When the world finally realized that blockchain's "transparency" was actually a bug—not a feature—for serious finance, Dusk was already five years ahead of the panic.

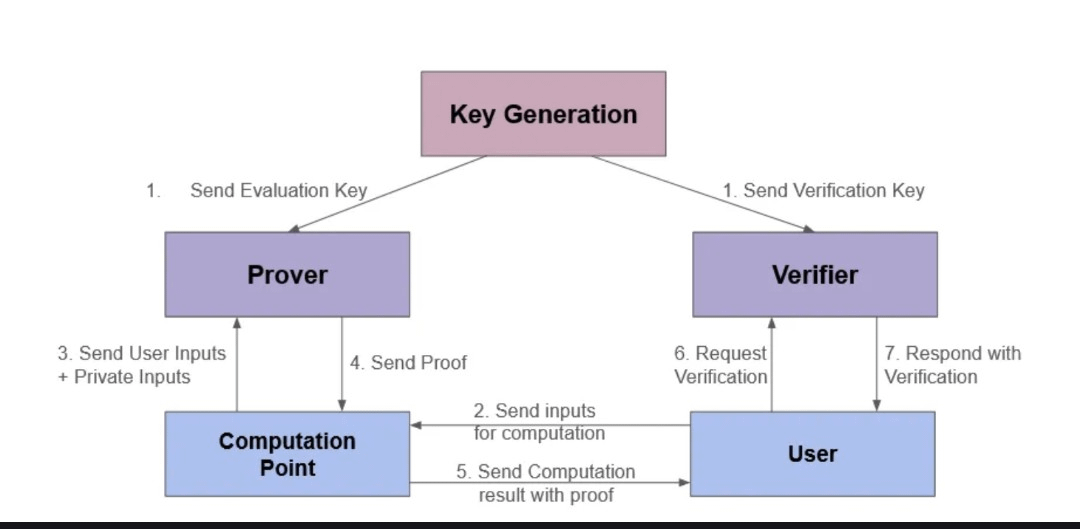

The cryptographic dance of zero-knowledge proofs: proving truth without revealing secrets

The Trillion-Dollar Wake-Up Call

Gold's 17.5 trillion dollar single-day revaluation didn't just break charts—it shattered illusions. While crypto Twitter celebrated another all-time high, institutional trading desks across London, Singapore, and New York saw something darker: a global vote of no-confidence in sovereign credit systems. The smart money wasn't just fleeing to precious metals; it was hunting for infrastructure that could survive the coming era of capital controls, surveillance capitalism, and regulatory overreach.

Here's what nobody on Crypto Twitter understood in early 2026: the same institutions that spent 2024 experimenting with DeFi had already pivoted. They weren't looking for faster blockchains or lower gas fees. They were desperate for something far more fundamental—the ability to move nine-figure positions on-chain without broadcasting their strategy to every competitor with a block explorer.

The dirty secret of institutional crypto adoption? Most public chains are commercially radioactive to serious finance.

Think about it: would you execute a 50 million corporate bond trade if your competitor could see your position size, your entry price, and your counterparty relationships in real-time? Of course not. Yet that's exactly what Ethereum, Solana, and virtually every "transparent" blockchain forces institutions to do. It's like playing poker with your cards face-up on the table.

This is where Dusk Network's philosophy becomes almost radical in its common sense. Founded in 2018—ancient by crypto standards—Dusk didn't chase the 2021 NFT hype or the 2023 L2 wars. Instead, they spent six years solving one problem: how to build financial infrastructure that treats privacy as a competitive necessity, not a criminal luxury.

The Architecture of Institutional Paranoia (And Why That's Good)

Piecrust: Where Zero-Knowledge Meets Silicon

In early 2026, Dusk completed its evolution from RuskVM to Piecrust—a virtual machine that sounds like it belongs in a cyberpunk novel but represents one of the most sophisticated pieces of financial infrastructure ever built for blockchain.

Piecrust isn't just "EVM-compatible." That would be missing the point entirely. While Ethereum's virtual machine processes transactions like a megaphone shouting secrets across a crowded room, Piecrust was engineered around WebAssembly (WASM) with native zero-knowledge operations baked into its DNA. It handles memory differently, executes circuits natively, and treats privacy not as a layer-2 afterthought but as a base-layer requirement.

The result? When an institution deploys a smart contract on Dusk, they're not just moving tokens—they're executing cryptographic proofs that verify compliance without exposing strategy. Gas fees, block rewards, even validator incentives—all of it travels through zero-knowledge circuits. The blockchain literally cannot leak information it was never designed to see.

Phoenix: The Invisible Ledger

Dusk's transaction model, Phoenix, operates on a principle that seems almost contradictory until you understand the mathematics: complete confidentiality with optional transparency. Using an advanced UTXO model rather than account-based tracking, Phoenix ensures that when assets move, observers see only statistical noise.

But here's the crucial twist that separates Dusk from privacy coins facing exchange delistings: Phoenix incorporates "view keys" that allow selective disclosure. A sovereign fund can maintain perfect secrecy during normal operations, but when regulators come knocking with proper authorization, specific transaction histories can be revealed without compromising the broader portfolio. It's not "privacy at all costs"—it's privacy with adult supervision.

This distinction matters enormously in 2026. While regulators worldwide are cracking down on "anarchist" privacy coins, Dusk's "auditable privacy" model has earned it a unique position: the only blockchain formally partnered with a Multilateral Trading Facility (MTF) licensed exchange (NPEX) that's actively tokenizing €200-300 million in real securities.

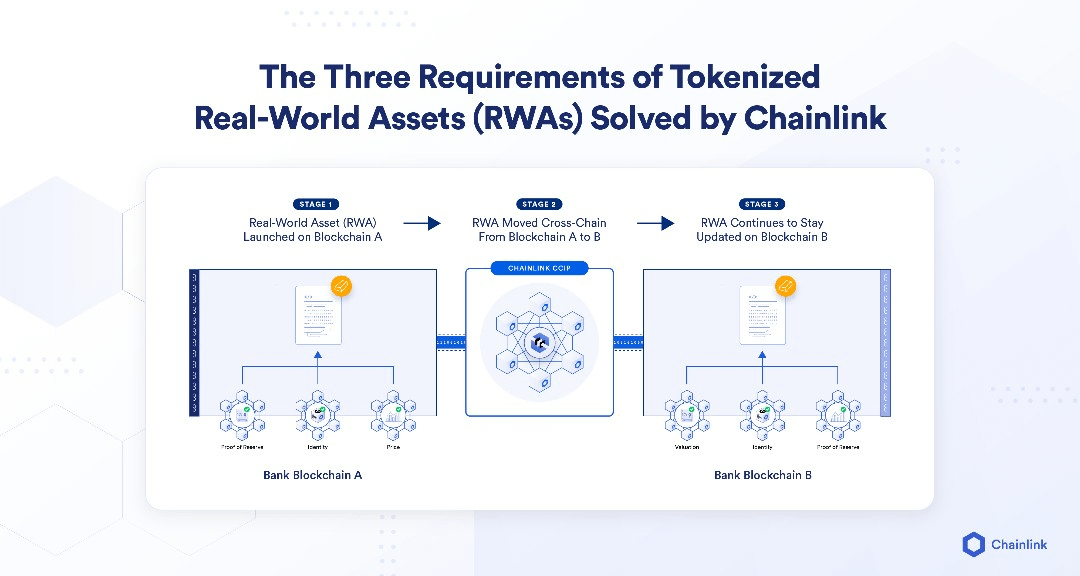

The three pillars of institutional-grade tokenization: seamless connectivity, proven reserves, and scalable infrastructure

Citadel: Self-Sovereignty for the Suit-and-Tie Crowd

If Piecrust is Dusk's computational engine and Phoenix is its transaction layer, Citadel is its soul. Launched after years of research and formal academic publication, Citadel represents a fundamental reimagining of digital identity for regulated markets.

The old model of KYC is broken—we all know this. Uploading passport photos to centralized databases that get hacked six months later isn't security; it's liability theater. Citadel replaces this with zero-knowledge identity credentials that live on users' devices, not corporate servers.

How it actually works: When an institution needs to verify you're a qualified investor, over 18, or a non-sanctioned entity, Citadel generates a cryptographic proof attesting to these facts without revealing your actual birthdate, nationality, or document numbers. The institution sees only a green light: "compliant" or "not compliant." Your raw data never leaves your hardware.

For financial institutions, this is transformative. Compliance costs drop by eliminating redundant verification processes across different subsidiaries. GDPR liability evaporates because they're no longer custodians of sensitive personal data. For users, it means genuine sovereignty—the ability to revoke access, set expiration dates on shared information, and maintain privacy while participating in regulated markets.

The protocol has already seen integration with Dutch financial institutions through the NPEX partnership, representing one of the first production deployments of self-sovereign identity in institutional-grade tokenization.

Succinct Attestation: When Finality Matters More Than Speed

Crypto loves to obsess over transactions per second. Dusk's consensus mechanism, Succinct Attestation (SA), targets something more valuable for serious finance: absolute finality with cryptographic certainty.

In securities settlement, "probably final" isn't good enough. When you're clearing a €10 million corporate bond trade, the possibility of chain reorganization isn't just a technical risk—it's a career-ending liability. SA achieves near-instant finality through a committee-based proof-of-stake system where blocks, once confirmed, are mathematically irreversible.

This isn't about being faster than Solana. It's about being predictable enough that compliance officers can sign off on nine-figure settlements without needing anxiety medication. The mechanism has been running live since mainnet launch in January 2025, processing real institutional transactions through the NPEX integration.

The delicate equilibrium between data privacy and regulatory compliance in modern blockchain architecture.

The NPEX Experiment: Real Assets, Real Volume, Real Compliance

While most RWA projects are still PowerPointing their "partnerships," Dusk has been processing live trades since 2025. The NPEX integration isn't a pilot program—it's a functioning secondary market for tokenized securities that moved from experimental to production status in early 2026.

The numbers tell the story: €200-300 million in tokenized assets actively trading, with Chainlink's CCIP integration enabling cross-chain settlement to Ethereum, Avalanche, and other EVM ecosystems. This isn't vaporware. These are real Dutch equities and bonds, held by real institutional investors, cleared through a real MTF-licensed exchange, settled on Dusk's blockchain.

What makes this different from every other RWA announcement? NPEX operates under the EU's DLT Pilot Regime and full MiCA compliance. These aren't theoretical regulatory frameworks—they're laws with teeth, and Dusk's infrastructure was built specifically to satisfy them. When the DLT Pilot Regime faces its extension decision in March 2026, NPEX's success on Dusk provides a working proof-of-concept that could unlock larger-scale tokenization across Europe.

The implications extend beyond Dutch equities. In Q1 2026, Dusk is rolling out Dusk Pay—a MiCA-compliant payment network for B2B settlements using stablecoins. The vision isn't just tokenizing existing assets; it's replacing the correspondent banking system with programmable, private, compliant settlement rails.

The Competitive Landscape: Why Dusk Isn't Just Another Privacy Chain

Comparing Dusk to Monero or Zcash misses the point entirely. Those protocols optimized for individual financial privacy—important work, but increasingly politically radioactive. Dusk optimized for institutional confidentiality within regulatory frameworks—a completely different design space.

Against "compliant" competitors, Dusk's advantage is architectural depth. Many enterprise blockchains sacrifice decentralization for performance, becoming effectively private databases with extra steps. Dusk maintains censorship resistance through its public, permissionless Layer 1 while enabling privacy through cryptography rather than centralization. It's the difference between a fortified public highway with encrypted tolls and a private road owned by a single corporation.

Against general-purpose chains like Ethereum, Dusk's specialization becomes obvious. Ethereum can add privacy features through layer-2s, but it cannot change its fundamental account-based architecture without breaking composability. Dusk was built from genesis block for confidential settlement—every component, from the BLS12-381 elliptic curve to the Poseidon hash function, selected specifically for zero-knowledge efficiency.

The January 2026 Chainlink partnership announcement—driving a 120% price surge—highlighted this positioning. By integrating CCIP, Dusk didn't abandon its specialization; it expanded its reach. Tokenized securities can now move between Dusk's privacy-preserving settlement layer and Ethereum's deep liquidity pools, combining the best of both worlds.

The Hard Truths Nobody's Talking About

Let's be honest about where Dusk stands in early 2026. The technology is production-ready. The regulatory compliance is battle-tested. The institutional partnerships are real. But adoption remains early.

Generating zero-knowledge proofs still requires computational overhead that makes mobile wallets drain battery faster than video streaming. Developer tooling, while improving, demands understanding of circuit design that most Solidity devs never needed to learn. The ecosystem of applications beyond securities settlement remains thin compared to Ethereum's sprawling DeFi landscape.

But here's the thing: these limitations aren't bugs in Dusk's model—they're the cost of doing business at the intersection of bleeding-edge cryptography and institutional finance. The projects that survive 2026 won't be those with the most TikTok influencers; they'll be those with working relationships with regulated exchanges and infrastructure that doesn't collapse under regulatory scrutiny.

Dusk's staking metrics suggest the market understands this. With over 200 million DUSK staked—36% of circulating supply—and Hyperstaking offering 12% APY with programmable logic, the network shows genuine committed capital rather than speculative hot money. When early investors take profits during price surges (as seen in January 2026's exchange inflows), long-term stakers tend to hold, suggesting conviction beyond short-term price action.

2026: The Year Privacy Became Compliance

We're witnessing a paradigm shift that most of crypto hasn't processed yet. The EU's MiCA framework, the UK's FCA guidelines, and even the US's increasingly coherent stablecoin legislation all point toward the same future: financial privacy won't be achieved through anonymity, but through cryptographic compliance.

Dusk's bet—that institutions would eventually need privacy-preserving infrastructure that regulators could actually approve—appears to be paying off. The NPEX integration proves the model works in production. The Chainlink partnership proves interoperability is achievable. The DLT Pilot Regime's potential extension in March 2026 could prove the regulatory environment is ready to scale.

The deeper narrative here isn't about one blockchain winning. It's about the entire concept of "transparent finance" being replaced by "verifiable confidentiality." Gold's massive revaluation in early 2026 signaled that capital is fleeing surveillance as much as inflation. Dusk represents the attempt to build digital infrastructure that respects this flight—providing the privacy of physical gold with the programmability of blockchain.

Whether you're a fund manager exploring tokenized securities, a developer interested in financial privacy tech, or simply someone who believes the future of money shouldn't require broadcasting your net worth to the world, Dusk's trajectory through 2026 deserves attention. They're not promising to disrupt finance through chaos; they're rebuilding it through better cryptography.