When you look at Plasma, it doesn’t feel like it started with a whiteboard full of ideas. It feels like it started with observation.

When you look at Plasma, it doesn’t feel like it started with a whiteboard full of ideas. It feels like it started with observation.

Someone noticed that stablecoins are already doing the real work in crypto. Not NFTs, not governance tokens, not yield games. Stablecoins. People use them to send money home, to save when their local currency keeps losing value, to pay freelancers, to move funds across borders quietly and quickly. This is already happening, every day.

Plasma seems to ask a simple question. If stablecoins are already acting like money, why are they still living on systems that were never designed for money?

That question shapes everything about Plasma.

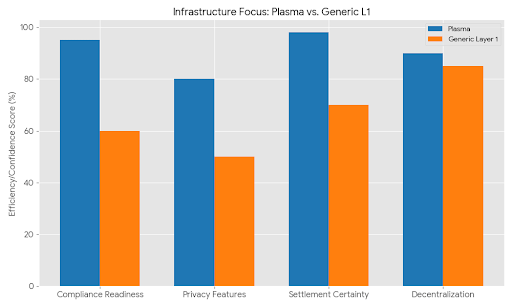

At its heart, Plasma is a Layer 1 blockchain built specifically for stablecoin settlement. It is not trying to be flashy or experimental. It is trying to be dependable. Fast finality, Ethereum compatibility, gasless stablecoin transfers, and a security model that leans on Bitcoin rather than trying to reinvent trust from scratch.

This is not about hype. It is about fixing friction.

Why this chain even needs to exist

Most blockchains treat stablecoins like guests. They are allowed in, but the house was not built for them.

Users have to hold a separate gas token they don’t understand or care about. Fees change without warning. Transactions fail when the network is busy. Finality is slow enough that payments feel risky. For people using stablecoins as actual money, this feels broken.

Institutions see a different version of the same problem. They care about settlement certainty. They care about timestamps, reversibility risk, and operational clarity. Waiting around for confirmations or dealing with unpredictable execution is not acceptable at scale.

Plasma exists because neither side is being properly served.

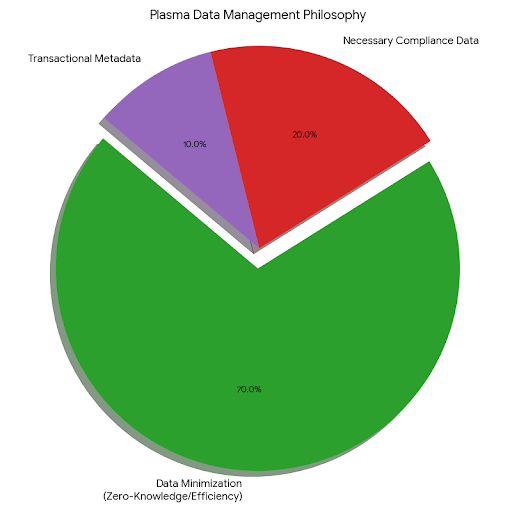

Instead of adding more features, Plasma removes assumptions. It assumes people want stability, clarity, and speed. It assumes stablecoins are not temporary. It assumes infrastructure should adapt to usage, not the other way around.

Plasma as a system, not a product

Plasma makes more sense when you stop thinking of it as a blockchain competing for attention and start thinking of it as financial plumbing.

The chain is fully EVM compatible, which means developers don’t have to relearn everything. That matters more than it sounds. Friction kills adoption quietly. Plasma avoids that by fitting into what already exists.

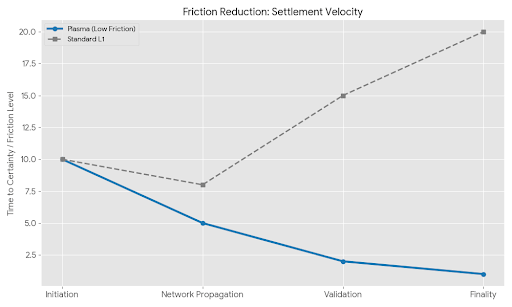

Finality happens in under a second. That changes behavior. When transactions feel final immediately, people trust them differently. Payments feel real. Settlement feels safe.

Gasless stablecoin transfers are not a gimmick. They remove one of the most confusing parts of crypto for normal users. If someone is sending USDT, they should not need to ask why they also need something else just to make it move.

Bitcoin anchoring adds another layer of seriousness. Plasma is not pretending it can outdo Bitcoin in neutrality. It borrows from it instead. By anchoring to Bitcoin, Plasma reduces the chance that its history or rules can be quietly rewritten. This is a long-term decision, not a marketing one.

All of this points to the same thing. Plasma is designed to disappear into usage. When infrastructure works well, people stop thinking about it.

How it feels to use, build, or integrate

For users, Plasma should feel boring in the best way. You send stablecoins. They arrive almost instantly. Nothing breaks. Nothing surprises you.

For developers, Plasma feels familiar. Smart contracts behave as expected. Tooling works. There is no pressure to design around strange token mechanics or temporary incentives. You build what you actually want to exist.

For institutions, Plasma feels like something you can depend on. Fast finality reduces risk. Predictable execution simplifies accounting. Stablecoin-first design aligns with how real payments already work.

This is not about excitement. It is about trust built over time.

The role of the native token

Plasma’s token does not try to be the star of the show.

It exists to secure the network, align validators, and allow governance decisions to happen. Validators stake it, earn rewards for honest participation, and face penalties for bad behavior.

What stands out is what Plasma does not do. It does not force users to transact in the native token. It does not push it as money. Stablecoins stay at the center.

This feels intentional. Plasma seems to understand that infrastructure tokens gain value when the system matters, not when they are artificially injected into every interaction.

The token’s future depends on whether Plasma becomes useful enough that securing and governing it is valuable.

Ecosystem growth, quietly

Plasma’s ecosystem is unlikely to explode overnight. And that might be the point.

The natural applications here are unglamorous but durable. Wallets focused on simplicity. Payment tools for merchants. Remittance systems. Payroll platforms. Settlement layers hidden behind fintech apps.

These are things people rely on, not things they flip.

Developers building in this environment are not chasing narratives. They are solving problems that already exist. That tends to create retention rather than churn.

Institutional adoption, if it happens, may happen quietly. Backend systems rarely announce themselves. But they last.

Where this goes long term

Plasma’s direction feels cautious, and that is refreshing.

Early focus is on stability, validator decentralization, and making sure Bitcoin anchoring works as intended. User experience around gas abstraction and wallet flows matters more than expanding feature sets.

Over time, Plasma could become a neutral settlement layer that supports multiple stablecoins and interoperates with other networks without losing its identity.

The goal does not seem to be domination. It seems to be relevance.

The risks are real

Plasma is not immune to pressure.

Stablecoin regulation could change quickly. Depending heavily on them carries exposure. Bitcoin anchoring adds complexity that must be maintained carefully. Competition from other chains will increase as everyone realizes stablecoins are the center of gravity.

There is also the risk of being overlooked. Infrastructure does not trend on timelines.

Plasma’s success depends on patience, execution, and real usage.

A human conclusion

Plasma does not promise a revolution. It accepts the present.

People already trust stablecoins more than many banks. They already move real value onchain. What they lack is infrastructure that respects how serious this has become.

Plasma feels like an attempt to meet that moment calmly. To build something steady enough that people stop asking questions and just use it.

In a space obsessed with being early, Plasma is comfortable being right.