Remember when sending stablecoins was supposed to be the easy part of crypto? The whole point was avoiding volatility, yet somehow the experience became its own kind of nightmare. Gas fees spiking unpredictably Transactions hanging for minutes during network congestion. Paying in ETH to move USDT which feels like needing gasoline to carry water.

@Plasma looked at this mess and asked a simple question. What if a blockchain actually optimized for the thing people use most? Stablecoins moved from curiosity to infrastructure faster than anyone expected. Remittances, payroll, cross border commerce, savings in volatile economies. The use cases are obvious to anyone watching global payment flows But the underlying technology has not caught up We are running 2024 transaction volumes on infrastructure designed for 2017 speculation patterns.

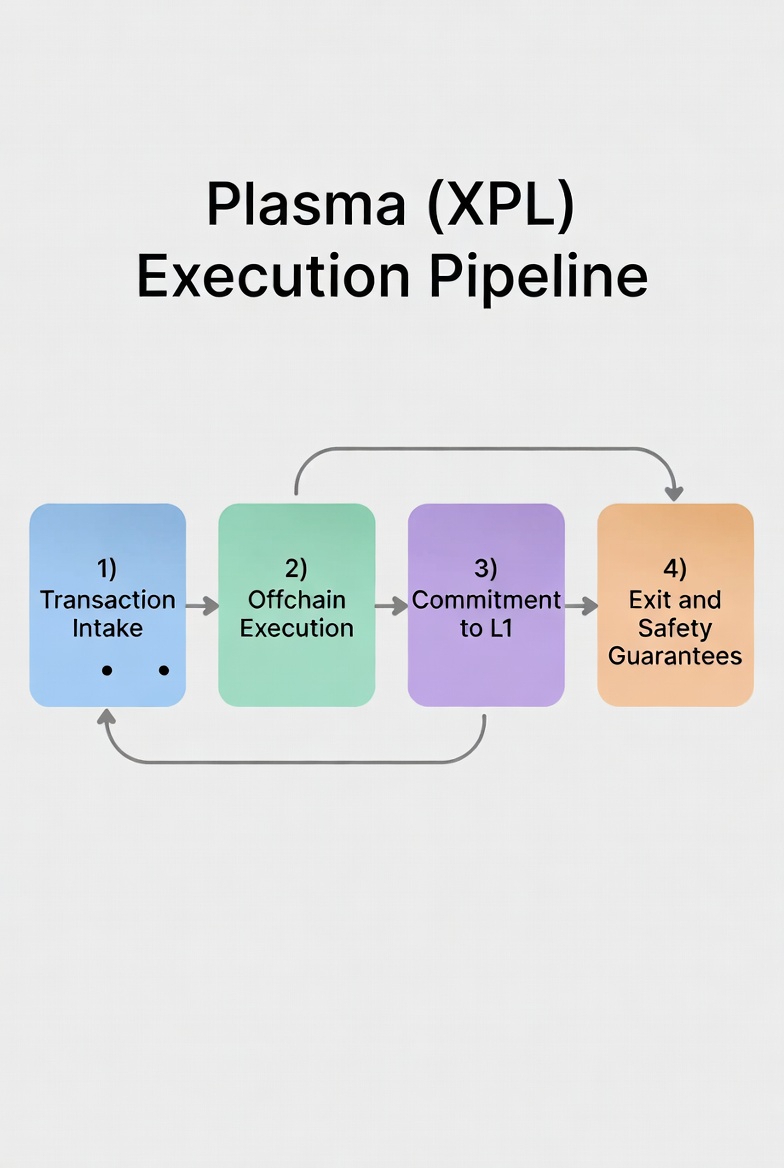

Plasma is a Layer One chain built specifically for this reality Not a general purpose smart contract platform trying to be everything Not an incremental scaling solution patching existing limitations. A ground up redesign assuming that stablecoin settlement is the primary function and everything else serves that goal.

The architecture reflects this focus. Plasma runs full EVM compatibility through Reth, meaning developers can deploy existing Ethereum applications without rewriting their code. That matters for adoption. No one wants to rebuild their payment infrastructure from scratch just to save on fees But the consensus mechanism, PlasmaBFT, delivers something Ethereum cannot offer: sub second finality.

Finality speed is where theory meets user experience When a merchant accepts payment, they need certainty the transaction is settled Not probably settled Not settled in a few blocks if network conditions cooperate. Actually finalized, irreversible, complete Traditional payment networks understood this decades ago Most blockchains still treat it as an acceptable tradeoff for decentralization theater.

Plasma disagrees. Their design prioritizes the certainty that merchants, payment processors, and financial institutions require. A transaction confirms, and it is done. No reorgs to worry about, no reversibility risk, no waiting for arbitrary block counts before releasing goods or services The gas model is where this gets interesting Plasma introduced genuine gasless USDT transfers. Not subsidized by a third party who might stop paying tomorrow. Not complicated fee abstraction that breaks when token prices fluctuate Actually zero cost movement of the most widely used stablecoin. For retail users in high adoption markets, this removes the fundamental friction that limits crypto payments. For institutions processing volume, it transforms the economics of settlement infrastructure.

Stablecoin first gas represents the other half of this innovation Instead of requiring native token holdings to pay for transactions, users can denominate fees directly in the stablecoins they are already holding The cognitive load disappears No calculations about native token prices, no juggling multiple assets in a wallet, no explaining to new users why they need to buy token A to move token B.

This seems obvious in retrospect Of course payment infrastructure should optimize for payments Yet most Layer One chains remain obsessed with DeFi trading, speculative token launches, and maximalist decentralization metrics. Plasma chose a different path, accepting that neutrality and censorship resistance matter most when anchored to genuine utility rather than ideological purity.

The Bitcoin security anchoring illustrates this balance Plasma leverages Bitcoin's established security model without inheriting its performance limitations This is not the lazy shortcut of wrapping assets or building bridges It is a designed integration that increases resistance to censorship and manipulation while maintaining the speed required for actual commerce For institutions evaluating blockchain infrastructure this combination addresses the two concerns that kill most adoption conversations: is it secure enough, and does it actually work for our volume?

Target markets reveal the strategy. Retail users in regions with high stablecoin adoption, which typically means places where local currency instability or banking restrictions created natural demand. These users need reliability more than they need novel features They need predictability more than they need decentralization theater. Plasma optimized for their actual behavior patterns rather than crypto native preferences.

Institutional users in payments and finance represent the other priority. These organizations move slowly for good reason. They have compliance requirements, risk committees, and customer service obligations. They cannot experiment with infrastructure that might change its economic model next quarter or become unusable during a speculative frenzy. Plasma's stablecoin centric design provides the consistency these integrations require.

The EVM compatibility matters enormously here. Financial institutions have spent years building internal expertise around Ethereum tooling. Their developers know Solidity. Their auditors understand the security patterns. Their legal departments have approved contract structures. Forcing them to abandon this investment for a proprietary system creates adoption friction that often proves fatal. Plasma allows them to keep their existing capabilities while gaining performance that makes commercial sense.

Competition in the Layer One space has become brutal. Dozens of chains promise speed, low fees, and developer friendly environments. Most are lying about at least one of these claims, or they have secured them through centralization tradeoffs that create different problems. Plasma distinguishes itself through specificity rather than breadth. They are not trying to host every possible application type. They are building the definitive infrastructure for stablecoin settlement, accepting that this single use case justifies the entire investment if executed correctly.

The timing carries both opportunity and risk. Stablecoin regulation remains uncertain across major jurisdictions. Competition from traditional payment networks has intensified as they modernize their infrastructure Central bank digital currencies threaten to capture some use cases currently served by private stablecoins.

Yet the growth trajectory suggests demand will outpace these concerns Global stablecoin transaction volume continues expanding rapidly driven by genuine utility in cross border commerce remittances and inflation hedging The infrastructure supporting this volume needs to mature beyond its speculative origins. Plasma represents an attempt to build that mature infrastructure, treating stablecoins as the primary design constraint rather than an afterthought.

For developers currently choosing where to build payment applications, the calculus has shifted. General purpose chains offer large user bases and extensive tooling, but they impose costs and delays that erode commercial viability. Specialized chains promise better performance but often require ecosystem rebuilding Plasma attempts to split this difference offering both familiar development environments and purpose built optimization.

The XPL token fits into this ecosystem as the coordination mechanism rather than the economic center It handles staking governance and network security without forcing users to hold or manage it for basic transactions This separation of infrastructure token from usage token reflects the design philosophy throughout technology should enable commerce not become the subject of it.

What makes Plasma worth watching is their clarity about success metrics. They are not optimizing for total value locked in speculative protocols. They are not chasing the latest narrative trend or token launch format. They measure progress by payment volume, merchant adoption and institutional integration These are boring metrics by crypto standards, which is precisely why they matter for actual adoption.

The blockchain industry has spent years building infrastructure for itself. Plasma is building infrastructure for everyone else. Whether that approach captures significant market share depends on execution quality, partnership development, and the continued expansion of stablecoin usage globally. But they have identified the correct problem.