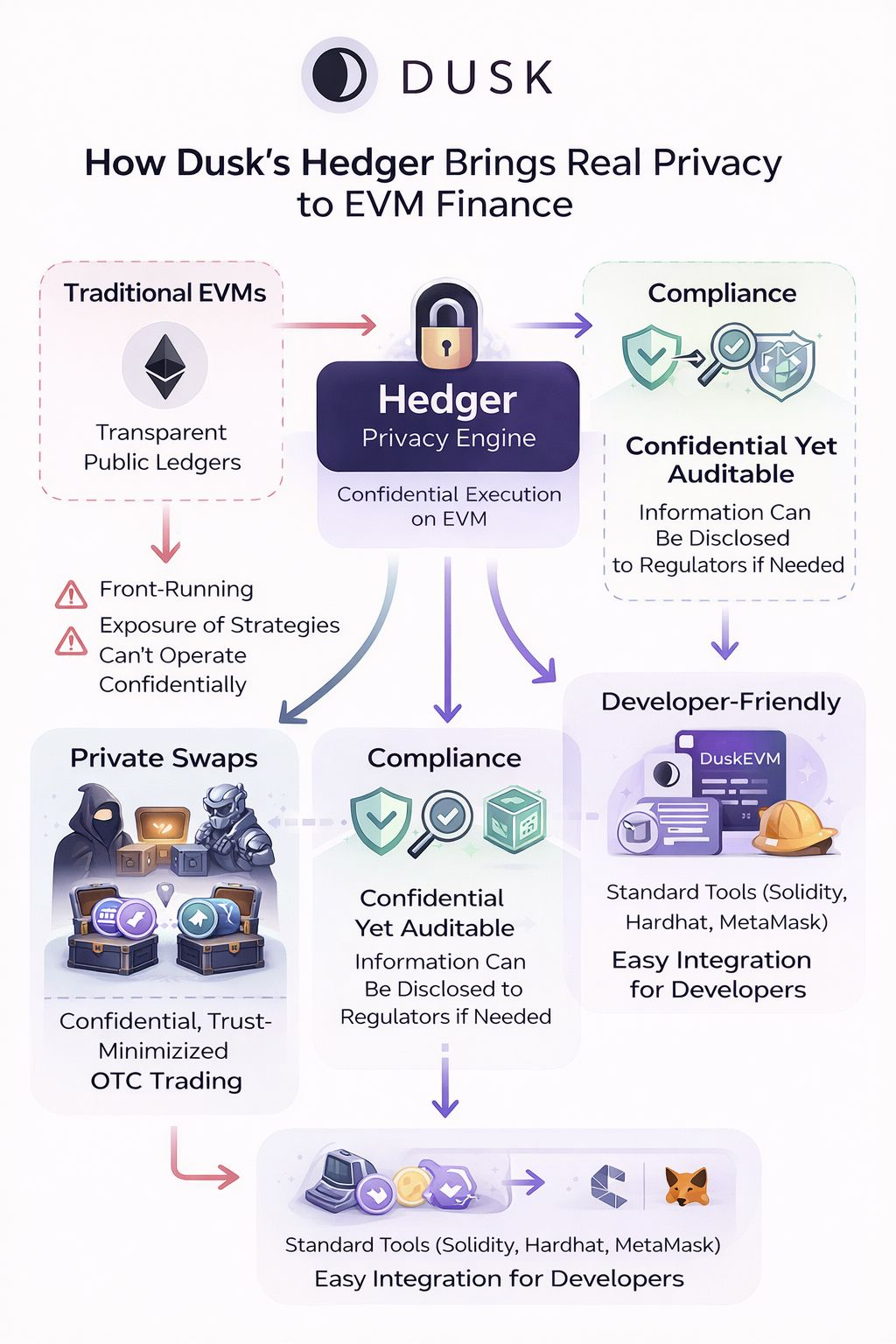

A key theme in the discussion was the problem with traditional EVM networks like Ethereum: everything is transparent by default. While this openness is great for verification, it creates serious issues for real financial activity. Traders can be front-run, strategies can be exposed, and institutions cannot operate confidentially. The speakers emphasized that public blockchains today function more like open ledgers than private financial systems and that’s a blocker for institutional adoption.

This is where Hedger comes in. Hedger was described as a system that allows transactions and financial interactions to stay encrypted while still being verifiable. Instead of revealing amounts, counterparties, or strategy details, the network proves that everything is valid without exposing sensitive information. The big idea is confidential execution on EVM, not just hiding wallet addresses but protecting the entire financial intent behind a transaction.

One especially interesting part of the discussion revolved around private swaps and OTC-style trading. A listener compared the concept to a Diablo-style item trade, where two parties place assets into a box and only finalize the trade once both agree. The hosts highlighted that Hedger enables similar trust-minimized swaps on-chain but privately. That means two parties could exchange assets (tokens, NFTs, or other instruments) without broadcasting trade size, pricing strategy, or negotiation details to the entire market. This could be a game-changer for OTC desks, institutional traders, and large holders who want to avoid slippage and MEV exploitation.

Another strong point made in the Space was that Dusk is not building privacy as an isolated feature it’s integrating it directly into an EVM-compatible environment. Developers wouldn’t need to abandon familiar tools or ecosystems. Instead, they can build with standard smart contract logic while Hedger handles confidential computation underneath. This lowers the barrier for adoption and makes privacy something developers can actually use, not just research.

Compliance was also part of the narrative. The speakers stressed that privacy does not have to mean secrecy from regulators. Hedger is designed so that information can remain hidden publicly while still being provable or selectively disclosed when required. This balance between confidentiality and auditability positions Dusk’s approach as suitable for regulated finance, not just anonymous DeFi use cases.

Overall, the Space painted a clear picture: the future of on-chain finance isn’t fully transparent or fully hidden it’s verifiable privacy. With Hedger, Dusk is aiming to make EVM powerful enough for real financial markets, where confidentiality, fair execution, and compliance all matter at the same time.