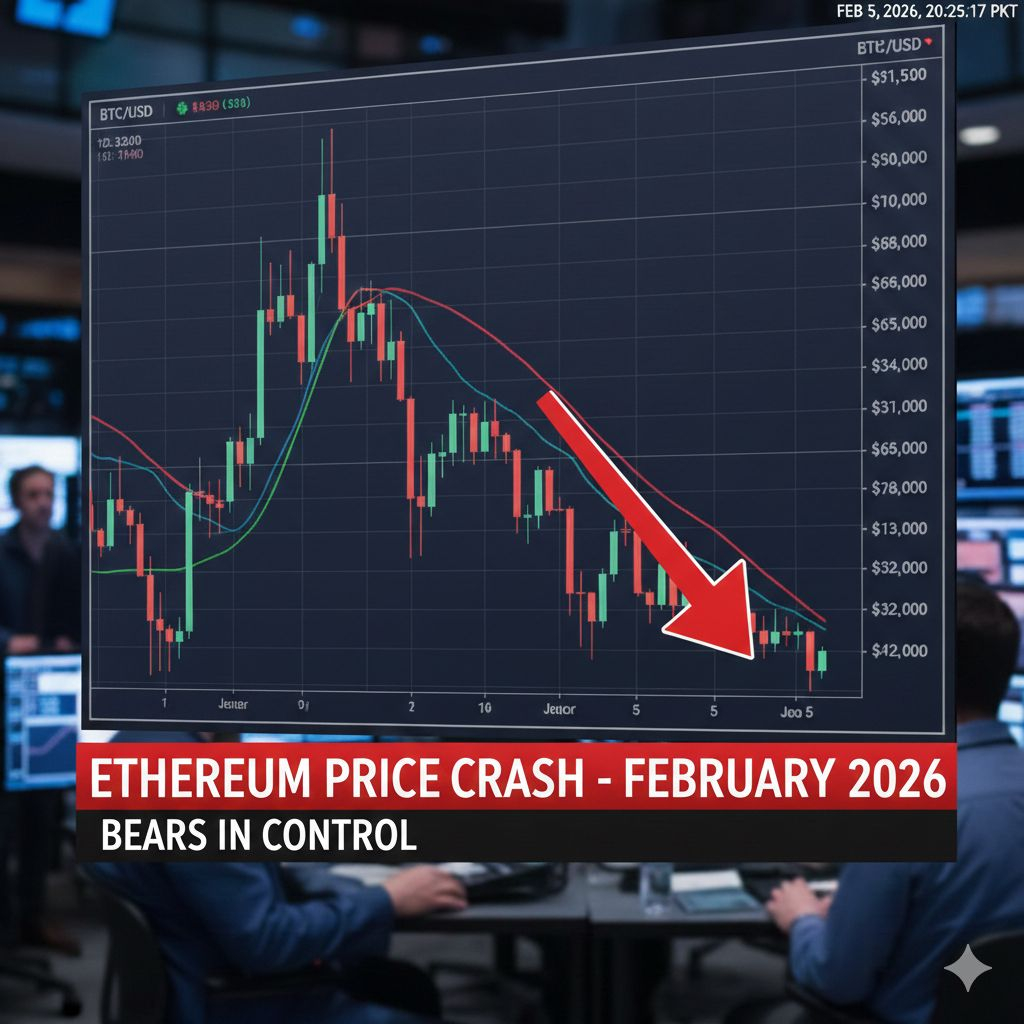

ETH is crashing right now in February 2026, and the crypto market is feeling the heat. After a strong start to the year and solid activity around DeFi and layer-2 adoption, Ether has pulled back sharply. Sellers have taken control and traders are reacting to the shift in sentiment.

In the short term, this drop is driven by profit-taking after recent highs, broader risk-off conditions in crypto, and spillover from Bitcoin weakness. When markets turn red, momentum traders exit quickly, and stops get hit on the way down, accelerating the slide.

Here’s how I see ETH moving from here:

Short-term (days to weeks)

Expect continued volatility. If $ETH breaks key near-term supports decisively, deeper pullbacks toward stronger zones are possible. We could see swings between support and resistance levels as buyers and sellers battle for control. Oversold conditions may produce short rallies, but they could fail until a clear bottom forms.

Medium-term (weeks to a few months)

Ethereum’s underlying ecosystem still matters. DeFi activity, staking growth, and adoption of rollups and other scaling tech could help stabilize price once panic eases. If major support levels hold, consolidation and range-bound trading may set up a base for recovery. Sellers may fatigue and longer-term holders could step back in at discounted levels.

Long-term (6–12+ months)

The fundamentals for Ethereum remain intact. It’s the foundation of DeFi, a hub for smart contracts, and continues to attract developers and capital. Over the long run, those structural drivers haven’t disappeared. If ETH avoids breaking through major historical support on strong volume, the probability of bouncing back into an uptrend increases. Dips in long-term trends are often healthy and can clear excess leverage.

Bottom line: Yes, ETH is under pressure now and short-term pain could continue. But unless key structural supports break sharply with high conviction, the long-term narrative still favors recovery. Approach lower prices thoughtfully, manage risk, and watch how support levels behave.

Where do you see ETH finding its next bottom?

#EthereumLayer2Rethink? #BitcoinDropMarketImpact #Ethereum