Let’s be honest: stablecoins are already doing real work in the world, but the “crypto experience” around them still feels unnecessarily complicated.

You open a wallet, you have USDT, you try to send it… and suddenly you’re dealing with stuff that has nothing to do with sending money: gas tokens, network timing, weird fee spikes, and that annoying feeling of “it says confirmed, but I’m not fully sure yet.” For normal people, that’s where trust breaks. They don’t think in terms of decentralization theory. They think, “I was just trying to pay someone.”

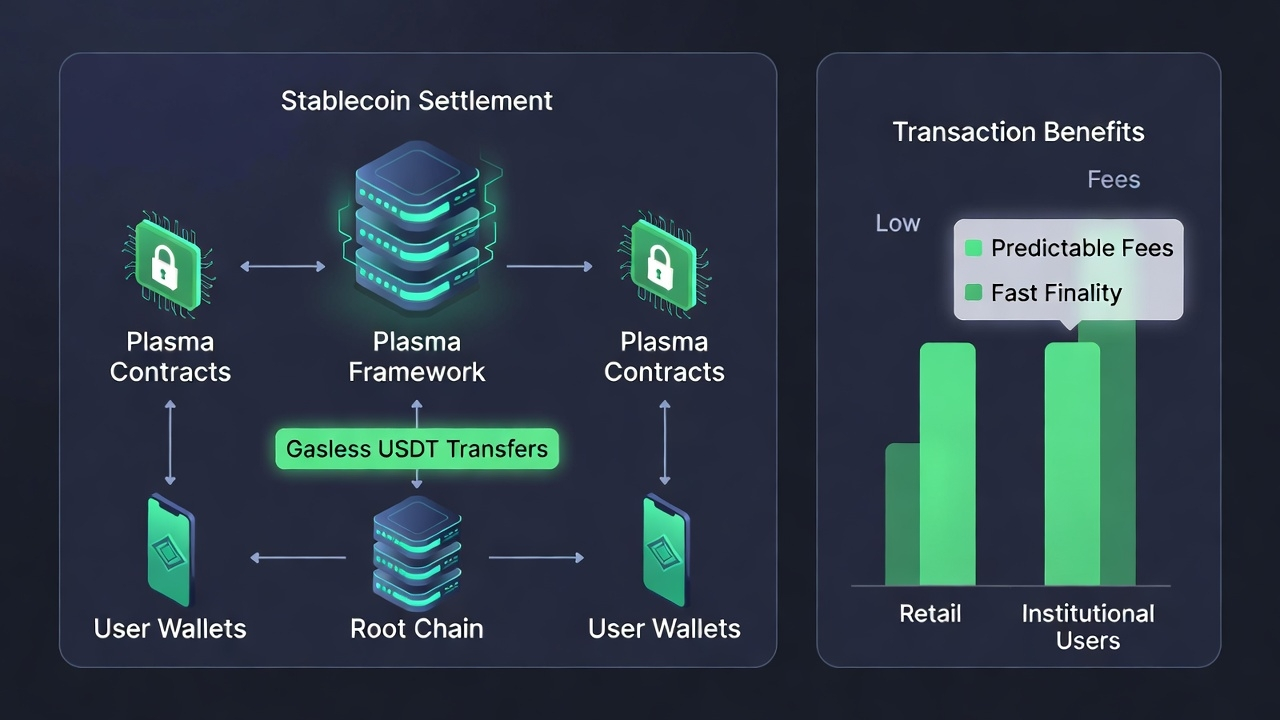

Plasma is basically built for that exact moment. It’s a Layer-1 that treats stablecoin settlement as the main job, not one feature among fifty. The whole chain is designed around the idea that moving stablecoins shouldn’t feel like navigating a chaotic city where you share the road with NFT hype, DeFi liquidations, memecoin storms, and bots competing for block space. Stablecoins can travel through those chains, sure, but they’re stuck in the same traffic and the toll prices change depending on how crowded it gets.

Plasma’s bet is that stablecoins have grown up enough to deserve their own lane. Not just “stablecoins are supported,” but stablecoins are prioritized at the protocol level. That’s why the design choices aren’t random—they all point back to one outcome: sending and settling stable value should be fast, predictable, and boring in the best way.

One reason Plasma tries to feel practical is that it doesn’t ask developers to abandon the Ethereum world. It’s built to be fully EVM compatible, with an execution approach that’s commonly described across ecosystem resources as being based on Reth. The useful part of that isn’t the name; it’s what it implies. If you’re a team building wallets, payment apps, remittance tools, fintech settlement systems, or stablecoin rails, you don’t want to rebuild your whole stack from scratch. You want to reuse Solidity contracts, familiar audit patterns, existing tooling, and the infrastructure that already exists around the EVM ecosystem. EVM compatibility here is less “technical brag” and more “shipping speed.” It means you can bring your existing product DNA with you, instead of learning a brand-new universe.

Then there’s finality, and this is one of those things that sounds like a technical detail until you look at it through the lens of payments. In a payment moment, “fast” is not just about performance. Fast is about certainty. If someone is paying a merchant, sending money to family, settling an invoice, or moving treasury funds, they don’t want “probably confirmed.” They want “done.” Plasma leans into a BFT-style consensus design often referred to as PlasmaBFT, and across sources it’s framed around deterministic finality with the intention that confirmations feel quick and reliable. You can argue about the exact numbers under different network conditions, but the emotional goal is obvious: confirmations should feel like a real-world receipt, not a guess.

But the real heart of Plasma is the fee experience, because fees are where users quit. In most chains, you can have the stablecoin you actually want to use, and still be blocked because you don’t have the separate token needed to pay gas. That’s the classic crypto “welcome ceremony” that kills onboarding: go buy another token, bridge it, don’t mess it up, hope fees don’t spike, then try again. Plasma tries to remove that friction with a simple product logic that feels more like a payment rail than a general-purpose chain.

The first part is the gasless USDT transfer idea. For the most common, human action—sending USDT from one person to another—Plasma introduces a model where those transfers can be sponsored, so the user can send USDT without holding a separate gas token. That’s huge for real-world usage because it turns USDT into something that behaves more like money: you have it, you can move it, no extra ceremony. But “free transfers” can’t be naive. If you make something free at the protocol level, someone will try to spam it, drain it, or weaponize it. So the way it’s described in the ecosystem is not “everything is free forever,” but “this is a scoped lane with controls”—the kind of anti-abuse design you’d expect: eligibility rules, rate limits, identity-aware protections, governance parameters, and other mechanisms that keep the free lane from becoming an attack surface.

The second part is stablecoin-first gas for more advanced behavior. Even if everyday transfers are sponsored, the network still needs a sustainable fee model and a normal economic engine for complex actions—smart contract calls, app interactions, institutional flows, and anything that’s genuinely computational or higher value. Plasma’s approach is to allow fees to be paid in stablecoins (or otherwise whitelisted assets), so users and applications don’t have to juggle yet another token just to use the chain. This is one of those design choices that sounds small until you watch a normal user’s behavior. People don’t want five different balances. They want one or two. If your payment app is built around USDT, the cleanest reality is that costs and fees should also be payable in a unit that behaves like USDT. That makes pricing, accounting, and UX dramatically simpler.

At this point most readers ask the fair question: if stablecoins are the main thing, and transfers can be gasless, what is the role of the native token? Plasma’s token is typically framed not as “the money,” but as the machine layer—staking, validator incentives, governance, sustainability, and the security budget that keeps the network honest. A simple way to put it is that stablecoins are what people use like cash, while the token is what keeps the engine running. You don’t buy engine oil to pay for groceries, but without it the car doesn’t move.

Then there’s the Bitcoin anchoring narrative, which is worth explaining without the hype. Anchoring does not mean Plasma turns into Bitcoin or inherits Bitcoin’s security in a magical way. It’s better understood as publishing an external receipt—checkpointing Plasma’s history to Bitcoin so there’s a public, highly resilient reference point outside Plasma’s direct control. The practical appeal is neutrality and censorship resistance posture: rewriting history becomes harder when a record exists on a ledger that is widely treated as extremely difficult to alter. It’s also something institutions can understand: an external timestamped audit breadcrumb trail in the most battle-tested public chain. It’s not a replacement for good internal security, but it can strengthen the overall integrity story.

The sustainability question still matters, and the only credible answer is a structured one. If you want gasless transfers to feel real, you subsidize what happens most frequently—simple transfers that drive adoption and liquidity gravity. Then you monetize higher-value activity—smart contract usage, institutional settlement flows, integrations, and the parts of the ecosystem where paying fees in stablecoins is acceptable because the action itself has higher value. In parallel, you maintain a security budget through staking economics and validator incentives. In other words, Plasma isn’t trying to make everything free; it’s trying to make the most common payment action not feel like a crypto obstacle course.

The target users reflect that strategy. On one side you have retail users in high stablecoin adoption markets: people receiving remittances, paying someone locally, saving in dollars, or moving value on a phone. These users care about three things: it works, it’s predictable, and it doesn’t ask them to learn extra rules. On the other side you have institutions—payments, finance, fintech apps, exchanges, settlement providers—who care about deterministic finality, predictable costs, strong security narratives, and integrations that don’t require reinventing the wheel. Plasma is trying to sit at the intersection where stablecoins already live: the meeting point between everyday usage and professional settlement infrastructure.

Of course, there’s a tradeoff that can’t be ignored. The very tools that make gasless transfers safe—sponsorship rules, eligibility controls, rate limits, identity-aware protections—can become governance choke points if decentralization and transparency don’t mature properly. Usability can quietly turn into gatekeeping if the chain’s control surfaces are too concentrated. So the long-term credibility of Plasma won’t only be about tech; it will be about how it balances safety, openness, decentralization, and neutral access as it scales.

And that leads to the most honest measure of success. Plasma doesn’t win because people tweet “Plasma is fast.” Plasma wins if nobody even thinks about Plasma. If wallets, fintech apps, remittance tools, and payment products just default to it quietly because it’s reliable, predictable, and stablecoin-first—and the end user only experiences “send USDT → received → done”—then Plasma has achieved what payment rails are supposed to achieve: the infrastructure disappears, and the money movement feels normal.#Plasma