Crypto likes simple stories. Open systems. No permissions. Full transparency. Anyone can join. That story worked when everything was small and experimental. It becomes uncomfortable when real money, real businesses, and real laws enter the picture.

Dusk Network starts from that uncomfortable place.

It does not pretend that finance can exist without rules. It assumes the opposite. That if blockchain ever becomes real infrastructure, it will have to deal with privacy laws, compliance, audits, and accountability. Dusk was founded in 2018 with that assumption baked in, not added later as a patch.

This already puts it on a very different path from most blockchains.

WHAT DUSK ACTUALLY IS

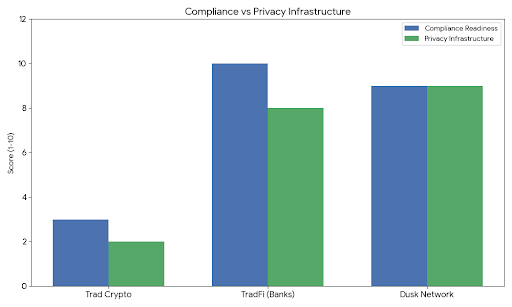

Dusk is a layer 1 blockchain built for financial activity that cannot be fully public, but also cannot be fully hidden. Think about how banks, funds, or companies operate. They do not publish every transaction to the world, but regulators can still verify what is happening.

Dusk tries to recreate that balance on-chain.

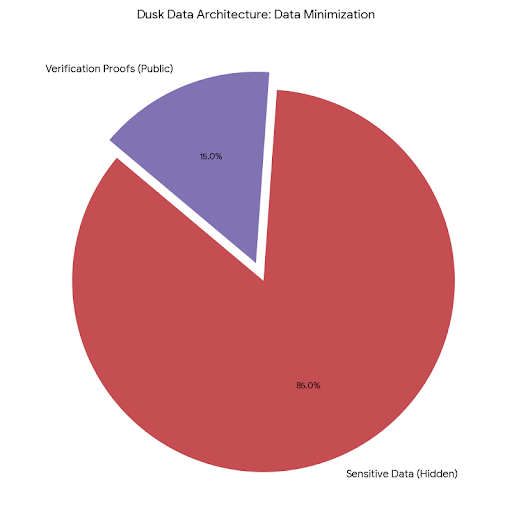

Instead of exposing everything, it uses cryptography to prove that rules are followed without revealing all the details. So an asset can move, a contract can execute, or a requirement can be met, without broadcasting sensitive information to everyone watching the network.

This is not about secrecy for its own sake. It is about making blockchain usable for people who are legally required to protect data.

WHY THIS EXISTS IN THE FIRST PLACE

Most public blockchains assume that transparency equals trust. In finance, transparency without context often creates risk.

If every position, balance, and strategy is public, you invite front-running, exploitation, and privacy violations. That might be acceptable for retail experiments. It is unacceptable for institutions managing large amounts of capital.

Because of this, traditional finance has mostly stayed away from public chains. They experiment in private networks, or not at all.

Dusk exists to close that gap. It is trying to answer a simple but uncomfortable question. Can a blockchain support finance without forcing everything into the open?

If the answer is no, then crypto remains a side system. If the answer is yes, chains like Dusk become essential.

HOW THE SYSTEM FEELS TO USE

Dusk is not built around hype or composability tricks. It is built around control and certainty.

Transactions can be private. Data can be hidden. But verification still happens. The network knows that the rules were followed, even if it does not see every detail.

There is also the idea of selective disclosure. Information stays private until it needs to be shown to the right party. This is how audits work in the real world. You do not publish your books to the internet. You show them when required.

Consensus on Dusk uses proof of stake, which keeps the system efficient and predictable. In financial contexts, predictability matters more than theoretical decentralization.

Smart contracts on Dusk are designed to enforce conditions. Who can interact, under what circumstances, and with what permissions. This is not censorship. It is structure

THE TOKEN WITHOUT THE DRAMA

The DUSK token exists to make the network function, not to tell a story.

It is used for staking, securing the chain, and processing transactions. Its value is tied to whether the network is actually used for real financial activity.

There is no illusion that the token will succeed on narrative alone. If nothing meaningful runs on Dusk, the token has no reason to matter.

That may sound boring, but it is honest.

THE ECOSYSTEM IS QUIET ON PURPOSE

You will not find viral apps or loud communities here. The ecosystem is focused on financial building blocks, things like tokenized securities, regulated DeFi, and compliant asset issuance.

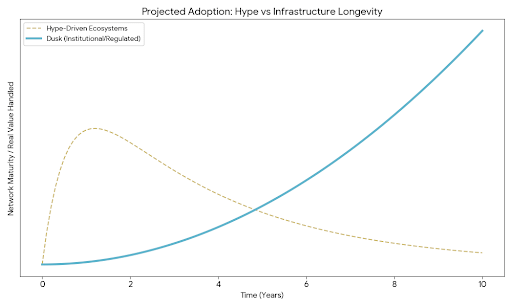

These are not products designed for daily engagement. They are systems designed to sit in the background and work reliably.

Growth here looks slow because it is slow. Institutions do not move quickly. Legal frameworks take time. Integration is careful and deliberate.

This is not an ecosystem built for trends. It is built for longevity.

WHERE THIS ALL LEADS

Dusk is not chasing mass adoption. It is positioning itself as infrastructure that can exist quietly for years.

The roadmap focuses on improving privacy mechanics, making it easier to build regulated financial applications, and strengthening the network so it can handle real value without surprises.

Interoperability matters, but not in the flashy sense. Dusk needs to connect to the existing financial world, not just other chains.

Success would look boring. Stable usage. Few headlines. Long-term relevance.

THE RISKS ARE REAL

There is no guarantee this works.

Institutions may never fully embrace public blockchains, even privacy-focused ones. Regulators may change rules. Competing systems may win mindshare or trust first.

There is also the risk of being stuck in the middle. Too controlled for crypto natives. Too novel for traditional finance.

And privacy technology is unforgiving. Mistakes cost trust, and trust is everything in finance.

A HUMAN WAY TO SEE DUSK

Dusk Network feels like someone asking a hard question early, before it was popular.

What happens to blockchain when the experiment phase ends?

Instead of chasing attention, it builds quietly for a future where rules exist and privacy matters. That future may arrive slowly, or not at all.

But if it does, systems like Dusk will not feel revolutionary. They will feel necessary.

And that is usually how real infrastructure looks in hindsight.